Spain Bicycle Market Research Report By Application (Racing, Transportation tools, Recreation) andBy Type (E-bikes, Conventional bikes)- Forecast to 2035

ID: MRFR/AM/43135-HCR | 200 Pages | Author: Sejal Akre| April 2025

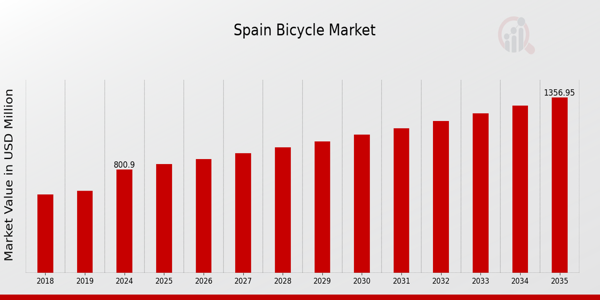

As per MRFR analysis, Spain Bicycle Market Size was estimated at 768.03 (USD Million) in 2023. Spain Bicycle Market Industry is expected to grow from 800.9(USD Million) in 2024 to 1,357.0 (USD Million) by 2035. Spain Bicycle Market CAGR (growth rate) is expected to be around 4.91% during the forecast period (2025 - 2035).

In Spain, the bicycle market is experiencing significant growth driven by a rising health consciousness among consumers and a shift towards sustainable transportation options. Government initiatives aimed at promoting cycling as an eco-friendly mode of transport play a crucial role as well. This aligns with national goals to reduce carbon emissions and improve overall urban mobility. Increasing investments in cycling infrastructure, such as bike lanes and parking spaces, are facilitating easier access to cycling in urban areas. Consumer preferences are shifting toward electric bicycles, reflecting a growing trend of adopting technology to enhance riding experiences and overcome physical barriers.

The COVID-19 pandemic has also accelerated interest in cycling, as many individuals seek alternatives to public transport while maintaining social distance. There is a push for local products, with brands emphasizing sustainability and local production to appeal to environmentally conscious consumers. Opportunities in Spain bicycle market includes expanding e-bike offerings and enhancing rental services particularly in tourist hotspots where cycling is popular. Furthermore, as remote work becomes more standard, there is potential to design cycling initiatives tailored for commuting, catering to a workforce that values flexibility and active lifestyles.The push to engage younger demographics through social media marketing and community events is another area to explore. Overall, recent times have shown a notable movement towards integrating cycling into daily life, reflecting a broader trend towards wellness and sustainability in Spain.

Spain has been more knowledgeable about pollution and air quality issues over the last few years. Sustained bike transport use has skyrocketed in cities like Barcelona and Madrid because the Spanish Ministry for Ecological Transition is encouraging the use of 'sustainable' bikes. Local governments have boosted the construction of bike paths due to the 'Sustainable Urban Mobility Plans,' which have resulted in solo cycling being safer and more enjoyable.

The latter two years, 2020 to 2022, appear to be the most favorable context for implementing a policy to promote the cycling level in these cities. Various studies show an increase in cycling by 20% in Spanish cities, not to mention the increasing prevalence of considering bikes as a practical substitute for automobiles. This development is further supported by the European Cyclists' Federation, which promotes cycling as a green transport alternative and sets requirements that have changed local policy. Consequently, it greatly assisted the sustainable mobility policies of urban centers in Spain.

The Spanish government has introduced numerous initiatives aimed at promoting cycling, which has been instrumental in driving Spain's Bicycle Market Industry growth. These initiatives include subsidies for purchasing electric bicycles and funding for the expansion of cycling infrastructure. The Ministry of Transport has allocated over €100 million for cycling infrastructure improvements over the next decade. Furthermore, regional governments in Spain are providing financial incentives to residents to purchase bicycles; for instance, the Basque Government launched a program offering up to 30% off on electric bicycle purchases.These financial incentives have encouraged more citizens to consider cycling, contributing to a projected increase of more than 15% in electric bicycle sales in the coming years.

The awareness of health and fitness is on the rise in Spain, particularly post-COVID-19. The Spanish health authorities have reported a significant increase in people engaging in physical activities to combat sedentary lifestyles. According to Spanish health surveys, roughly 40% more residents are now integrating cycling into their daily routines. This was further supported by the Ministry of Health's 'Active Lifestyle' campaign, promoting cycling as an effective means for maintaining physical health.The growing trend of fitness enthusiasts choosing bicycles over traditional gym memberships has significantly boosted the Spain Bicycle Market Industry, creating a flourishing demand for various bicycles tailored to meet the needs of health-conscious consumers, such as fitness bikes and electric bicycles.

