Urbanization Trends

Rapid urbanization in South Korea is driving the demand for construction equipment, particularly excavators. As urban areas expand, the need for residential and commercial buildings increases, leading to a heightened requirement for excavation and earthmoving activities. The urban population is projected to reach 85% by 2030, which suggests a continuous demand for excavators in the construction sector. This trend is further supported by the government's initiatives to develop smart cities, which necessitate advanced excavation technologies. Consequently, the excavators market is likely to benefit from this urbanization trend, with an expected growth rate of around 12% annually as construction projects proliferate in urban centers.

Rising Construction Costs

The escalating costs associated with construction materials and labor in South Korea are driving the demand for more efficient excavation solutions. As construction companies face tighter profit margins, there is a growing emphasis on utilizing advanced excavators that can enhance productivity and reduce operational costs. This trend indicates a shift towards investing in high-performance machinery that can deliver better results in less time. Consequently, the excavators market is likely to see an increase in demand for premium models that offer advanced features and capabilities. Analysts predict a growth rate of around 8% in the market as companies seek to optimize their resources and improve project outcomes.

Infrastructure Development Initiatives

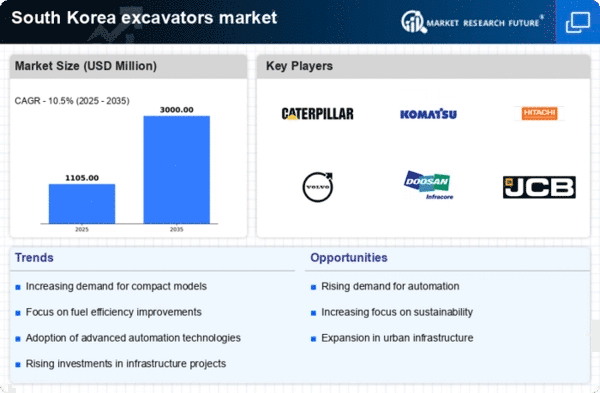

The South Korean government has been actively investing in infrastructure development, which appears to be a primary driver for the excavators market. With a projected investment of over $100 billion in various infrastructure projects, including roads, bridges, and public transportation systems, the demand for excavators is likely to surge. This investment strategy aims to enhance connectivity and stimulate economic growth, thereby creating a robust environment for construction activities. As a result, the excavators market is expected to experience significant growth, with an anticipated increase in sales of approximately 15% over the next five years. The government's commitment to modernizing infrastructure is a crucial factor influencing the market dynamics in South Korea.

Environmental Regulations and Compliance

Stringent environmental regulations in South Korea are influencing the excavators market by necessitating the adoption of eco-friendly machinery. The government has implemented various policies aimed at reducing emissions and promoting sustainable construction practices. As a result, manufacturers are increasingly focusing on producing excavators that comply with these regulations, which may include electric or hybrid models. This shift towards environmentally friendly equipment is likely to attract a new segment of customers who prioritize sustainability in their construction projects. The market for eco-friendly excavators is projected to grow by 20% in the coming years, reflecting the industry's response to regulatory pressures and changing consumer preferences.

Technological Integration in Construction

The integration of advanced technologies in construction processes is reshaping the excavators market in South Korea. Innovations such as telematics, automation, and artificial intelligence are enhancing the efficiency and productivity of excavators. These technologies enable real-time monitoring and data analysis, which can lead to improved operational performance. As construction companies increasingly adopt these technologies, the demand for modern excavators equipped with such features is likely to rise. This shift towards technological integration is expected to contribute to a market growth of approximately 10% over the next few years, as companies seek to optimize their operations and reduce costs in the competitive construction landscape.