Spain Biometric ATM Market Overview

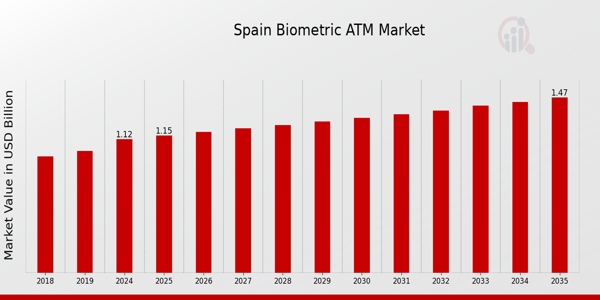

As per MRFR analysis, the Spain Biometric ATM Market Size was estimated at 1.09 (USD Billion) in 2023. The Spain Biometric ATM Market Industry is expected to grow from 1.12(USD Billion) in 2024 to 1.47 (USD Billion) by 2035. The Spain Biometric ATM Market CAGR (growth rate) is expected to be around 2.48% during the forecast period (2025 - 2035).

Key Spain Biometric ATM Market Trends Highlighted

Driven by the need for improved security and effective customer service, the Spain Biometric ATM Market is showing numerous important trends. A major market driver driving banks and financial institutions in Spain to install biometric ATMs, which utilize fingerprints, iris recognition, and face recognition technology to authenticate user identification, is growing worried about bogus transactions and identity theft.

This technical connection improves security and simplifies the transaction process, therefore presenting biometric ATMs as a more effective alternative for both customers and service providers. There are many opportunities in this industry, especially in cities where the need for rapid and safe financial solutions is exploding.

The use of biometric ATMs in high-traffic public areas might be a competitive advantage for banks as more customers give safety in financial transactions first priority. Furthermore, since Spain emphasizes smart banking solutions and innovation as part of its digital transformation plan, cooperation between financial institutions and technology companies can improve ATM capacities even further.

Apart from the COVID-19 epidemic, which has hastened the need for contactless solutions in Spain, recent trends show a continuous move towards cashless transactions. In addition to offering safe transactions, biometric ATMs fit the increasing customer inclination toward touchless interfaces.

In the framework of Spain's established banking industry, the integration of biometric technologies into ATM networks might change how customers interact with financial services, therefore providing a mix of ease and safety that conventional ATMs cannot equal.

Driven by technology developments, changing customer expectations, and a rising emphasis on security in banking procedures, the Spain Biometric ATM Market is overall expected to be growing.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Spain Biometric ATM Market Drivers

Growing Demand for Enhanced Security Features

The demand for enhanced security measures in the banking sector is a primary driver for the Spain Biometric ATM Market Industry. According to the Bank of Spain, fraudulent activities in the banking sector have seen a rise, prompting banks to seek advanced security solutions. In 2022, the total amount of fraud reported by banks in Spain was approximately 1.5 billion Euros, indicating a pressing need for reliable and secure transaction methods.

Biometrics, such as fingerprint or iris recognition, offers a way to mitigate this risk, making their integration into ATMs crucial. Major banks like Banco Santander are investing heavily in Research and Development (R&D) to incorporate biometric technology into their ATMs, aiming to reduce the incidence of fraud while improving user experience. This trend demonstrates a clear alignment between customer safety and technological innovation, contributing to the growth of the Spain Biometric ATM Market.

Regulatory Support and Financial Inclusion Initiatives

The Spanish government has been actively promoting financial inclusion through regulatory support, bolstering the Spain Biometric ATM Market Industry. Initiatives aimed at increasing financial access for unbanked populations make it necessary for financial institutions to adopt solutions that are convenient and secure, which biometrics can provide.

For example, Spain's National Payment Systems Plan emphasizes the importance of technological innovations, including biometrics, in ensuring that financial services reach underserved communities. As such, several banks like CaixaBank are leading the charge in deploying biometric ATMs in rural areas to facilitate better access to banking. The regulatory environment is thereby propelling the adoption of biometric solutions as critical enablers for financial inclusion.

