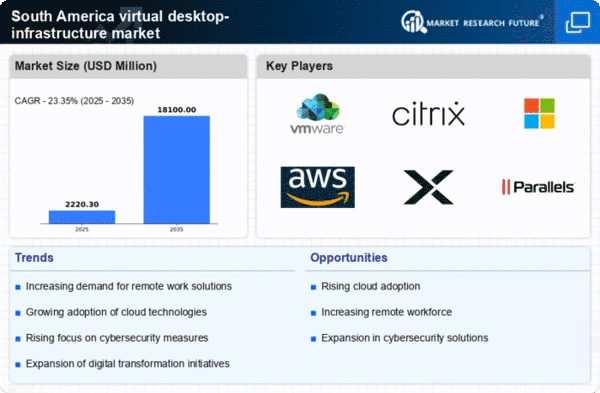

Rising Cybersecurity Concerns

The virtual desktop-infrastructure market in South America is significantly influenced by rising cybersecurity concerns among businesses. With the increasing frequency of cyber threats, organizations are compelled to adopt robust security measures to protect sensitive data. Virtual desktop infrastructure offers enhanced security features, such as centralized data storage and controlled access, which are appealing to companies looking to mitigate risks. According to recent studies, nearly 70% of businesses in the region have reported heightened concerns regarding data breaches. This growing awareness is likely to drive the adoption of virtual desktop solutions, as organizations seek to safeguard their digital assets. The virtual desktop-infrastructure market is thus positioned to thrive in an environment where cybersecurity is a top priority.

Support for Diverse Work Environments

The virtual desktop-infrastructure market in South America is also being driven by the need to support diverse work environments. As companies expand their operations and workforce, they require flexible solutions that can accommodate various working conditions, including remote, hybrid, and on-site setups. Virtual desktop infrastructure provides the necessary adaptability, allowing employees to access their work environments from any location. This flexibility is crucial for organizations aiming to enhance employee satisfaction and productivity. Furthermore, the ability to scale resources according to demand is a significant advantage. The virtual desktop-infrastructure market is thus likely to benefit from this trend as businesses seek to create inclusive and adaptable work environments.

Growing Demand for Remote Work Solutions

The virtual desktop-infrastructure market in South America is experiencing a notable surge in demand for remote work solutions. As organizations increasingly adopt flexible work arrangements, the need for secure and efficient remote access to desktop environments becomes paramount. This shift is reflected in a projected growth rate of approximately 15% annually in the region. Companies are seeking to enhance productivity while ensuring data security, which drives the adoption of virtual desktop solutions. Furthermore, the ability to centralize IT management and reduce hardware costs adds to the appeal of these solutions. The virtual desktop-infrastructure market is thus positioned to benefit from this trend, as businesses prioritize remote work capabilities to attract and retain talent.

Cost Efficiency and Resource Optimization

Cost efficiency remains a critical driver for the virtual desktop-infrastructure market in South America. Organizations are increasingly seeking ways to optimize their IT expenditures while maintaining high levels of performance. Virtual desktop infrastructure allows companies to reduce hardware costs and minimize energy consumption, leading to significant savings. Reports indicate that businesses can achieve up to 40% reduction in IT costs by implementing virtual desktop solutions. This financial incentive is particularly appealing in a region where budget constraints are common. As organizations strive to maximize their resources, the virtual desktop-infrastructure market is likely to see sustained growth driven by the pursuit of cost-effective solutions.

Investment in Digital Transformation Initiatives

In South America, the virtual desktop-infrastructure market is being propelled by significant investments in digital transformation initiatives. Organizations are increasingly recognizing the importance of modernizing their IT infrastructure to remain competitive. This trend is evidenced by a reported increase in IT spending, with many companies allocating up to 30% of their budgets towards digital solutions. Virtual desktop infrastructure plays a crucial role in this transformation, enabling businesses to streamline operations and enhance collaboration. By adopting these technologies, companies can improve their agility and responsiveness to market changes. The virtual desktop-infrastructure market is thus likely to see continued growth as organizations prioritize digital transformation as a key strategic objective.