Rising Geriatric Population

The demographic shift towards an aging population in South America is a crucial driver for the heparin market. As individuals age, they are more susceptible to various health issues, including thromboembolic disorders, which often require anticoagulation therapy. The geriatric population is projected to increase by 20% over the next decade, leading to a higher demand for heparin as a preventive and therapeutic measure. This demographic trend is prompting healthcare providers to focus on tailored treatment plans for older adults, thereby increasing the utilization of heparin. Additionally, the growing awareness of the importance of managing health in older age groups is likely to further boost the heparin market. The combination of these factors suggests a robust growth trajectory for heparin products in the coming years.

Increasing Cardiovascular Diseases

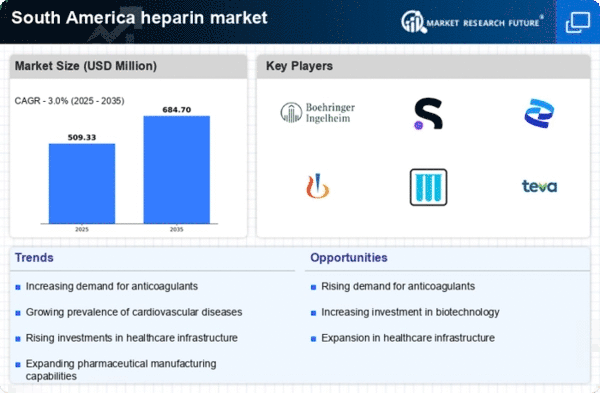

The rising incidence of cardiovascular diseases in South America is a primary driver for the heparin market. Conditions such as deep vein thrombosis and pulmonary embolism are becoming more prevalent, leading to a higher demand for anticoagulants like heparin. According to health statistics, cardiovascular diseases account for approximately 30% of all deaths in the region. This alarming trend necessitates effective treatment options, thereby propelling the heparin market forward. Healthcare providers are increasingly prescribing heparin to manage these conditions, which is expected to contribute to a market growth rate of around 5% annually. The increasing awareness of cardiovascular health among the population further supports this trend, as patients seek preventive measures and treatments, thereby enhancing the overall demand for heparin products.

Expansion of Healthcare Infrastructure

The ongoing expansion of healthcare infrastructure in South America significantly impacts the heparin market. Governments and private sectors are investing heavily in healthcare facilities, aiming to improve access to medical services. This expansion includes the establishment of new hospitals and clinics, which are essential for providing timely treatments for conditions requiring anticoagulation therapy. As healthcare access improves, the utilization of heparin is likely to increase, particularly in emergency care settings. Reports indicate that healthcare spending in South America is projected to grow by 7% annually, which will likely enhance the availability of heparin and related products. Consequently, this growth in infrastructure is expected to create a favorable environment for the heparin market, facilitating better patient outcomes and increased sales of heparin.

Advancements in Pharmaceutical Research

Advancements in pharmaceutical research are playing a pivotal role in shaping the heparin market in South America. Ongoing research efforts are focused on improving the efficacy and safety profiles of heparin products, which may lead to the development of novel formulations and delivery methods. These innovations could enhance patient compliance and treatment outcomes, thereby increasing the overall demand for heparin. Furthermore, the introduction of biosimilar heparins is anticipated to create competitive pricing dynamics, making heparin more accessible to a broader patient population. The pharmaceutical sector in South America is expected to invest approximately $1 billion in research and development over the next five years, which could significantly impact the heparin market. As new products emerge, healthcare providers may adopt these advancements, further driving market growth.

Increased Awareness of Thrombosis Management

There is a growing awareness of thrombosis management among healthcare professionals and patients in South America, which is positively influencing the heparin market. Educational initiatives and campaigns aimed at informing the public about the risks associated with thromboembolic events are becoming more prevalent. This heightened awareness is leading to earlier diagnosis and treatment, resulting in an increased demand for heparin as a first-line therapy. Studies indicate that effective awareness programs can lead to a 15% increase in the diagnosis of thrombosis-related conditions. As patients become more informed about their health, they are more likely to seek medical advice and treatment, thereby driving the heparin market forward. This trend is expected to continue, as healthcare systems prioritize education and prevention strategies.