Increasing Consumer Acceptance of Biometric Solutions

Consumer acceptance of biometric technology is rapidly increasing, positively impacting the Spain Biometric ATM Market Industry. A recent survey conducted by the Spanish Technology and Innovation Agency found that over 70% of Spanish consumers are open to using biometric authentication for transactions, citing convenience and security as key benefits.

This growing acceptance is driving banks to install more biometric ATMs, as the demand for faster and more secure transaction methods rises. Prominent financial institutions such as Bankia are adopting these technologies to cater to consumer preferences, thus further propelling the growth of the market. The increasing readiness of consumers to embrace biometric solutions will likely lead to higher rates of adoption and innovation within the industry.

Technological Advancements in Biometric Systems

Technological advancements in biometric systems are significantly influencing the evolution of the Spain Biometric ATM Market Industry. Recent improvements in biometric sensor technologies, artificial intelligence, and machine learning have made biometric systems more efficient and accurate. The Spanish Institute of Engineering has reported a 35% improvement in biometric recognition accuracy over the past three years, making these systems a viable option for financial institutions.

Companies specializing in biometric solutions, such as Innovatrics and Fingerprint Cards, are playing a critical role in advancing this technology and making it suitable for widespread ATM deployment. Financial institutions eager to leverage these advancements are likely to drive the market growth further, providing a competitive advantage in the security-conscious banking environment.

Spain Biometric ATM Market Segment Insights

Biometric ATM Market Application Insights

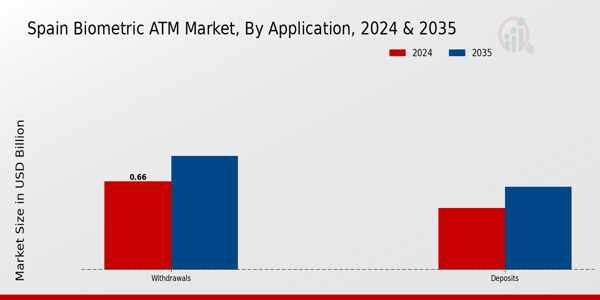

The Spain Biometric ATM Market, with increasing traction towards enhancing security measures in banking transactions, showcases a defined Application segment consisting primarily of Withdrawals and Deposits. The increasing adoption of biometric authentication in ATMs is fundamentally transforming the way users interact with banking systems.

Biometrics, such as fingerprints and facial recognition, provide a seamless experience while ensuring enhanced security, thereby addressing growing concerns regarding unauthorized access and fraud.

In the context of Withdrawals, the implementation of biometric ATMs allows users to withdraw cash without the need for traditional PINs or cards, significantly reducing the risk of card skimming and PIN theft. This feature not only accelerates the transaction process but also enhances user confidence in utilizing ATMs, especially in high-risk areas.

The ability to swiftly complete transactions holds considerable importance for individuals in urban centers across Spain, where high traffic at ATMs is prevalent. On the other hand, the Deposits aspect of biometric ATMs presents a compelling opportunity for banks to modernize their services. By integrating biometric technology, financial institutions can streamline the deposit process, allowing customers to make transactions securely without the hassle of physical cards or remembering complex passwords.

This convenience factor appeals particularly to tech-savvy customers who prefer efficient and rapid banking solutions. Given Spain's commitment to digital transformation, with government initiatives pushing for improved banking technologies, the growth in biometric ATM functionality is poised to gain momentum.

Both Withdrawals and Deposits functional segments play critical roles in the expansion of the Spain Biometric ATM Market. With increasing regulatory emphasis on security measures in financial transactions, the demand for reliable biometric systems in ATMs is further strengthened. Additionally, as more users become accustomed to this modern technology, the acceptance and its subsequent growth will likely result in increased market penetration.

