Rising Health Awareness

There is a notable shift in consumer attitudes towards health and nutrition in the UK, which is significantly influencing the ready to-eat-meals market. As individuals become more health-conscious, they are increasingly scrutinizing the nutritional content of their food choices. Reports indicate that around 45% of UK consumers are actively seeking meals that are lower in calories, fat, and sugar, while also being rich in essential nutrients. This growing awareness has prompted manufacturers to reformulate their products, incorporating healthier ingredients and transparent labeling practices. The ready to-eat-meals market is thus evolving to meet these demands, with an emphasis on providing options that align with dietary preferences, such as vegetarian, vegan, and gluten-free meals.

Diverse Consumer Preferences

The ready to-eat-meals market in the UK is characterized by a diverse range of consumer preferences, driven by cultural influences and lifestyle choices. With an increasingly multicultural population, there is a growing demand for meals that reflect various culinary traditions. This has led to the introduction of a wide array of international cuisines in the ready to-eat segment, catering to the tastes of different demographic groups. Additionally, the rise of niche markets, such as organic and artisanal ready-to-eat meals, indicates a shift towards more personalized food experiences. As consumers seek variety and authenticity, manufacturers are responding by expanding their product lines to include unique flavors and ingredients, thereby enhancing the overall appeal of the ready to-eat-meals market.

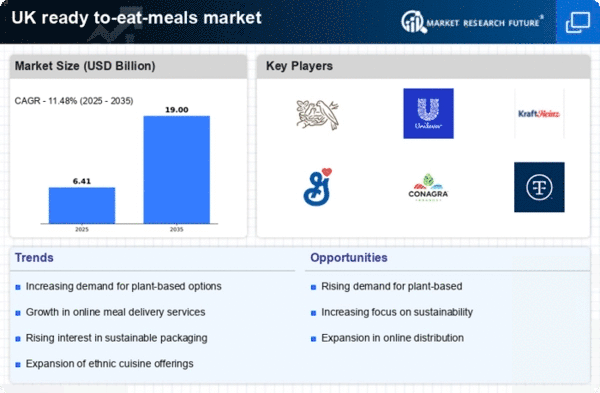

Increased Focus on Sustainability

Sustainability has emerged as a pivotal concern for consumers in the UK, influencing their purchasing decisions within the ready to-eat-meals market. As awareness of environmental issues grows, consumers are increasingly inclined to support brands that demonstrate a commitment to sustainable practices. This includes the use of eco-friendly packaging, ethically sourced ingredients, and transparent supply chains. Recent surveys indicate that approximately 55% of UK consumers are willing to pay a premium for products that align with their sustainability values. Consequently, manufacturers are adapting their strategies to incorporate sustainable practices, which not only appeal to environmentally conscious consumers but also enhance brand loyalty in the competitive ready to-eat-meals market.

Convenience and Time-Saving Solutions

The increasing pace of modern life in the UK has led to a growing demand for convenience foods, particularly in the ready to-eat-meals market. Consumers are increasingly seeking meals that require minimal preparation time, allowing them to balance busy schedules with the need for nutritious options. According to recent data, approximately 60% of UK consumers express a preference for meals that can be consumed quickly, highlighting the importance of convenience in purchasing decisions. This trend is particularly pronounced among working professionals and families, who often prioritize time-saving solutions. As a result, manufacturers in the ready to-eat-meals market are innovating to create products that cater to this demand, offering a variety of options that are not only quick to prepare but also appealing in taste and presentation.

Technological Advancements in Food Production

Technological innovations are playing a crucial role in shaping the ready to-eat-meals market in the UK. Advances in food processing and preservation techniques have enabled manufacturers to enhance the quality and shelf-life of their products. For instance, the adoption of vacuum packaging and modified atmosphere packaging has improved the freshness and safety of ready to-eat meals, making them more appealing to consumers. Furthermore, the integration of smart technology in food production processes is streamlining operations and reducing waste. As a result, the ready to-eat-meals market is witnessing a transformation, with products that not only meet consumer expectations for quality but also adhere to stringent safety standards.