Government Initiatives and Funding

Government initiatives and funding play a crucial role in the growth of the medical robotics market. The UK government has recognized the potential of robotic technologies in improving healthcare delivery and has allocated substantial resources to support research and development in this field. Various funding programs aim to foster innovation and collaboration between academic institutions and industry players. For example, the UK Research and Innovation (UKRI) has launched initiatives to promote the development of advanced robotic systems for surgical applications. Such support is likely to enhance the capabilities of the medical robotics market, encouraging the introduction of new products and solutions that meet the evolving needs of healthcare providers.

Technological Advancements in Robotics

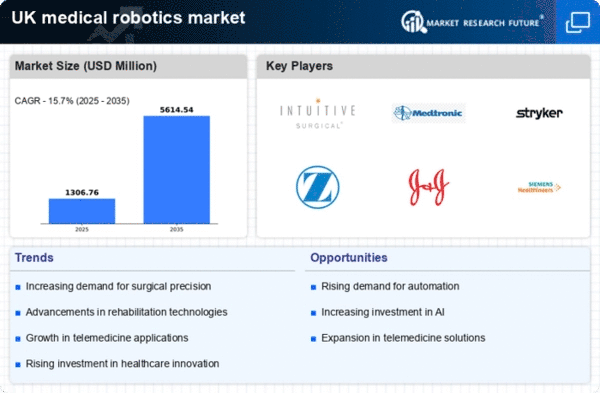

The medical robotics market is experiencing rapid technological advancements, which are driving innovation and adoption across various healthcare settings. Enhanced precision, improved imaging techniques, and miniaturization of robotic systems are notable trends. For instance, robotic surgical systems are now capable of performing complex procedures with minimal invasiveness, leading to shorter recovery times and reduced hospital stays. The UK healthcare sector is increasingly investing in these technologies, with estimates suggesting that the market could grow at a CAGR of around 15% over the next five years. This growth is likely to be fueled by the demand for better patient outcomes and the need for efficient surgical solutions, thereby propelling the medical robotics market forward.

Enhanced Training and Education Programs

Enhanced training and education programs for healthcare professionals are emerging as a vital driver in the medical robotics market. As robotic technologies become more prevalent in surgical settings, there is a pressing need for skilled practitioners who can operate these sophisticated systems. In the UK, medical institutions are increasingly incorporating robotic training into their curricula, ensuring that new surgeons are well-versed in the use of robotic systems. Furthermore, ongoing professional development courses are being offered to existing medical staff, which is likely to improve the overall competency in robotic-assisted procedures. This focus on education is expected to facilitate the growth of the medical robotics market by ensuring a steady pipeline of qualified professionals.

Aging Population and Rising Chronic Diseases

The aging population in the UK is contributing to an increased prevalence of chronic diseases, which in turn drives the demand for advanced medical technologies, including robotics. As the population ages, the need for surgical interventions and rehabilitation services rises, creating a significant opportunity for the medical robotics market. It is estimated that by 2030, nearly 20% of the UK population will be over 65 years old, leading to a higher incidence of conditions such as arthritis, cardiovascular diseases, and cancer. This demographic shift is likely to necessitate the adoption of robotic systems that can provide efficient and effective treatment options, thereby expanding the market.

Increasing Demand for Minimally Invasive Procedures

There is a growing demand for minimally invasive surgical procedures within the medical robotics market, as patients and healthcare providers alike seek alternatives to traditional surgery. These procedures typically result in less pain, reduced scarring, and quicker recovery times. In the UK, the National Health Service (NHS) has been actively promoting the use of robotic-assisted surgeries, which are perceived to enhance surgical precision and patient safety. Reports indicate that the adoption of robotic systems in surgical theatres has increased by approximately 20% in recent years. This trend is expected to continue, as more hospitals integrate robotic technologies into their surgical protocols, thereby expanding the medical robotics market.