- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

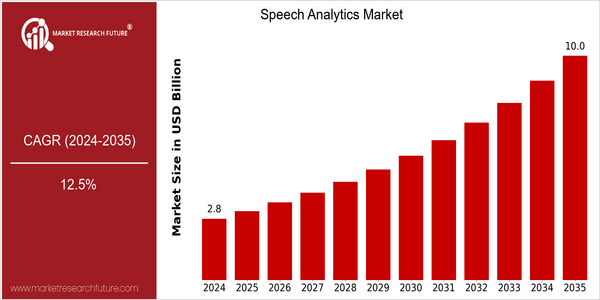

| Year | Value |

|---|---|

| 2024 | USD 2.76 Billion |

| 2035 | USD 10.0 Billion |

| CAGR (2025-2035) | 12.5 % |

Note – Market size depicts the revenue generated over the financial year

The global speech analytics market is expected to reach USD 10 billion by 2035. It is estimated that the compound annual growth rate of the speech analytics market is expected to be 12.5% from 2025 to 2035. This growth rate is expected to indicate a strong upward trend in the demand for speech analytics solutions. The use of artificial intelligence and machine learning is on the rise, and the need to improve customer experience and the operational efficiency of businesses is growing. Natural language processing and real-time analytics have transformed the way organizations use speech data. It has become possible to obtain valuable insights from customer conversations. The leading companies in the speech analytics industry, such as NICE, Verint, and CallMiner, are actively investing in innovation and strategic alliances to enhance their product offerings. Recent collaborations to integrate artificial intelligence into existing solutions are expected to drive the growth of the speech analytics market. The use of speech data for making decisions and improving customer experience is expected to increase further.

Regional Market Size

Regional Deep Dive

The Speech Analytics Market is gaining significant momentum across the globe, driven by the advancements in artificial intelligence, machine learning, and natural language processing. In North America, the market is characterized by the high adoption of speech analytics solutions by the enterprises for enhancing the customer experience and operational efficiency. In Europe, the market is highly diversified and influenced by the varying regulatory frameworks. The Asia-Pacific region is fast emerging as a hub for innovation, owing to the rising investments in digital transformation. The Middle East and Africa region is witnessing the slow but steady adoption of speech analytics solutions, mainly in the telecommunications and customer service sectors. The Latin America region is also focusing on the use of speech analytics solutions for improving the business processes and customer interactions.

Europe

- The European Union's General Data Protection Regulation (GDPR) has led to a surge in demand for compliant speech analytics solutions, pushing companies to innovate in data handling and privacy measures.

- Organizations like NICE and Verint are leading the charge in Europe, developing advanced speech analytics platforms that cater to the unique regulatory landscape and customer expectations in the region.

Asia Pacific

- In India and China, the telecommunications and IT industries are growing rapidly, and companies such as TCS are investing in speech analytics.

- The rise of voice-enabled devices and applications in the region is creating new opportunities for speech analytics, as businesses seek to harness voice data for improved customer engagement and service delivery.

Latin America

- The growing emphasis on customer experience in Latin America is driving interest in speech analytics, with companies like Movistar exploring these technologies to better understand customer needs and preferences.

- Economic factors, such as the increasing penetration of smartphones and internet access, are facilitating the adoption of speech analytics solutions, enabling businesses to leverage voice data for competitive advantage.

North America

- The integration of AI-driven speech analytics tools by major companies like Amazon and Google is revolutionizing customer service operations, enabling businesses to derive actionable insights from customer interactions.

- Regulatory changes, such as the California Consumer Privacy Act (CCPA), are prompting organizations to adopt more transparent and compliant speech analytics solutions, ensuring customer data protection while leveraging analytics for business growth.

Middle East And Africa

- Telecommunications companies in the UAE, such as Etisalat, are increasingly implementing speech analytics to enhance customer service and streamline operations, reflecting a growing trend in the region.

- Government initiatives aimed at digital transformation, such as Saudi Arabia's Vision 2030, are encouraging businesses to adopt advanced technologies, including speech analytics, to improve efficiency and customer satisfaction.

Did You Know?

“Approximately 70% of organizations that implement speech analytics report improved customer satisfaction scores within the first year of deployment.” — Gartner Research

Segmental Market Size

The Speech Analytics Market is experiencing a steady growth, owing to the growing need for improved customer experience and operational efficiency in the various industries. The growing need to monitor customer interactions for insights is the major factor driving the growth of the market. The growing adoption of artificial intelligence (AI) is also boosting the growth of the market. Regulations, especially in the banking and financial services, insurance, and healthcare industries, require compliance monitoring, thereby boosting the demand for speech analytics solutions. At present, the market is in the process of deployment, with market leaders such as NICE and Verint deploying speech analytics solutions in North America and Europe. The major applications of speech analytics include customer service optimization in call centers, compliance monitoring in the banking and financial services industry, and sentiment analysis in marketing campaigns. The trend toward remote working is boosting the growth of this application. Natural language processing (NLP) and machine learning are playing a major role in the evolution of speech analytics, enabling more advanced data interpretation and actionable insights.

Future Outlook

The Speech Analytics Market is expected to grow at a robust CAGR of 12.5% from 2024 to 2035. The growth will be driven by the increasing adoption of artificial intelligence and machine learning, which will enhance the accuracy and efficiency of speech recognition systems. With an increase in the demand for advanced speech analytics solutions from the healthcare, finance, and customer service industries, the demand for speech analytics will increase. In 2035, more than 60% of organizations will have speech analytics in place, compared to around 30% in 2024. The growth will be a result of the growing focus on data-driven decision-making. Natural language processing (NLP) and real-time analytics will also drive the growth. NLP and real-time analytics will help organizations to analyze customer interactions in real time, which will result in improved customer experience and operational efficiency. Besides, the focus on data privacy and security will shape the market, as companies will look for compliant solutions that will protect sensitive data while delivering speech analytics capabilities. Besides, the increasing adoption of omni-channel communication and the growing importance of customer sentiment analysis will also drive the adoption of speech analytics solutions.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 1.8 Billion |

| Market Size Value In 2023 | USD 2.16 Billion |

| Growth Rate | 20.38% (2023-2032) |

Speech Analytics Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.