UK E-Waste Management Market Overview

As per MRFR analysis, the UK E-Waste Management Market Size was estimated at 3.64 (USD Billion) in 2023.The UK E-Waste Management Market is expected to grow from 3.88(USD Billion) in 2024 to 8.32 (USD Billion) by 2035. The UK E-Waste Management Market CAGR (growth rate) is expected to be around 7.177% during the forecast period (2025 - 2035).

Key UK E-Waste Management Market Trends Highlighted

The growing awareness of environmental sustainability and the expanding rules around trash disposal are the main drivers of the notable market trends in the UK e-waste management industry. In order to encourage companies and consumers to handle e-waste properly, the UK government has set aggressive goals to decrease landfill trash and increase recycling rates.

A systematic strategy to recycling e-waste has been created by improved rules like the Waste Electrical and Electronic Equipment (WEEE) Directive, which have clearly defined duties for distributors and producers. As a result, both companies and customers are now more likely to participate in recycling initiatives.

The creation of cutting-edge recycling services and technology that can improve the efficacy and efficiency of e-waste disposal is one opportunity to be investigated in the e-waste industry. Companies may create sustainable business models that emphasize repairing and recycling electronic gadgets thanks to the UK's growing circular economy principles.

The market for used electronics and parts is rising in tandem with this trend, indicating a change in consumer behavior toward sustainability. Recent trends also show that awareness programs encouraging customers to dispose of their e-waste responsibly are becoming more and more important.

Environmental groups and municipal governments have spearheaded educational programs that have greatly increased public awareness of the risks associated with inappropriate e-waste disposal.

Innovation in e-waste management solutions is also being stimulated by government-private sector cooperation. When taken as a whole, these patterns show that the UK is gradually moving toward a more effective and sustainable e-waste disposal system.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

UK E-Waste Management Market Drivers

Increasing Government Regulations and Initiatives

The UK government has been implementing stringent regulations regarding electronic waste disposal and recycling. The Waste Electrical and Electronic Equipment Directive (WEEE Directive) promotes the collection, treatment, and recycling of e-waste, requiring producers to take responsibility for their products at the end-of-life stage.

According to the UK Environment Agency, there was a notable increase of 15% in e-waste recycling rates from 2019 to 2021, indicating a growing awareness and compliance among manufacturers and consumers.

The continuation of such measures is expected to drive the UK E-Waste Management Market significantly, pushing organizations like Veolia Environmental Services and Biffa Group to innovate and expand their recycling capabilities to meet regulatory demands and consumer expectations.

Growing Consumer Awareness and Demand for Sustainability

As consumers increasingly prioritize sustainability, there has been a noticeable rise in demand for eco-friendly waste management solutions. The UK government reported that 79% of the public are concerned about environmental issues, emphasizing proper e-waste disposal.

This growing awareness is prompting companies to invest in technologies and practices that support recycling and waste reduction. Leading firms in the UK E-Waste Management Market, such as Sims Recycling Solutions, are responding by enhancing their services to ensure responsible recycling methods, further solidifying their market presence in a sustainable manner.

Technological Advancements in E-Waste Recycling

Innovation in recycling technology is facilitating better recovery of valuable materials from e-waste, which is a crucial driver of the UK E-Waste Management Market. For instance, the extraction efficiency of precious metals has significantly improved with advanced processes such as hydrometallurgy and pyrometallurgy.

In 2022, the UK Research and Innovation Council announced funding of 10 million GBP for projects aiming to enhance recycling technologies, which is projected to improve recycling rates and restore materials while reducing environmental impact. This investment underscores the government's commitment to technological developments that can bolster the industry's growth.

Rising Volume of E-Waste Generation

The rapid growth of technology and electronic device consumption in the UK has led to an exponential increase in e-waste generation. According to the Global Waste Electrical and Electronic Equipment Forum, the UK generated approximately 1.5 million tonnes of e-waste in 2020, with expected growth of 10% annually.

This surge necessitates efficient e-waste management solutions, driving businesses in the UK E-Waste Management Market to scale their operations. Companies like ERP UK are actively enhancing their collection and processing facilities to address this growing challenge, thereby contributing to the market outlook.

