Spain E-Wallet Market Overview:

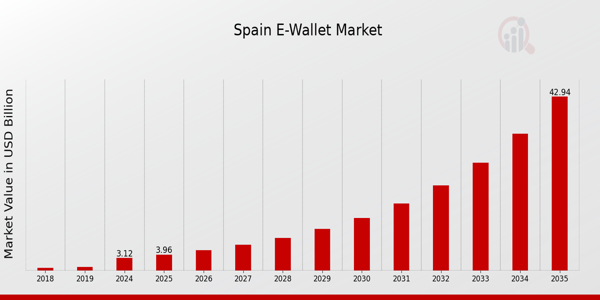

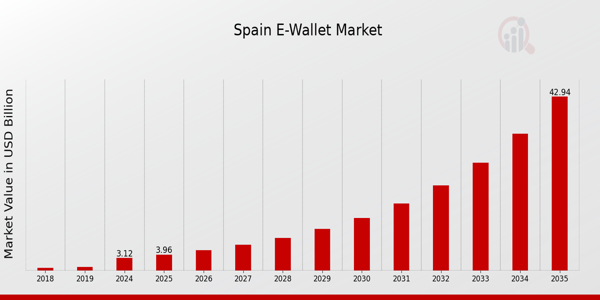

As per MRFR analysis, the Spain E-Wallet Market Size was estimated at 2.55 (USD Billion) in 2023. The Spain E-Wallet Market Industry is expected to grow from 3.12(USD Billion) in 2024 to 42.87 (USD Billion) by 2035.

The Spain E-Wallet Market CAGR (growth rate) is expected to be around 26.916% during the forecast period (2025 - 2035).

Key Spain E-Wallet Market Trends Highlighted

The Spain E-Wallet Market is experiencing significant growth driven by increasing digital payment adoption among consumers. One of the key market drivers is the rising penetration of smartphones and internet connectivity, enabling a larger segment of the population to access e-wallet services easily. With the Spanish government promoting a cashless society through various initiatives, consumers are becoming more accustomed to using digital payment methods for everyday transactions. This shift is further supported by the convenience and security features that e-wallets offer, leading to their widespread acceptance across retail outlets and online platforms.

In recent times, the trend of contactless payments has gained significant traction in Spain, accelerated by the COVID-19 pandemic, which has heightened awareness of hygiene and safety in payment methods. As e-commerce continues to flourish, e-wallets are emerging as a preferred payment option for online shopping, allowing for faster, smoother transactions. The integration of e-wallets with various loyalty programs and promotions is also attracting consumers, making this a valuable area for businesses to explore.

Moreover, internal market dynamics reveal opportunities for innovation in e-wallet features, such as loyalty rewards, instant transfers, and enhanced security measures, which could further boost consumer adoption.Financial inclusion is another area that presents significant opportunities, as e-wallets can reach underserved populations in Spain, providing them with access to financial services. As more consumers and businesses recognize the advantages of digital wallets, Spain is poised to see continued expansion in its e-wallet market, with evolving consumer preferences shaping the future landscape.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Spain E-Wallet Market Drivers

Rapid Digital Transformation in Spain

The growing digital revolution in Spain is a major driver of the Spain E-Wallet Market Industry. The Spanish National Institute of Statistics reports that nearly 75% of the Spanish population has an internet connection, indicating a spike in the usage of digital payment options. This growing digital participation is evident in the expansion of e-commerce operations, which have increased by about 30% in recent years, a trend amplified by the COVID-19 epidemic. Businesses are increasingly using e-wallet solutions such as PayPal and Stripe to meet the growing demand for online transactions.

As more Spanish shops provide e-wallet services, customer adoption will increase, supporting a solid development trajectory in the Spain E-Wallet Market Industry.

IGovernment Initiatives Promoting Digital Payments

The Spanish government's commitment to fostering a cashless economy plays a crucial role in the growth of the Spain E-Wallet Market Industry. Initiatives such as the 'Plan de Digitalizacin de las Empresas' aim to enhance digital payment solutions and promote the use of e-wallets among small and medium enterprises (SMEs). With nearly 98% of Spanish businesses classified as SMEs, addressing their needs for efficient payment solutions is essential.

The Ministry of Economic Affairs reported a significant increase in digital payment adoption, with around 40% of businesses integrating e-wallets within their payment systems within just the last two years.This governmental support and promotion of cashless payments ensure that the Spain E-Wallet Market continues to thrive in the coming years.

Growing Consumer Preference for Contactless Payments

The increasing consumer preference for contactless payment methods is significantly influencing the Spain E-Wallet Market Industry. According to a report from the Bank of Spain, contactless card transactions alone have seen a substantial increase, accounting for more than 50% of total card transactions in recent years.

This shift has been further augmented by the public's desire for safer transaction methods during the COVID-19 pandemic, leading to a marked rise in contactless payment adoption, which aligns seamlessly with e-wallet usage.With large retailers in Spain, such as Mercadona and Carrefour, integrating e-wallet payment options at their checkout points, this trend is only expected to grow, aligning with the consumer’s expectations for speed and convenience in transactions.

