The South Korea Lawful Interception Market is characterized by a dynamic landscape shaped by rapid technological advancements and increasing regulatory requirements aimed at ensuring national security and public safety. This market serves as a vital component for telecommunications providers and governmental agencies, facilitating the legal monitoring of communications to support crime investigation and counter-terrorism efforts.

The competitive environment features a blend of both local and international players who strive to innovate and offer robust solutions tailored to meet the stringent demands of the South Korean regulatory framework.

The growing emphasis on securing the integrity of communications coupled with emerging technologies such as 5G and the Internet of Things are driving the evolution and strategic positioning of key market participants.SK Telecom stands out as a prominent player in the South Korea Lawful Interception Market, leveraging its extensive experience in telecommunications and innovative technology solutions.

The company has established a solid market presence through its advanced network infrastructure and commitment to compliance with legal interception requirements set forth by the South Korean government. SK Telecom’s strengths lie in its robust capabilities in data management and analytics, allowing for efficient implementation of lawful interception processes.

Additionally, its reputation for reliability and operational excellence fosters trust among governmental agencies and enhances its competitive edge.

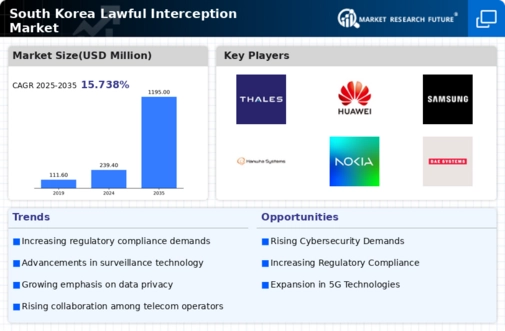

By prioritizing research and development, SK Telecom continually enhances its lawful interception solutions, thus positioning itself favorably in an evolving market.Thales Group is another significant entity within the South Korea Lawful Interception Market, recognized for its cutting-edge security technologies and comprehensive suite of products and services.

The company specializes in providing solutions that ensure secure communication channels while enabling lawful access for appropriate authorities. Thales Group maintains a strong market presence through strategic collaborations and partnerships with local telecom providers, which enable seamless integration of interception capabilities.

Its strengths are augmented by a portfolio that includes advanced cyber defense solutions and real-time data processing systems, vital in ensuring compliance with South Korean laws.

The company's focus on mergers and acquisitions has also enhanced its technological assets and market offering in the region, allowing it to adapt and respond effectively to the demands of the lawful interception landscape.