Increasing Healthcare Expenditure

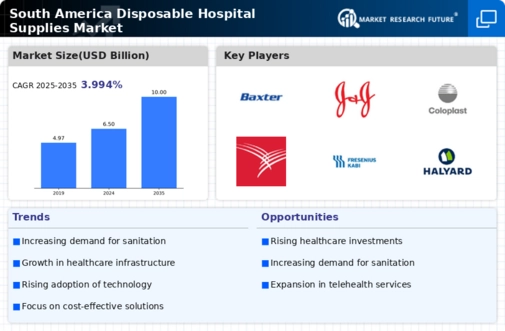

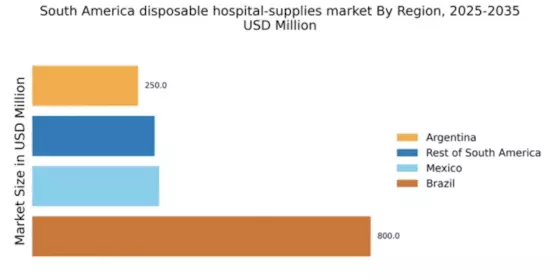

The rising healthcare expenditure in South America appears to be a pivotal driver for the disposable hospital-supplies market. Governments and private sectors are investing more in healthcare infrastructure, which includes the procurement of disposable supplies. For instance, healthcare spending in countries like Brazil and Argentina has seen an increase of approximately 10% annually. This trend suggests that hospitals are more likely to allocate budgets towards disposable products, which are essential for maintaining hygiene and preventing infections. As a result, the disposable hospital-supplies market is likely to experience growth, driven by the need for cost-effective and efficient healthcare solutions.

Expansion of Healthcare Facilities

The expansion of healthcare facilities across South America is another key driver for the disposable hospital-supplies market. New hospitals and clinics are being established to meet the growing healthcare needs of the population. For instance, Brazil has seen a surge in the construction of healthcare facilities, with an estimated investment of $1 billion in new hospitals in the past year. This expansion necessitates a corresponding increase in the procurement of disposable supplies, as new facilities require a wide range of products for daily operations. Consequently, the disposable hospital-supplies market is poised for growth as these new establishments seek to equip themselves with essential disposable items.

Regulatory Compliance and Standards

Regulatory compliance plays a crucial role in shaping the disposable hospital-supplies market in South America. Governments are implementing stringent regulations to ensure the safety and efficacy of medical products. For example, the ANVISA in Brazil has established guidelines that manufacturers must adhere to, which may lead to increased demand for compliant disposable supplies. This regulatory environment encourages hospitals to invest in high-quality disposable products that meet safety standards, thereby driving growth in the market. The disposable hospital-supplies market is thus influenced by the need for compliance, which may enhance product quality and safety.

Rising Awareness of Infection Control

There is a growing awareness of infection control among healthcare providers and patients in South America, which significantly impacts the disposable hospital-supplies market. Hospitals are increasingly adopting disposable products to minimize the risk of hospital-acquired infections (HAIs). Studies indicate that the use of disposable supplies can reduce infection rates by up to 30%. This heightened awareness is prompting healthcare facilities to prioritize the procurement of disposable items, thereby driving demand in the market. The disposable hospital-supplies market is likely to benefit from this trend as hospitals seek to enhance patient safety and care quality.

Technological Innovations in Product Development

Technological innovations in product development are transforming the disposable hospital-supplies market in South America. Advances in materials science and manufacturing processes are leading to the creation of more efficient and effective disposable products. For example, the introduction of biodegradable materials is gaining traction, appealing to environmentally conscious healthcare providers. This innovation not only addresses sustainability concerns but also enhances the functionality of disposable supplies. As a result, the disposable hospital-supplies market is likely to see increased competition and growth, driven by the demand for innovative and sustainable products.