Rising Operational Costs

The UK Building Automation System Market is also influenced by the rising operational costs associated with building management. As energy prices continue to fluctuate and maintenance expenses increase, building owners are seeking ways to reduce costs while maintaining operational efficiency. Building automation systems offer a viable solution by automating various processes, thereby minimizing manual intervention and reducing labor costs. Moreover, these systems enable better energy management, which can lead to significant savings on utility bills. The growing awareness of the financial benefits of building automation is likely to drive more organizations in the UK to invest in these technologies, further propelling the market.

Technological Advancements

The UK Building Automation System Market is experiencing rapid technological advancements that are reshaping the landscape of building management. Innovations in artificial intelligence, machine learning, and data analytics are enabling more efficient and intelligent building automation systems. These technologies allow for predictive maintenance, energy optimization, and enhanced user experiences. For instance, AI-driven systems can analyze historical data to forecast energy usage patterns, leading to more informed decision-making. The integration of advanced technologies not only improves operational efficiency but also reduces costs for building owners. As these innovations continue to evolve, they are likely to attract more investments in the UK building automation sector, thereby driving market growth.

Increased Focus on Sustainability

The UK Building Automation System Market is increasingly driven by a heightened focus on sustainability and environmental responsibility. As climate change concerns grow, building owners and operators are seeking solutions that minimize their environmental impact. Building automation systems contribute to sustainability by optimizing energy use, reducing waste, and enhancing indoor air quality. The UK government has set ambitious targets for achieving net-zero carbon emissions by 2050, which has prompted many organizations to adopt building automation technologies as part of their sustainability strategies. This shift towards greener practices is likely to create new opportunities for market players, as more businesses recognize the importance of sustainable building management.

Growing Demand for Smart Buildings

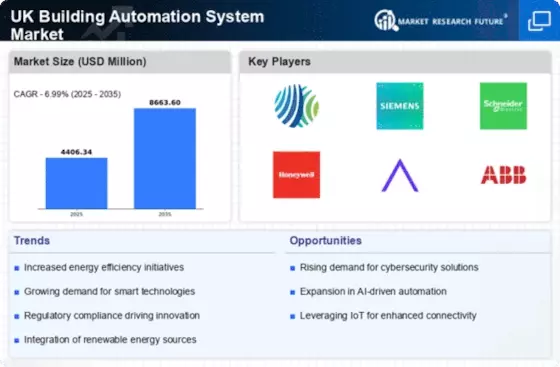

The UK Building Automation System Market is witnessing a surge in demand for smart buildings, which are designed to enhance occupant comfort, safety, and energy efficiency. This trend is driven by the increasing awareness of the benefits of smart technologies among property developers and building owners. According to recent data, the smart building market in the UK is projected to grow at a compound annual growth rate of over 20% in the coming years. Building automation systems play a crucial role in this transformation by enabling real-time monitoring and control of various building functions, such as lighting, heating, and security. As more stakeholders recognize the value of smart buildings, the demand for sophisticated building automation solutions is expected to rise, further propelling the market.

Government Regulations and Standards

The UK Building Automation System Market is significantly influenced by stringent government regulations aimed at enhancing energy efficiency and sustainability. The UK government has implemented various policies, such as the Energy Act and the Building Regulations, which mandate the integration of energy-efficient technologies in new and existing buildings. These regulations not only promote the adoption of building automation systems but also encourage innovation in the sector. As a result, companies are increasingly investing in advanced automation solutions to comply with these standards, thereby driving market growth. The UK government has set ambitious targets for reducing carbon emissions, which further propels the demand for building automation systems that optimize energy consumption and improve overall building performance.