UK E-Waste Management Market Segment Insights

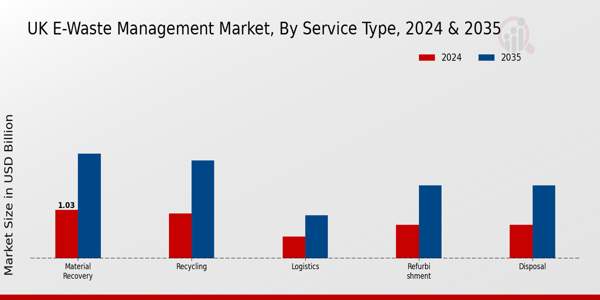

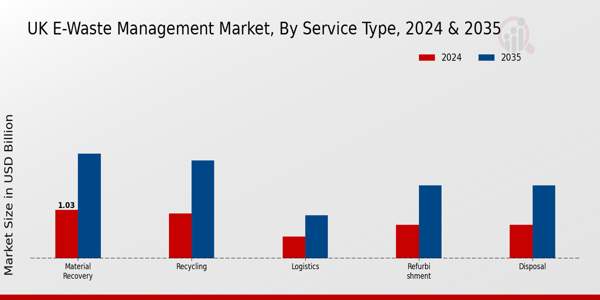

E-Waste Management Market Service Type Insights

The UK E-Waste Management Market is characterized by its diverse Service Type segment, which includes Material Recovery, Refurbishment, Recycling, Disposal, and Logistics. This market plays a pivotal role in addressing the growing concerns associated with e-waste, driven by the increasing volume of electronic products entering the waste stream due to rapid technological advancements and consumption patterns.

Among these services, Recycling is particularly significant, catering to the environmentally conscious demand for responsibly processing e-waste, thereby extracting valuable materials while minimizing landfill usage.

Following closely, Material Recovery has become essential, focusing on reclaiming metals and other resources, which not only supports sustainability initiatives but also addresses the scarcity of raw materials in various industries, making it an ideal target for further investments.

Refurbishment of electronic devices has gained traction, as it aligns with a circular economy approach, extending product lifecycles, and reducing environmental footprint. This service type not only enhances device longevity but also meets consumer demands for affordable technology.

Disposal services focus on the safe and compliant removal of e-waste, adhering to stringent regulatory frameworks established by the UK government, which underscores the importance of responsible e-waste management.

Furthermore, effective Logistics is crucial for the efficient collection and distribution of e-waste, ensuring that materials are redirected correctly to processing facilities. This segment requires significant coordination and infrastructure investment and plays a key role in the overall success of the UK E-Waste Management Market.

Overall, the growth of these service types reflects changing market dynamics and the increasing need for sustainable solutions in electronic waste disposal, highlighting substantial opportunities for stakeholders in this industry to innovate and enhance service offerings while contributing to environmental conservation efforts.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

E-Waste Management Market Source of E-Waste Insights

The Source of E-Waste segment within the UK E-Waste Management Market has witnessed significant transformation, reflecting the growing consumption of electronic products in households and industries. Household appliances contribute heavily to this segment, as an increasing number of households replace outdated units with more energy-efficient models.

Consumer electronics also play a vital role, with trends showing rapid technological advancement leading to shorter product lifecycles, driving the influx of electronic waste. IT equipment remains a major contributor, particularly as businesses upgrade their systems to maintain competitiveness, resulting in a substantial amount of discarded equipment.

Telecommunications equipment, driven by advancements in communication technology, continuously fuels E-Waste generation, creating opportunities for effective management solutions. Industrial equipment represents another pivotal area, as companies increasingly invest in automation and modernization, leading to a significant pool of retired machinery and electronics.

Effective management of these sources not only addresses environmental concerns but also opens avenues for resource recovery and recycling, assisting the UK in achieving sustainability goals as outlined by government initiatives.

As the population becomes more aware of the implications of E-Waste, the market shows potential for significant growth in management solutions tailored specifically for these sources.

E-Waste Management Market End-user Insights

The UK E-Waste Management Market features diverse segments focused on various End-users, including Residential, Commercial, Industrial, and Government. Each of these segments plays a crucial role in the overall landscape of electronic waste management in the UK.

The Residential segment is significant as households increasingly dispose of outdated electronics, spurred by trends in consumer technology adoption and sustainability awareness.

Meanwhile, the Commercial sector, comprising businesses and organizations, actively engages in responsible disposal practices, driven by the need to comply with regulations and reduce their environmental footprints.

The Industrial segment stands out as major contributors to e-waste due to high volumes of electronic equipment used in operations, highlighting the necessity for efficient recycling and waste management systems. The Government segment emphasizes policy-making and waste management strategies, aiding in standardizing processes and encouraging public awareness on e-waste disposal.

The increasing regulatory frameworks and awareness initiatives in the UK are expected to drive future growth in E-Waste Management Market revenue, while the emphasis on sustainable practices presents further opportunities for innovation within these end-user categories. The segmentation reflects a responsive approach to managing the diverse sources of e-waste effectively within the UK ecosystem.

E-Waste Management Market Material Type Insights

The Material Type segment of the UK E-Waste Management Market plays a crucial role in the effective recovery and recycling of electronic waste. This segment consists mainly of Metals, Plastics, Glass, and Circuit Boards, each holding significant importance in the industry.

Metals are essential due to their high recyclability and economic value, often dominating recovery efforts because of their demand in various manufacturing processes. Plastics, while presenting recycling challenges, are increasingly being targeted through innovative techniques that improve their recovery rates.

Glass, found in many electronic devices, not only requires careful handling due to environmental concerns but also contributes substantially to the efficient recycling process through processes that minimize waste.

