Increasing Regulatory Scrutiny

The healthcare cold-chain-monitoring market is significantly influenced by the increasing regulatory scrutiny surrounding the transportation of temperature-sensitive products. Regulatory bodies in South Korea are enforcing stricter guidelines to ensure that pharmaceuticals and biologics are stored and transported under controlled conditions. Compliance with these regulations is essential for market players, as non-compliance can lead to substantial financial penalties and reputational damage. As a result, companies are investing in advanced monitoring systems to ensure adherence to these regulations, thereby propelling the growth of the healthcare cold-chain-monitoring market.

Growth of E-commerce in Pharmaceuticals

The rapid growth of e-commerce in the pharmaceutical sector is a key driver for the healthcare cold-chain-monitoring market. As online sales of temperature-sensitive products increase, the need for efficient cold-chain logistics becomes paramount. In South Korea, e-commerce sales in the pharmaceutical industry are projected to grow by 25% annually, necessitating robust cold-chain solutions to ensure product quality during transit. This trend is prompting logistics providers to enhance their cold-chain capabilities, thereby driving innovation and investment in monitoring technologies that can support the burgeoning e-commerce landscape.

Rising Demand for Biologics and Vaccines

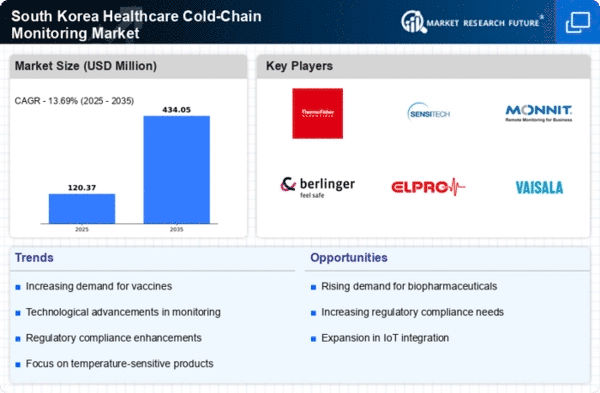

The increasing demand for biologics and vaccines in South Korea is a pivotal driver for the healthcare cold-chain-monitoring market. As the biopharmaceutical sector expands, the need for stringent temperature control during transportation and storage becomes critical. In 2025, the market for biologics is projected to reach approximately $5 billion, necessitating advanced cold-chain solutions to maintain product integrity. This trend underscores the importance of reliable monitoring systems that ensure compliance with temperature requirements, thereby safeguarding public health. The healthcare cold-chain-monitoring market is likely to experience growth as stakeholders invest in technologies that enhance the traceability and safety of these sensitive products.

Technological Integration in Supply Chains

The integration of advanced technologies such as IoT and blockchain into supply chains is transforming the healthcare cold-chain-monitoring market. These technologies facilitate real-time monitoring and data analytics, which are essential for maintaining optimal conditions for temperature-sensitive products. In South Korea, the adoption of IoT devices in logistics is expected to increase by 30% by 2026, enhancing visibility and accountability in the supply chain. This technological evolution not only improves operational efficiency but also reduces the risk of product spoilage, thereby driving demand for sophisticated cold-chain monitoring solutions.

Consumer Awareness and Demand for Quality Assurance

There is a growing consumer awareness regarding the importance of quality assurance in healthcare products, which is influencing the healthcare cold-chain-monitoring market. South Korean consumers are increasingly concerned about the safety and efficacy of pharmaceuticals and biologics, leading to heightened expectations for transparency in the supply chain. This shift in consumer behavior is prompting manufacturers and distributors to adopt advanced cold-chain monitoring solutions to provide assurance of product integrity. As a result, the healthcare cold-chain-monitoring market is likely to see increased investment in technologies that enhance visibility and traceability throughout the supply chain.