Top Industry Leaders in the Toluene Diisocyanates Market

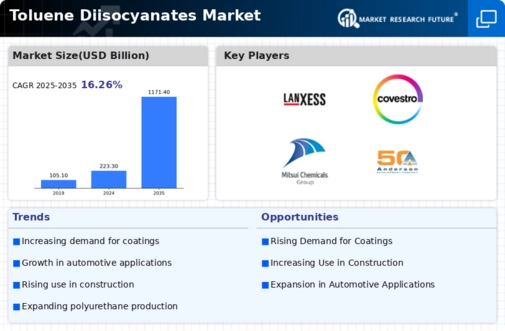

Toluene Diisocyanates Market

Toluene Diisocyanates (TDI), a vital raw material for polyurethane (PU) production, finds applications across diverse industries like construction, automotive, furniture, and coatings. The global TDI market is driven by factors like rising urbanization, increasing disposable income, and expanding automotive and construction sectors. However, the competitive landscape remains dynamic, with established players jostling for market share and new entrants seeking opportunities in niche segments.

Market Share Strategies:

-

Product Diversification: Leading players like Covestro, BASF, and Wanhua Group are actively expanding their product portfolios beyond traditional TDI grades to cater to specific application demands. This includes developing flame-retardant, high-performance, and environmentally friendly TDI variants.

-

Technological Advancements: Investing in R&D and adopting advanced production technologies are crucial for enhancing efficiency, reducing costs, and minimizing environmental impact. For example, Covestro's MDI technology offers a greener alternative to TDI in certain applications.

-

Regional Expansion: Emerging economies like China and India are witnessing a surge in demand for TDI. Established players are strategically investing in production facilities and distribution networks in these regions to capitalize on the growth potential.

-

Vertical Integration: Integrating upstream and downstream operations provides greater control over the supply chain and cost optimization. For instance, BASF has secured its raw material supply by acquiring TDI feedstock producers.

-

Sustainability Initiatives: The increasing focus on environmental regulations and consumer preferences for eco-friendly products is driving the development of bio-based TDI alternatives. Companies like Wanhua Group are investing in renewable feedstocks to produce sustainable TDI grades.

Factors Influencing Market Share:

-

Production Capacity and Efficiency: Players with large production capacities and efficient operations have a cost advantage, making them more competitive. -

Geographical Presence and Distribution Network: A strong presence in key regions and a robust distribution network ensure timely delivery and market penetration. -

Product Portfolio and Innovation: Offering a diverse range of TDI grades and actively innovating to meet evolving application demands are key to capturing market share. -

Brand Reputation and Customer Relationships: Building a strong brand reputation and establishing long-term relationships with customers can provide a competitive edge. -

Pricing Strategy and Cost Management: Balancing competitive pricing with cost efficiency is crucial for profitability and market share retention.

Key Companies in the Toluene Diisocyanates market include

- Tosoh Corporation (Japan)

- BASF SE (Germany)

- The Dow Chemical Company (US)

- LANXESS (Germany)

- Covestro (Germany)

- Mitsui Chemicals, Inc. (Japan)

- Wanhua Chemical Group Co. Ltd (China)

- Cangzhou Dahua Group Co. Ltd (China)

- China National Bluestar (Group) Co., Ltd (China)

- Anderson Development (US)

Recent Developments:

September 2023: BASF signed a long-term supply agreement with a major automotive OEM for its high-performance TDI grades, boosting its presence in the automotive sector.

October 2023: The Chinese government announced stricter environmental regulations for TDI production, prompting some smaller manufacturers to shut down operations, potentially benefiting larger players with established environmental compliance measures.

November 2023: A fire at a major TDI production facility in Europe disrupted supply and briefly led to price spikes in the global market.