Increased Regulatory Pressures

The quality management-software market is being shaped by increased regulatory pressures across various industries in the UK. Regulatory bodies are imposing stricter guidelines to ensure product safety and quality, compelling organizations to adopt comprehensive quality management systems. This trend is particularly evident in sectors such as pharmaceuticals, food and beverage, and automotive, where compliance with regulations is critical. As a result, businesses are investing in quality management software to facilitate adherence to these regulations and avoid potential penalties. The market is projected to grow by approximately 6% annually as companies seek to enhance their compliance capabilities. This heightened focus on regulatory compliance is likely to drive the adoption of quality management software, positioning it as a vital tool for organizations aiming to maintain their market standing.

Rising Demand for Quality Assurance

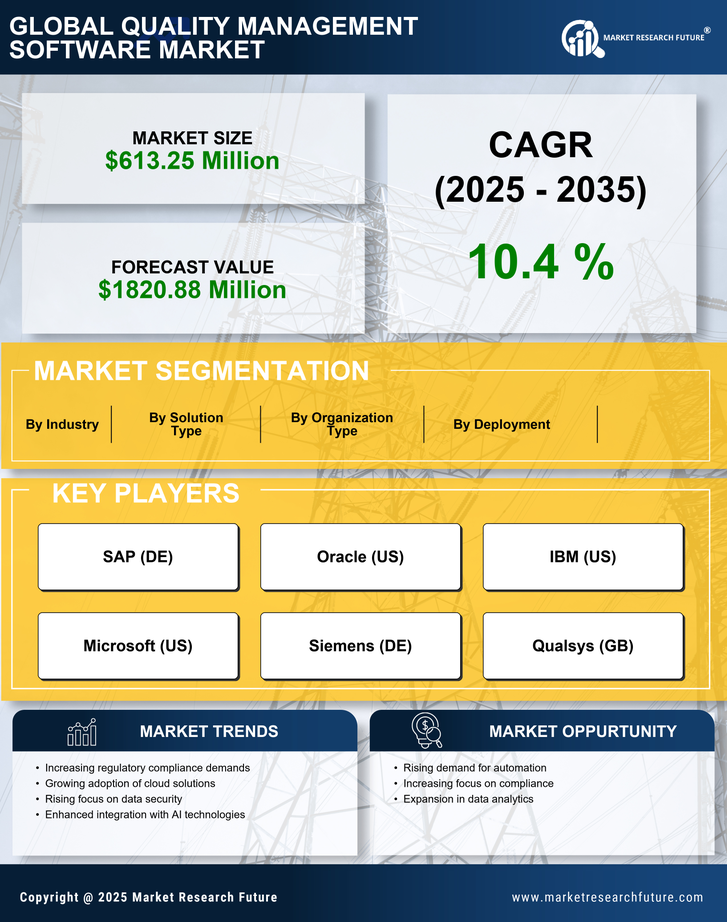

The quality management-software market is experiencing a notable increase in demand for quality assurance solutions across various sectors in the UK. This trend is driven by the need for businesses to enhance product quality and customer satisfaction. As companies strive to meet stringent regulatory requirements, the adoption of quality management software becomes essential. In 2025, the market is projected to grow at a CAGR of approximately 8%, reflecting the increasing emphasis on quality assurance. Industries such as manufacturing, healthcare, and food services are particularly focused on implementing robust quality management systems to mitigate risks and ensure compliance. This rising demand indicates a shift towards prioritizing quality as a competitive advantage, thereby propelling the growth of the quality management-software market.

Growing Emphasis on Customer Experience

In the UK, there is a growing emphasis on customer experience, which is significantly impacting the quality management-software market. Organizations are increasingly recognizing that delivering high-quality products and services is essential for customer retention and brand loyalty. As a result, businesses are turning to quality management software to streamline processes and ensure consistent quality across all touchpoints. This trend is expected to drive market growth, with an estimated increase of 7% in the coming years. Companies are likely to leverage quality management solutions to gather customer feedback, analyze quality data, and implement improvements based on insights. This focus on enhancing customer experience through quality management is likely to position the software as a critical component of business strategy.

Technological Advancements in Quality Management

Technological advancements are significantly influencing the quality management-software market in the UK. The integration of advanced technologies such as data analytics, machine learning, and IoT is transforming how organizations manage quality. These innovations enable real-time monitoring and analysis of quality metrics, leading to more informed decision-making. As businesses increasingly rely on data-driven insights, the demand for sophisticated quality management software is expected to rise. In 2025, the market is anticipated to reach a valuation of over £1 billion, driven by the need for enhanced operational efficiency and reduced costs. Companies are likely to invest in software solutions that offer predictive analytics and automated reporting, thereby streamlining quality management processes and improving overall performance.

Shift Towards Integrated Quality Management Systems

The quality management-software market is witnessing a shift towards integrated quality management systems that encompass various business functions. Organizations in the UK are increasingly seeking solutions that not only address quality management but also integrate with other operational areas such as supply chain management and project management. This holistic approach allows for better visibility and control over quality processes, leading to improved efficiency and reduced costs. The market is projected to grow by approximately 5% as businesses recognize the benefits of integrated systems. By adopting comprehensive quality management software, organizations can streamline workflows, enhance collaboration, and ensure that quality is maintained throughout the entire value chain. This trend indicates a move towards more cohesive and efficient quality management practices.