- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

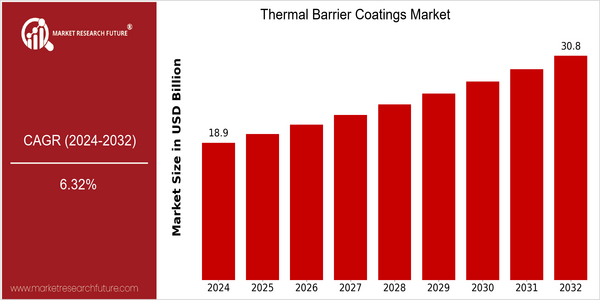

Thermal Barrier Coatings Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 18.87 Billion |

| 2032 | USD 30.8 Billion |

| CAGR (2024-2032) | 6.32 % |

Note – Market size depicts the revenue generated over the financial year

In the meantime, the market for the production of thermal insulating coatings is on the increase, with a current market of $ 18.87 billion, and projected to reach $ 30.82 billion in 2032. A CAGR of 6.32% for the forecast period. In particular, the increasing demand for thermal insulating coatings in the aeronautical, automobile and energy industries is a major driving force for this growth. These industries, which seek to improve the performance and the service life of their components, are relying more and more on advanced coatings. There are many factors to explain the increase in the market for thermal insulating coatings. There have been advances in the field of materials, such as the development of nanostructured coatings and advanced ceramic materials, which have improved the thermal resistance and the resistance of these coatings. Also, the growing need for energy savings and the search for sustainable development are pushing industries to use more and more resistant and low-consumption coatings. These factors are also exploited by the major players of the market, such as Pratt & Whitney, Siemens and General Electric, through the establishment of strategic alliances, the launch of new products and the implementation of R & D. -driven programs.

Regional Deep Dive

The market for thermal barrier coatings (TBC) is experiencing a high growth in different regions, due to technological developments and rising demand from industries such as the aircraft, automobile and energy industries. In North America, the market is characterized by the presence of major players and innovation-driven. In Europe, stringent regulations are driving the use of eco-friendly coatings. In the Asia-Pacific region, the market is growing rapidly, due to rising industrialization and investments in manufacturing capabilities. Middle East and Africa (MEA) is characterized by growth in the oil and gas industry, while the industry in Latin America is gradually adopting TBCs as industries are modernized.

North America

- In order to increase the efficiency of heat shields in gas-turbine engines, the Department of Energy has launched a program to develop these materials.

- Taking advantage of the growing demand for aircraft, Pratt & Whitney and General Electric are investing in the most advanced TBCs to improve the performance and life of their aeronautical parts.

- The automobile industry’s increasing concern with reducing exhaust emissions and improving fuel economy is creating a need for new thermal barrier coatings.

Europe

- REACH is a European regulation which is pushing manufacturers to develop eco-friendly insulating materials, leading to innovations in non-toxic materials.

- In Europe, companies like Oerlikon and Bodycote are expanding their operations. They are investing in new, highly advanced coatings that meet the most stringent of the new, stricter environment standards.

- Aerospace in Europe is increasingly using these blades to improve the performance of jet engines. The need for greater efficiency and reduced emissions has driven this development.

Asia-Pacific

- China’s rapid industrialization and government initiatives to promote manufacturing have significantly increased the demand for heat-resistant paints in many different industries.

- Hitachi and Mitsubishi Materials have been investing in research and development to produce advanced products for the region’s growing automobile and aero industries.

- Electrification of Japan and Korea has given rise to new opportunities for TBC in the field of batteries and thermal management.

MEA

- Among the industries which are most active in the Middle East, the oil and gas industry, and especially the oil industry, are the petrochemical industry, and the oil and gas industry.

- The regulatory framework is evolving, encouraging the implementation of a broader range of solutions in order to improve the energy efficiency of power plants.

- The growing emphasis on renewable energy projects in the United Arab Emirates is resulting in a growing demand for thermal barrier coatings in solar thermal applications.

Latin America

- The automobile industry is gradually adopting these insulating coatings to improve the performance and the fuel economy of its engines, with the help of the government’s support for innovation.

- This has resulted in a more competitive market for the TBC industry.

- Latin American mining is exploring the use of thermal barrier coatings to protect equipment from extreme temperatures, thus creating a niche market.

Did You Know?

“The heat-reflecting coatings, by reducing the temperature of the surface by as much as 200°, increase the life and efficiency of the component.” — NASA Technical Reports Server

Segmental Market Size

The TBCs play a crucial role in enhancing the performance and life of components in high-temperature applications, especially in the aeronautics and power generation industries. This market is growing, driven by a rising demand for improved energy efficiency and the performance of jet engines and gas-turbines. The need for materials that can withstand extreme temperatures is another major driver. Moreover, regulations governing emissions and fuel efficiency are driving the need for improved performance.

In the meantime, the use of TBCs has reached a stage of practical application, with Pratt & Whitney and Siemens being the two leading manufacturers of the technology. These TBCs are primarily used in the engines of aeroplanes, industrial gas-turbines and automobile engines, where they improve the heat-conducting properties and the wear resistance of the components. Also, the trend towards the use of alternative energy sources and the drive for a reduction in emissions are driving the growth of the industry. TBCs are constantly being improved by the use of newer and more effective methods of manufacture, such as those based on the use of plasma spraying and physical vapour deposition.

Future Outlook

From 2024 to 2032, the TBC market is expected to grow from $18.87 billion to $30.8 billion, at a hefty CAGR of 6.32%. This growth is largely due to the growing demand for high-performance materials in the aircraft, automobile and power generation industries, where thermal efficiency and service life are paramount. Energy efficiency and emissions reduction are two of the major concerns for industry, and TBCs are expected to penetrate further into these industries. Their use will increase, particularly in advanced combustion systems and in gas-turbine engines.

A few key developments, such as the development of new ceramic materials and improved application techniques, will enhance the performance and lifetime of thermal barrier coatings. In addition, more stringent regulations and a greater focus on reducing greenhouse gas emissions will lead to an increase in demand for TBCs, which will enable higher operating temperatures and improved fuel efficiency. Nanotechnology and the rise of additive manufacturing are likely to create new opportunities for TBCs, which will expand their use across different industries. In conclusion, the TBC market is expected to grow strongly, driven by technological innovation and a strong focus on sustainability.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 17.6 Billion |

| Growth Rate | 7.20% (2023-2032) |

Thermal Barrier Coatings Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.