Circuit Boards represent a complex challenge since they are composed of multiple materials; however, advancements in technology are making their recycling more feasible. The growth of the UK's circular economy principles drives further developments in these areas, as businesses and consumers alike are becoming more aware of the benefits of e-waste recycling.

Overall, the UK E-Waste Management Market is witnessing a dynamic shift towards sustainable management practices with a focus on effective material recovery across all types in the sector.

UK E-Waste Management Market Key Players and Competitive Insights

The UK E-Waste Management Market is witnessing significant growth driven by increasing public awareness about sustainable waste disposal, stringent regulations, and technical advancements in recycling processes.

Key players in this sector are constantly adopting innovative methods and technologies to optimize operations, enhance customer engagement, and ensure compliance with national and international waste management standards.

As the country transitions towards a more circular economy, competition in the e-waste market is intensifying, with various entities striving to capture market share through exceptional service offerings and strategic collaborations.

The focus on environmentally friendly practices not only caters to regulatory requirements but also addresses consumer expectations for responsible product disposal, pushing companies to enhance their competitiveness in the market.

Key Companies in the UK E-Waste Management Market Include

- Renewi

- Enviroserve

- Veolia

- SUEZ

- Electronics Recycling Limited

- Biffa

UK E-Waste Management Market Developments

Citing that existing VAT rates impede reuse and extend e-waste lifecycles, a coalition including Suez UK and Back Market called for the UK government to remove VAT on refurbished devices in July 2025. This initiative might increase the adoption of refurbishment and generate up to 80,000 employment by 2040.

In light of the 100,000 tons of residential electricals that are thrown each year, the UK announced new legislation in December 2024 that require internet marketplaces such as Amazon and eBay to make financial contributions to e-waste recycling in order to bring their costs into line with those of domestic shops.

The Royal Mint opened a gold recovery plant in South Wales in 2024 as well. This factory processes around 4,000 tons of circuit boards annually and extracts precious metals for use in jewelry and coins.

Significant corporate and governmental investment has been reflected in the expansion of AI-powered and electrochemical recycling systems, including mobile sorting units and hydrometallurgical battery recycling, since Q1 2024 by experts like Enviroserve, Veolia, SUEZ, Renewi, and Biffa.

For instance, in 2024–2025, Enviroserve expanded its capacity with a focus on the Middle East and obtained significant contracts through agreements with Abu Dhabi.

In order to promote its downstream circular economy model, Renewi sold its UK municipal company to Biffa in May 2024 and refocused on recycling-centric activities. In France, it also introduced new e-waste plastics sorting plants.

UK E-Waste Management Market Segmentation Insights

E-Waste Management Market Service Type Outlook

- Material Recovery

- Refurbishment

- Recycling

- Disposal

- Logistics

E-Waste Management Market Source of E-Waste Outlook

- Household Appliances

- Consumer Electronics

- IT Equipment

- Telecommunications

- Industrial Equipment

E-Waste Management Market End-user Outlook

- Residential

- Commercial

- Industrial

- Government

E-Waste Management Market Material Type Outlook

- Metals

- Plastics

- Glass

- Circuit Boards

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

3.64(USD Billion) |

| MARKET SIZE 2024 |

3.88(USD Billion) |

| MARKET SIZE 2035 |

8.32(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

7.177% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

WEEE Ireland, London Waste and Recycling Board, Renewi, Enviroserve, Veolia, SUEZ, Electronics Recycling Limited, Recycle Your Electricals, The Recycling Group, WasteCare, Biffa, Richmond Recycling, Panda Waste, Groupe EcoSystemes |

| SEGMENTS COVERED |

Service Type, Source of E-Waste, End User, Material Type |

| KEY MARKET OPPORTUNITIES |

Increased recycling awareness initiatives, Government regulations and policies enhancement, Growth in electronics consumption, Emerging technologies for e-waste recycling, Expansion of circular economy practices |

| KEY MARKET DYNAMICS |

growing environmental regulations, increasing electronic consumption, rising public awareness, technological advancements, expanding recycling infrastructure |

| COUNTRIES COVERED |

UK |

Frequently Asked Questions (FAQ):

The UK E-Waste Management Market is projected to be valued at 3.88 billion USD in 2024.

In 2035, the UK E-Waste Management Market is expected to reach a value of 8.32 billion USD.

The expected CAGR for the UK E-Waste Management Market from 2025 to 2035 is 7.177%.

Material Recovery is projected to have the largest market value of 2.225 billion USD in 2035.

The recycling segment of the UK E-Waste Management Market is valued at 0.954 billion USD in 2024.

Key players in the market include firms such as WEEE Ireland, Renewi, and Veolia.

The market value for logistics services in the UK E-Waste Management Market is expected to be 0.919 billion USD in 2035.

The refurbishment segment is anticipated to be valued at 1.548 billion USD in 2035.

In 2024, the disposal segment is valued at 0.716 billion USD.

Growth in the UK E-Waste Management Market is driven by increasing electronic waste production and environmental regulations.