Spain E-Wallet Market Segment Insights:

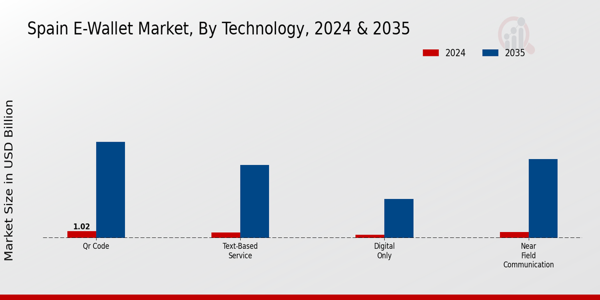

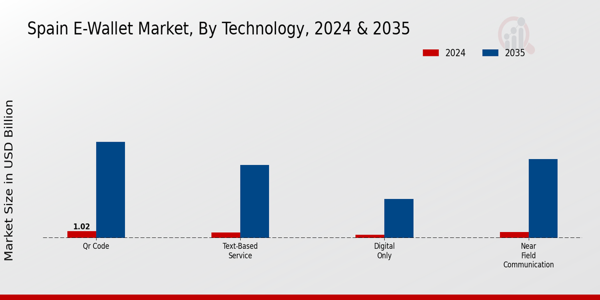

E-Wallet Market Technology Insights

The Spain E-Wallet Market, particularly within the Technology segment, showcases a dynamic landscape influenced by advancements in digital payment solutions. The predominant technology driving user engagement includes Near Field Communication (NFC). This technology allows users to make instantaneous transactions simply by tapping their devices, significantly enhancing customer experience and convenience. NFC's ease of use and speed underlies its importance in urban areas of Spain, where consumers lean towards quick, contactless payments driven by a desire for efficiency in their transactions.

Another vital aspect is the integration of QR Code technology, which has rapidly gained traction, particularly during the pandemic, as businesses sought contactless interaction methods.

QR codes offer a seamless approach for users to access payment systems without the need for additional app installations. Its low-cost implementation makes it appealing for small and medium enterprises in Spain, facilitating their entry into the digital payment arena and improving their operational efficiency.Text-based services are also noteworthy within the Spain E-Wallet Market, allowing users to conduct transactions via SMS or other messaging platforms. This segment caters to a demographic that may not have access to high-speed internet or smartphones, thus expanding the reach of e-wallets to a broader audience.

Text-based transactions retain a level of security while providing convenience for users preferring minimalistic approaches. The Digital Only segment represents a paradigm shift in how Spanish consumers interact with financial services. These services prioritize digital experiences by removing physical cards and focusing solely on app-based solutions. The rise of this segment reflects broader societal trends toward digitalization and the increasing comfort of consumers in conducting their financial affairs online.

This shift reinforces a cultural move towards tech-savvy practices among the Spanish populace, highlighting the increasing relevance of e-wallets in everyday financial transactions.The Spain E-Wallet Market segmentation into these technology-centric categories illuminates the evolving needs of consumers, driven by innovation and a desire for convenience. Each technology serves unique user demands while contributing to the overall growth of digital payment solutions in the country, driven by changing consumer behaviors, the rise of e-commerce, and increased smartphone penetration among the population.

As the landscape continues to evolve, these technologies will lay the groundwork for a more interconnected and efficient financial ecosystem in Spain.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

E-Wallet Market Application Insights

The Application segment of the Spain E-Wallet Market plays a crucial role in the overall financial landscape, reflecting the growing adoption of digital payment solutions across various industries. Retail and E-Commerce stand out as key drivers, with consumers increasingly favoring seamless payment methods for a more convenient shopping experience. The Hospitality and Transportation sectors have also embraced E-Wallet solutions, allowing for faster transaction processing, which enhances customer satisfaction in services ranging from hotel bookings to ride-hailing.

Banking services have integrated E-Wallets for secure money transfers and account management, appealing to tech-savvy users seeking streamlined financial management. Additionally, vending machines utilizing E-Wallet technology provide a quick and efficient means for consumers to make purchases, catering to the growing trend of cashless transactions in public spaces.

The overall Spain E-Wallet Market segmentation highlights a robust ecosystem where convenience, speed, and security come together, addressing the evolving needs and preferences of Spanish consumers amidst a rapidly digitizing economy.The increasing penetration of smartphones and internet access further fuels the growth of these applications, positioning the Spain E-Wallet Market for substantial evolution in the coming years.

Spain E-Wallet Market Key Players and Competitive Insights:

The Spain E-Wallet Market has witnessed significant growth in recent years, driven by the increasing adoption of digital payment solutions and a shift toward cashless transactions. The competition in this space is intensifying as more players enter the market, aiming to facilitate seamless payment experiences for both consumers and businesses. The presence of various local and international companies has diversified the offerings available, enabling users to choose e-wallet solutions that best meet their needs.