The landscape of banking in Spain is moving towards incorporating biometric solutions, thus enhancing user experience while tackling challenges like fraud and identity theft. Overall, the insights into the Application segment reveal a market focused on innovation and efficiency, essential for adapting to the evolving demands of the Spanish banking sector.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Biometric ATM Market Product Type Insights

The Spain Biometric ATM Market, under the Product Type segmentation, showcases a diverse range of technologies, including Iris Recognition, Fingerprint Biometrics, Voice Recognition, Facial Recognition, and Others, each contributing uniquely to enhancing security and user convenience in banking. Iris Recognition is particularly notable for its high accuracy and use in secure transactions, making it an attractive option for financial institutions aiming to enhance authentication processes.

Fingerprint Biometrics continues to lead in popularity due to its widespread adoption and user familiarity, offering a balance between security and ease of use.

Voice Recognition is gaining traction as a convenient alternative that allows for hands-free operation, which aligns with the growing trend of contactless interactions, especially in light of health considerations. Facial Recognition technology is also on the rise, benefiting from advancements in artificial intelligence, which improves its efficiency and reliability in identifying customers.

The "Others" category encompasses various innovative solutions, reflecting the dynamic nature of the biometric landscape in Spain. The overall trend in this market segment is towards more integrated and user-friendly systems that prioritize user experience and security, in response to increasing demands for sophisticated fraud prevention measures in the banking sector.

Biometric ATM Market Component Insights

The Spain Biometric ATM Market has been increasingly focused on the Component segment, which encompasses various essential elements such as Hardware, Software, and Services that drive the overall functionality and efficiency of biometric ATMs. Within this landscape, Hardware plays a pivotal role, incorporating advanced biometric sensors and devices that enhance security measures, making transactions safer for users.

Software is equally crucial, providing the necessary infrastructure for biometric recognition systems and ensuring smooth communication between the ATM and user databases.

As for Services, they support the deployment, maintenance, and upgrades of biometric systems, contributing to the overall reliability of these machines. This segment's importance is underscored by the growing demand for enhanced security features in ATMs, driven by rising concerns about fraud and identity theft.

The trends in the Spain Biometric ATM Market indicate a notable shift toward integrating more sophisticated biometric technologies, which not only bolster user confidence but also comply with evolving regulatory standards aimed at improving financial security. The constant innovation within these segments signifies their significance in shaping the overall landscape of the biometric ATM industry in Spain.

Spain Biometric ATM Market Key Players and Competitive Insights

The Spain Biometric ATM Market has seen significant growth and innovation in recent years, driven by the increasing demand for secure and efficient banking solutions. As financial institutions seek to enhance customer experiences while minimizing fraud, biometric technology has emerged as a vital component of ATM services.

The competitive landscape of this market consists of several players striving for advancement in biometric authentication methods such as fingerprint, facial recognition, and iris scanning. Companies are continuously working on integrating these technologies into their ATMs to provide seamless access to banking services while ensuring data security.

The dynamic nature of the market also fosters collaboration and the development of partnerships to boost technological capabilities and expand market reach. Hantle has established a noteworthy presence in the Spanish market by leveraging its strengths in innovative ATM solutions that cater specifically to the needs of financial institutions.

The company's ATMs are designed with advanced biometric security features, helping banks enhance customer verification processes and reduce the risks associated with identity theft. Hantle's focus on user-friendly designs and reliable performance has led to increased adoption across various segments within the market.

Their strategy includes offering tailored solutions that not only meet regulatory requirements but also address customer expectations for convenience and security. Hantle's commitment to research and development enables the company to stay ahead of technological trends while fostering strong relationships with its clients in Spain, ultimately solidifying its position in the competitive landscape. Innovus has carved out a strong niche within the Spain Biometric ATM Market through its dedication to integrating cutting-edge biometric systems into its offerings.

The company's product line features a range of ATMs equipped with various biometric authentication technologies, ensuring high levels of security and efficiency for users. Innovus emphasizes not just product excellence but also providing comprehensive support and service to its clients across Spain, making it a trusted partner for numerous financial institutions.

