Rising Demand for Food Security

Food security remains a pressing concern in South Korea, driving the growth of the 5g smart-farming market. With a growing population and limited arable land, the need for efficient agricultural practices is paramount. The 5g smart-farming market offers solutions that enhance productivity and sustainability, addressing these challenges. By leveraging advanced technologies, farmers can increase crop yields while minimizing environmental impact. Reports indicate that the agricultural sector could see a productivity increase of up to 25% through the adoption of smart farming techniques. This demand for food security is likely to propel investments in the 5g smart-farming market, as stakeholders seek to ensure a stable food supply for the future.

Enhanced Data Analytics Capabilities

The ability to harness data analytics is a crucial driver for the 5g smart-farming market in South Korea. With the advent of big data and machine learning, farmers can analyze vast amounts of information to make better decisions regarding crop management and resource allocation. The integration of 5g technology facilitates real-time data transmission, allowing for immediate insights into farming operations. This capability is expected to enhance operational efficiency and reduce costs, with studies suggesting that data-driven farming can lower operational expenses by as much as 15%. As farmers increasingly recognize the value of data analytics, the 5g smart-farming market is likely to expand, driven by the demand for smarter agricultural solutions.

Environmental Sustainability Initiatives

The push for environmental sustainability is significantly influencing the 5g smart-farming market in South Korea. As climate change poses challenges to agriculture, there is a growing emphasis on sustainable farming practices. The 5g smart-farming market provides tools that help farmers reduce their carbon footprint and manage resources more effectively. Technologies such as precision irrigation and smart pest management systems enable farmers to use water and chemicals judiciously, thereby minimizing environmental impact. It is estimated that implementing these sustainable practices could lead to a reduction in resource consumption by up to 40%. This alignment with sustainability goals is likely to attract more stakeholders to the 5g smart-farming market.

Technological Advancements in Agriculture

The 5g smart-farming market in South Korea is experiencing a surge due to rapid technological advancements in agricultural practices. Innovations such as precision farming, which utilizes data analytics and IoT devices, are becoming increasingly prevalent. These technologies enable farmers to monitor crop health, soil conditions, and weather patterns in real-time, leading to improved yields and reduced resource wastage. The integration of 5g technology enhances connectivity, allowing for seamless communication between devices and systems. As a result, farmers can make informed decisions quickly, optimizing their operations. The market is projected to grow significantly, with estimates suggesting an increase of over 30% in adoption rates by 2027, driven by these technological improvements.

Increased Investment in Agricultural Technology

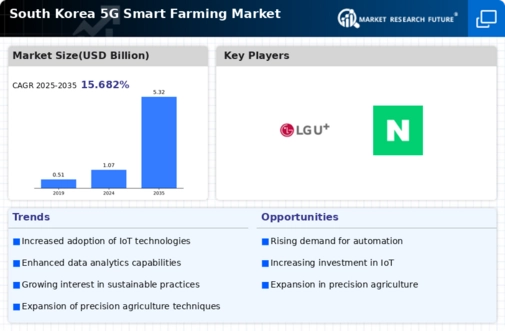

Investment in agricultural technology is a key driver of the 5g smart-farming market in South Korea. The government and private sector are channeling funds into research and development of innovative farming solutions. This influx of capital is fostering the creation of advanced tools and systems that utilize 5g connectivity to enhance farming efficiency. For instance, smart sensors and drones are being developed to monitor crop health and optimize resource usage. The market is expected to witness a compound annual growth rate (CAGR) of approximately 20% over the next five years, as these investments continue to transform traditional farming practices into more efficient, data-driven operations.

Leave a Comment