As the market evolves, factors such as regulatory changes, technological advancements, and consumer preferences are shaping the competitive landscape, making it essential for companies to adapt and innovate to retain their market positions.In the Spain E-Wallet Market, PayPal stands out for its strong brand recognition and extensive network. The company has established itself as a leading player due to its commitment to security and user convenience.

PayPal offers a user-friendly interface that allows individuals and businesses to easily send and receive money, enhancing the overall payment experience. Its strengths include a robust customer support system and integration with numerous online platforms, which boost its appeal among both merchants and consumers. The company's existing partnerships with various retailers and service providers in Spain further solidify its position, allowing it to capture a significant share of the e-wallet market.

This reliance on user trust and its established reputation for reliability play key roles in maintaining its competitive edge.Pagantis is another noteworthy player in the Spain E-Wallet Market, focusing on providing innovative payment solutions such as instant credit and tools for managing online purchases.

The company has positioned itself effectively within the e-commerce sector by catering to merchants looking for financing options for their customers. Pagantis's strengths lie in its ability to facilitate smooth checkout processes for consumers and offer tailored financial products that meet local market demands. The company has formed strategic partnerships with various retailers and platforms in Spain, expanding its market presence while enhancing its service offerings. With continuous innovation and a focus on customer experience, Pagantis has enhanced its capabilities, paving the way for potential mergers and acquisitions to further solidify its market standing.

Its emphasis on localized solutions helps differentiate it within the competitive landscape of the Spain E-Wallet Market.

Key Companies in the Spain E-Wallet Market Include:

- PayPal

- Pagantis

- TransferWise

- Stripe

- Apple Pay

- LemonWay

- Klarna

- N26

- Bizum

- Square

- Adyen

- Revolut

- Monzo

- Samsung Pay

- Google Pay

Spain E-Wallet Market Industry Developments

The Spain E-Wallet market has witnessed significant developments recently, especially with companies like PayPal, Pagantis, and Stripe enhancing their service offerings. Noteworthy is the growth of Bizum, which has become increasingly popular among Spanish consumers for peer-to-peer transactions, boasting a user base that exceeds 23 million as of September 2023. Meanwhile, Apple Pay and Google Pay continue to expand their acceptance among retailers, catering to the growing demand for contactless payments.

In terms of mergers and acquisitions, notable activity has been limited; however, reports indicate that TransferWise (now known as Wise) has seen growth in its customer base within Spain, emphasizing the trend towards cross-border financial services. Current market valuations reflect a positive trajectory, indicating increased investment and interest in the E-Wallet space. As of July 2023, the fintech segment in Spain reportedly attracted significant venture capital, indicating a robust ecosystem for digital payments. Additionally, Klarna has introduced new services aimed at facilitating smoother transactions, reflecting a broader trend towards innovation in payment solutions tailored for the Spanish market.

The ongoing expansion of e-commerce coupled with increasing mobile payment adoption continues to shape the landscape of the Spain E-Wallet market.

Spain E-Wallet Market Segmentation Insights

E-Wallet Market Technology Outlook

- Near Field Communication

- QR Code

- Text-based Service

- Digital Only

E-Wallet Market Application Outlook

- Retail & E-Commerce

- Hospitality & Transportation

- Banking

- Vending Machine

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2018 |

2.55(USD Billion) |

| MARKET SIZE 2024 |

3.12(USD Billion) |

| MARKET SIZE 2035 |

42.87(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

26.916% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

PayPal, Pagantis, TransferWise, Stripe, Apple Pay, LemonWay, Klarna, N26, Bizum, Square, Adyen, Revolut, Monzo, Samsung Pay, Google Pay |

| SEGMENTS COVERED |

Technology, Application |

| KEY MARKET OPPORTUNITIES |

Rising smartphone penetration, Increasing online shopping, Growing demand for contactless payments, Expansion of fintech startups, Supportive government regulations |

| KEY MARKET DYNAMICS |

rising smartphone penetration, increasing digital payment adoption, regulatory support for fintech, growing e-commerce activities, enhanced security features |

| COUNTRIES COVERED |

Spain |

Frequently Asked Questions (FAQ):

The Spain E-Wallet Market is expected to be valued at 3.12 billion USD by the year 2024.

By 2035, the Spain E-Wallet Market is projected to reach a value of 42.87 billion USD.

The expected CAGR for the Spain E-Wallet Market from 2025 to 2035 is 26.916%.

The QR Code technology segment is anticipated to have the highest market value of 14.38 billion USD in 2035.

The Near Field Communication technology market is valued at 0.84 billion USD in 2024 and is projected to reach 11.76 billion USD in 2035.

Major players in the Spain E-Wallet Market include PayPal, Apple Pay, Google Pay, and Revolut.

Key opportunities driving the Spain E-Wallet Market growth include increased digital payment adoption and enhanced mobile payment technologies.

The Text-based Service technology is expected to be valued at 10.94 billion USD in 2035.

Challenges faced by the Spain E-Wallet Market include cybersecurity threats and regulatory compliance issues.

The Digital Only technology segment is expected to be valued at 0.48 billion USD in 2024.