Telemedicine Market Summary

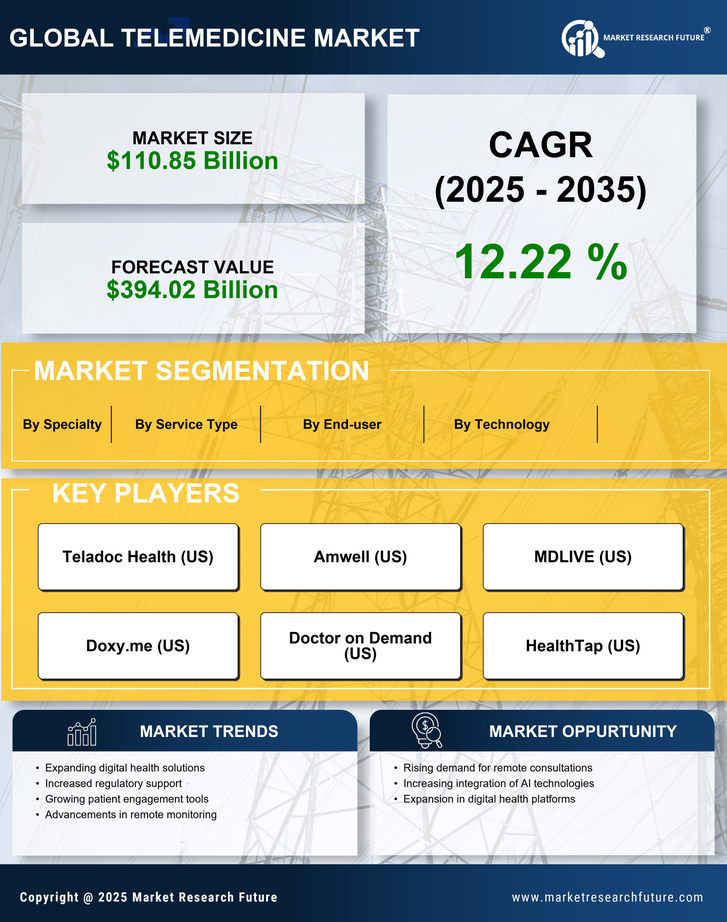

As per Market Research Future analysis, the Telemedicine Market Size was estimated at 110.85 USD Billion in 2024. The Telemedicine industry is projected to grow from 124.4 USD Billion in 2025 to 394.02 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 12.22% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The telemedicine market is experiencing robust growth driven by technological advancements and increasing demand for accessible healthcare.

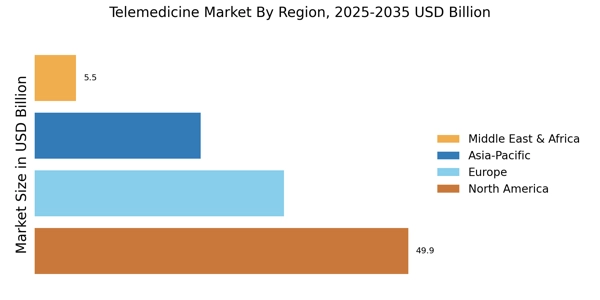

- North America remains the largest market for telemedicine, driven by high healthcare expenditure and advanced infrastructure.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by increasing smartphone penetration and internet accessibility.

- Real-time consultation services dominate the market, while remote patient monitoring is rapidly gaining traction due to its convenience and effectiveness.

- Key market drivers include the rising demand for accessible healthcare and technological advancements in communication, which enhance service delivery.

Market Size & Forecast

| 2024 Market Size | 110.85 (USD Billion) |

| 2035 Market Size | 394.02 (USD Billion) |

| CAGR (2025 - 2035) | 12.22% |

Major Players

Teladoc Health Doxy.me Amwell (US), MDLIVE (US), Doctor on Demand (US), HealthTap (US), Lemonaid Health (US), PlushCare (US), Zocdoc (US). These organizations are among the largest telemedicine companies, serving as market share leaders with significant telehealth companies market share and influence over the global telemedicine market share.