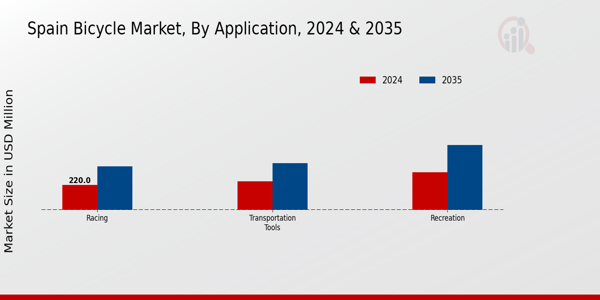

The Application segment of Spain's Bicycle Market showcases a diverse range of functionalities, evidencing the multifaceted nature of bicycle usage within the country. With the growing emphasis on sustainability and health, bicycles serve not only as recreational tools but also as essential transportation modes, contributing considerably to urban mobility. The inclination towards racing bicycles has grown significantly, fueled by the popularity of competitive cycling events across various regions of Spain, supported by local clubs and events that encourage sportsmanship and athletic achievement. Additionally, the burgeoning trend of using bicycles as transportation tools is evident in major cities, where local governments have initiated bike-sharing programs and infrastructure development, thereby enhancing the bicycle commuting experience. Such initiatives not only lessen traffic congestion but also align with Spain's environmental goals, contributing to reduced emissions. Recreational cycling further bolsters this segment, with the picturesque landscapes and scenic routes available throughout Spain offering cyclists ample opportunity to engage in leisure activities while exploring their surroundings.

The rise of cycling events, festivals, and community activities is indicative of a robust cycling culture that appreciates both the health benefits and social aspects associated with biking. Each of these applications captures a significant audience, positioning Spain's Bicycle Market as a versatile industry ripe for growth and innovation, with trends leaning towards eco-friendliness and active living. The distinct preferences and requirements across these usages reveal valuable insights into consumer behavior, guiding industry stakeholders in making informed decisions as they navigate this evolving market.The recognition of bicycles as tools for recreation, competition, and transportation reflects a broader lifestyle shift in Spain, accentuating the importance of infrastructure development and community engagement in nurturing cycling's prominence within society.

Spain's Bicycle Market is witnessing notable growth, particularly in the Type segment, which encompasses E-bikes and Conventional bikes. E-bikes have surged in popularity due to increased urbanization and the push for sustainable transportation solutions. Their convenient features appeal to a wider demographic, including commuters who are keen on reducing carbon footprints. On the other hand, conventional bikes maintain a solid presence, are favored for recreational purposes and fitness activities, and have a long-standing heritage in Spanish culture. The integration of advanced technologies in E-bikes is redefining the riding experience, making them a significant force in the market dynamics, while Conventional bikes continue to attract traditional cycling enthusiasts and support outdoor leisure activities.

As the demand for eco-friendly transportation options grows, Spain's Bicycle Market industry is positioned for further evolution, propelled by changing consumer attitudes toward health and wellness. With a focus on innovation and improved biking infrastructure, opportunities abound for both segments, ensuring a competitive landscape is sustained in the coming years. This market segmentation offers a comprehensive view of consumer preferences, making it vital for stakeholders to align with emerging trends and demands effectively.

Spain's Bicycle Market has been witnessing significant growth, driven by various factors, including increased awareness of health and fitness, urban mobility trends, and a growing emphasis on eco-friendly transportation alternatives. The competitive landscape is characterized by a mix of established domestic brands and international players, each vying for market share through innovative designs, enhanced technology, and effective marketing strategies. The market participants are increasingly focusing on sustainable practices and product differentiation to cater to diverse consumer preferences. The emergence of cycling as both a recreational activity and a mode of transportation has led to a surge in demand for a variety of bicycle types, prompting companies to adapt quickly to changing consumer needs. The presence of numerous specialized bike shops and online retail platforms further intensifies the competition, providing consumers with a wealth of choices.In the context of Spain's bicycle market, Merida Industry Co has established a formidable presence, and it is recognized for its high-performance bicycles and commitment to quality.

The company has built a strong brand reputation through decades of experience and innovation in the cycling industry. Its primary strengths lie in the production of a diverse range of bicycles that cater to different segments, including road, mountain, and electric bikes. Merida's focus on advanced engineering and research has enhanced its product quality and performance, capturing the interest of serious cyclists. Strategic collaborations with professional cycling teams have also bolstered its credibility in the market, while its effective distribution network ensures availability across various regions within Spain. The company continually invests in marketing and sponsorships, further solidifying its position as a leader in the competitive landscape of the Spanish cycling sector.

