Growing Aging Population

The demographic shift towards an aging population in South America significantly influences the digital wound-measurement-devices market. As individuals age, they become more susceptible to chronic wounds, including pressure ulcers and venous leg ulcers. The World Health Organization estimates that by 2030, the number of people aged 60 and older in South America will reach 200 million. This demographic trend necessitates improved wound care solutions, as older adults often have comorbidities that complicate wound healing. Digital wound-measurement devices offer healthcare professionals the tools needed to monitor and manage these wounds effectively, thereby enhancing patient outcomes. Consequently, the demand for such devices is expected to rise, reflecting the urgent need for innovative solutions in wound care.

Rising Incidence of Diabetic Foot Ulcers

The increasing prevalence of diabetes in South America is a critical driver for the digital wound-measurement-devices market. Reports indicate that approximately 10% of the adult population in the region is affected by diabetes, leading to a higher incidence of diabetic foot ulcers. These ulcers require precise measurement and monitoring to prevent complications, thereby driving demand for advanced digital wound-measurement devices. The ability of these devices to provide accurate and timely data is essential for effective management and treatment, which is increasingly recognized by healthcare providers. As the healthcare system in South America continues to evolve, the integration of digital solutions for wound management is likely to become a standard practice, further propelling market growth.

Rising Awareness of Wound Care Best Practices

There is a growing awareness of wound care best practices among healthcare professionals and patients in South America, which is driving the digital wound-measurement-devices market. Educational initiatives and training programs are being implemented to inform stakeholders about the importance of accurate wound assessment and management. This heightened awareness is leading to an increased demand for digital devices that provide precise measurements and facilitate better treatment decisions. As healthcare providers recognize the benefits of using technology in wound care, the adoption of digital wound-measurement devices is likely to accelerate. This trend suggests a shift towards evidence-based practices, ultimately improving patient outcomes and fostering market growth.

Technological Integration in Healthcare Systems

The integration of technology into healthcare systems in South America is a significant driver for the digital wound-measurement-devices market. As electronic health records (EHR) and telemedicine become more prevalent, the need for compatible digital wound-measurement solutions is increasing. These devices not only enhance the accuracy of wound assessments but also facilitate seamless data sharing among healthcare providers. The ability to track wound healing progress through digital platforms is becoming essential for effective patient management. As healthcare systems continue to evolve and embrace digital transformation, the demand for innovative wound-measurement devices is expected to rise, reflecting a broader trend towards technology-driven healthcare solutions.

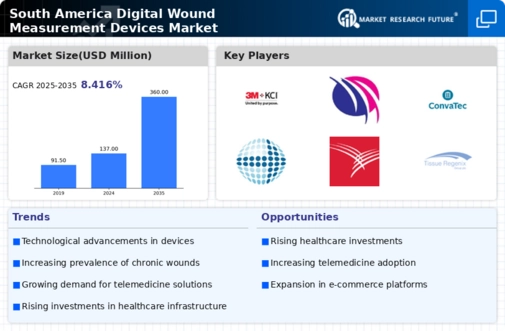

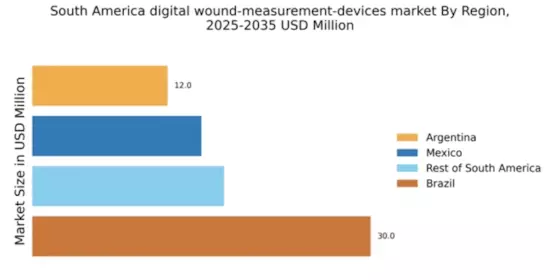

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure across South America is a pivotal driver for the digital wound-measurement-devices market. Governments and private entities are channeling resources into modernizing healthcare facilities, which includes the adoption of advanced medical technologies. For instance, Brazil and Argentina have announced substantial funding initiatives aimed at enhancing healthcare services, with a focus on integrating digital health solutions. This trend is likely to facilitate the widespread adoption of digital wound-measurement devices, as healthcare providers seek to improve patient care and operational efficiency. The market is projected to grow as hospitals and clinics upgrade their equipment and embrace digital solutions, reflecting a broader commitment to enhancing healthcare delivery.