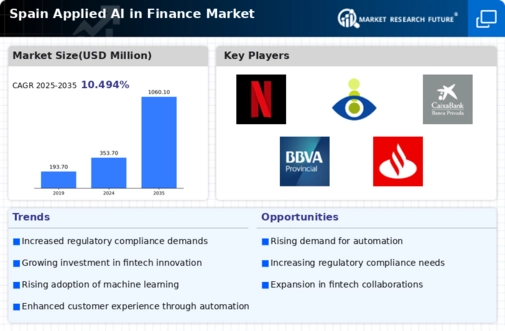

The Spain Applied AI in Finance Market has become increasingly competitive with various players leveraging advanced technologies to enhance financial services. The integration of AI in finance is not only transforming traditional banking but also paving the way for innovative FinTech solutions tailored to meet customer needs in Spain. This landscape is characterized by rapid technological advancements, regulatory changes, and a growing demand for personalized financial services. The competition revolves around delivering value-added solutions such as predictive analytics, automated customer service, and sophisticated risk assessment tools, all of which have become key components in providing efficient and customer-friendly financial services.

Fintonic stands out in the Spain Applied AI in Finance Market due to its innovative approach to personal finance management. The company specializes in offering users a platform to manage their finances efficiently, analyze spending habits, and ultimately enhance financial literacy. Fintonic's strengths lie in its user-friendly interface and the ability to provide personalized financial insights leveraging AI. This aligns perfectly with the growing trend of consumers seeking more control over their finances while benefiting from tailored advice. Its presence in the market is marked by a strong customer base and continuous efforts to enhance user engagement through technology.

The application's commitment to customer-centric solutions has empowered consumers, allowing them to make informed financial decisions and gain access to better credit offerings.

N26 has carved a notable niche within the Spain Applied AI in Finance Market by offering an innovative digital banking experience. This mobile bank focuses on providing seamless banking solutions that enhance customer convenience and engagement. N26's key products include personal accounts, business accounts, and various payment services, all designed to cater to the modern consumer's needs. The strengths of N26 lie in its streamlined user experience, rapid account setup, and advanced mobile functionalities. The company has made significant strides in expanding its market presence in Spain, earning a reputation for reliability and efficient customer service.

Moreover, N26 has engaged in a series of strategic partnerships and potentially impactful mergers that have bolstered its capabilities, allowing it to invest in AI applications that facilitate personalized banking services. The focus on leveraging AI for optimizing financial processes and improving customer interactions is a testament to N26's commitment to staying at the forefront of the FinTech revolution in Spain.