Pinarello is another key player in the Spanish bicycle market, renowned for its performance-oriented racing bicycles that appeal to both amateurs and professional cyclists. The brand is well-known for its innovative technology and design features, which enhance aerodynamics and riding efficiency. Pinarello's strength lies in its ability to deliver high-quality products that resonate with cycling enthusiasts, leading to a loyal customer base in Spain. The company offers a range of bicycles that include road bikes, gravel bikes, and electric models, each tailored to meet specific cycling needs. Furthermore, Pinarello has strengthened its market presence through strategic partnerships and sponsorships in professional cycling events, which elevate the brand's visibility and prestige. The brand has also engaged in a few acquisitions that have enriched its engineering capabilities and technological advancements, enabling it to remain at the forefront of the competitive landscape. This unwavering focus on innovation and performance has positioned Pinarello as a preferred choice among serious cyclists in Spain.

Spain's Bicycle Market has recently experienced significant developments with an increase in demand for electric bicycles, which has been driven by growing environmental awareness and government incentives for sustainable transportation. In September 2023, Merida Industry Co. announced the launch of a new line of e-bikes tailored for urban commuting, responding to the increased interest in eco-friendly commuting options. Additionally, Bianchi moved to enhance its presence in Spain by collaborating with local retailers to improve accessibility to their high-end racing bikes, while Decathlon reported an expansion of its bicycle range, including affordable e-bikes, catering to a broader audience.

Furthermore, significant mergers have been observed, including Trek Bicycle Corporation acquiring a smaller local brand in August 2023 to strengthen its foothold in the region. Notably, the overall valuation of the bicycle market in Spain has been on an upward trajectory, attributed to cycling becoming a popular recreational activity post-COVID-19 lockdown. Last year, in July 2022, Scott Sports introduced innovative cycling gear aimed at professional cyclists, further fueling competition within the market. The increasing trend towards cycling for sport and leisure, combined with the government's commitment to cycling infrastructure, underpins the current growth trajectory of Spain's bicycle industry.

Racing

Transportation tools

Recreation

Bicycle Market Type Outlook

E-bikes

Conventional bikes

| Report Attribute/Metric Source: | Details |

| MARKET SIZE 2018 | 768.03 (USD Million) |

| MARKET SIZE 2024 | 800.9 (USD Million) |

| MARKET SIZE 2035 | 1357.0 (USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 4.91% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| MARKET FORECAST PERIOD | 2025 - 2035 |

| HISTORICAL DATA | 2019 - 2024 |

| MARKET FORECAST UNITS | USD Million |

| KEY COMPANIES PROFILED | Merida Industry Co, Pinarello, Bianchi, Specialized Bicycle Components, Brompton Bicycle, Felt Bicycles, Trek Bicycle Corporation, Kona Bicycle Company, Scott Sports, Giant Manufacturing Co, Santa Cruz Bicycles, Orbea, Decathlon, Cube Bikes, Cannondale |

| SEGMENTS COVERED | Application, Type |

| KEY MARKET OPPORTUNITIES | Growing urban cycling infrastructure, Increasing eco-conscious consumer base, Rising demand for e-bikes, Expanding tourism cycling experiences, Government incentives for cycling promotion |

| KEY MARKET DYNAMICS | increasing health consciousness, urban mobility trends, sustainable transport initiatives, e-commerce growth, government cycling infrastructure investment |

| COUNTRIES COVERED | Spain |

Frequently Asked Questions (FAQ) :

The Spain Bicycle Market is projected to be valued at 800.9 million USD in 2024.

By 2035, the Spain Bicycle Market is expected to reach a valuation of approximately 1357.0 million USD.

The expected CAGR for the Spain Bicycle Market from 2025 to 2035 is 4.91 percent.

The Racing segment is forecasted to reach a value of 380.0 million USD in the Spain Bicycle Market by 2035.

The Transportation tools segment is expected to be valued at 410.0 million USD in 2035.

The Recreation segment is projected to reach a value of 567.0 million USD by the year 2035.

Major players in the Spain Bicycle Market include Merida Industry Co, Pinarello, and Bianchi among others.

The Racing segment was valued at 220.0 million USD in the Spain Bicycle Market in 2024.

In 2024, the Transportation tools segment was valued at 250.0 million USD in the Spain Bicycle Market.

Key growth drivers for the Spain Bicycle Market include increasing demand for eco-friendly transportation and recreational activities.

Leading companies partner with us for data-driven Insights.

Kindly complete the form below to receive a free sample of this Report

© 2025 Market Research Future ® (Part of WantStats Reasearch And Media Pvt. Ltd.)