The company has engaged in strategic mergers and acquisitions, bolstering its capabilities and facilitating the expansion of its market presence. This strategy has allowed Innovus to enhance its technological offerings and cater to a diverse clientele, demonstrating resilience and a forward-thinking approach to meeting the evolving demands of the banking sector. By focusing on innovation, customer service, and strategic growth, Innovus continues to maintain a competitive edge in the biometric ATM landscape within Spain

Key Companies in the Spain Biometric ATM Market Include

- Innovus

- NCR Corporation

- Diebold Nixdorf

- GRG Banking

- KAL ATM Software

- IDEMIA

- Euronet Worldwide

- Fujitsu

Spain Biometric ATM Market Developments

Recent developments in the Spain Biometric ATM Market indicate a growing trend toward enhancing security and user experience. Notable players like NCR Corporation and Diebold Nixdorf are pushing innovations in biometric technology, integrating fingerprint and facial recognition systems into ATMs to meet the rising demand for secure transactions.

In September 2023, Innovus announced a partnership to enhance its biometric systems, aligning with regulatory advancements aimed at bolstering cybersecurity measures. Moreover, the market has seen growth, with the valuation of companies like GRG Banking increasing significantly due to increased investments in biometric ATM solutions.

Recent mergers include the acquisition of Wincor Nixdorf by Diebold, which was finalized in January 2023, allowing both organizations to leverage their strengths in the biometric sector.

Overall, the landscape is shifting as companies like Fujitsu and IDEMIA work on new ATM features that integrate biometric authentication, reflecting a broader commitment to modernizing the financial services infrastructure in Spain. The growing adoption of biometric technology is substantially impacting market dynamics, providing safer and more convenient solutions in an increasingly digital world.

Spain Biometric ATM Market Segmentation Insights

Biometric ATM Market Application Outlook

Biometric ATM Market Product Type Outlook

- Iris Recognition

- Fingerprint Biometrics

- Voice Recognition

- Facial Recognition

- Others

Biometric ATM Market Component Outlook

- Hardware

- Software

- Services

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

1.09 (USD Billion) |

| MARKET SIZE 2024 |

1.12 (USD Billion) |

| MARKET SIZE 2035 |

1.47 (USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

2.48% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Hantle, Innovus, ATML Holdings, NCR Corporation, Wincor Nixdorf, Diebold Nixdorf, GRG Banking, KAL ATM Software, Transax, IDEMIA, Euronet Worldwide, Gemalto, Fujitsu, SMA ATM Services, Verifone |

| SEGMENTS COVERED |

Application, Product Type, Component |

| KEY MARKET OPPORTUNITIES |

Increased demand for security solutions, Growing adoption of contactless transactions, Expansion of digital banking services, Government support for fintech innovation, Rising consumer acceptance of biometric technology |

| KEY MARKET DYNAMICS |

growing demand for security, technological advancements in biometrics, regulatory compliance requirements, increasing cashless transactions, consumer acceptance of biometric solutions |

| COUNTRIES COVERED |

Spain |

Frequently Asked Questions (FAQ) :

The Spain Biometric ATM Market is expected to be valued at 1.12 USD Billion in 2024.

By 2035, the market size of the Spain Biometric ATM Market is projected to reach 1.47 USD Billion.

The expected CAGR for the Spain Biometric ATM Market from 2025 to 2035 is 2.48%.

In 2024, withdrawals are expected to be valued at 0.66 USD Billion, while deposits will be valued at 0.46 USD Billion.

By 2035, the withdrawals market is projected to reach 0.85 USD Billion, and deposits are expected to reach 0.62 USD Billion.

Major players in the Spain Biometric ATM Market include Hantle, Innovus, NCR Corporation, and Diebold Nixdorf.

The Spain Biometric ATM Market is primarily segmented into withdrawals and deposits.

Growing demand for secure transactions and advancements in biometric technology are key emerging trends.

Increased adoption of biometric systems in banking and financial services offers significant growth opportunities.

Challenges include high implementation costs and regulatory compliance issues affecting market growth.