Advancements in Synthetic Biology

The protein engineering market in South Korea is experiencing a surge due to advancements in synthetic biology. This field enables the design and construction of new biological parts, devices, and systems. As a result, companies are increasingly investing in research and development to create novel proteins with enhanced functionalities. The South Korean government has recognized the potential of synthetic biology, allocating approximately $200 million to support related initiatives. This funding is likely to foster innovation and drive growth in the protein engineering market, as researchers and companies collaborate to develop applications in pharmaceuticals, agriculture, and environmental sustainability.

Regulatory Support for Biotechnology

Regulatory frameworks in South Korea are evolving to support the protein engineering market. The government is implementing policies that facilitate the approval and commercialization of biotechnological products. This regulatory support is crucial for companies looking to bring innovative protein-based solutions to market. For instance, the Ministry of Food and Drug Safety has streamlined the approval process for biopharmaceuticals, reducing the time to market. Such initiatives are expected to encourage investment in protein engineering, as companies can navigate the regulatory landscape more efficiently, ultimately leading to a more dynamic and competitive market.

Growing Demand for Biopharmaceuticals

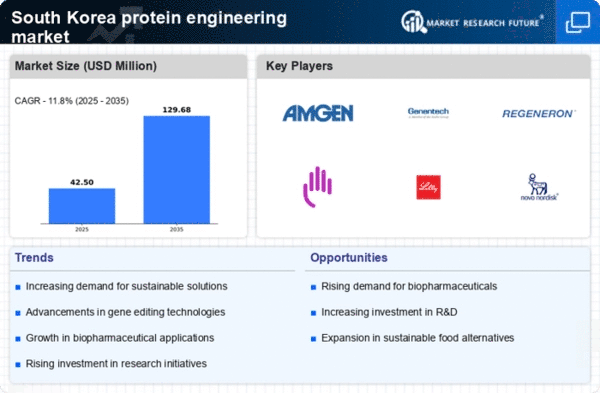

The protein engineering market is significantly influenced by the growing demand for biopharmaceuticals in South Korea. With an increasing prevalence of chronic diseases, the need for effective therapeutic proteins is on the rise. The biopharmaceutical sector is projected to reach a market value of $10 billion by 2026, indicating a robust growth trajectory. This demand is prompting companies to invest in protein engineering to develop more efficient and targeted therapies. As a result, the protein engineering market is likely to expand, driven by innovations in drug design and production processes that enhance the efficacy and safety of biopharmaceuticals.

Increased Focus on Sustainable Practices

Sustainability is becoming a key driver in the protein engineering market in South Korea. As environmental concerns grow, there is a push for the development of sustainable protein sources and production methods. Companies are exploring engineered proteins that can replace traditional animal-based products, which are often resource-intensive. This shift is supported by consumer demand for eco-friendly alternatives, with a reported 60% of South Koreans willing to pay more for sustainable products. Consequently, the protein engineering market is likely to see increased investment in research aimed at creating sustainable protein solutions that align with both consumer preferences and environmental goals.

Emergence of Startups and Innovation Hubs

The protein engineering market in South Korea is witnessing a rise in startups and innovation hubs dedicated to biotechnology. These entities are fostering a culture of innovation, attracting talent and investment. The presence of incubators and accelerators is facilitating collaboration between researchers and entrepreneurs, leading to the development of cutting-edge protein engineering solutions. In 2025, it is estimated that over 100 biotech startups will be operational in South Korea, contributing to a vibrant ecosystem. This influx of new ideas and technologies is likely to drive competition and growth in the protein engineering market, as startups introduce novel applications and products.