- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

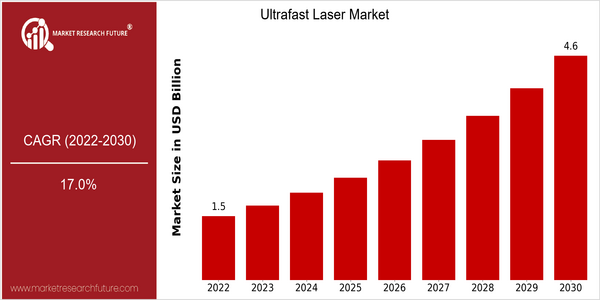

Ultrafast Laser Market, Size Snapshot

| Year | Value |

|---|---|

| 2022 | USD 1.5 Billion |

| 2030 | USD 4.6 Billion |

| CAGR (2022-2030) | 17.0 % |

Note – Market size depicts the revenue generated over the financial year

The Ultrafast Laser Market is poised for substantial growth, with the current market size estimated at $ 1.5 billion in 2022, growing at a CAGR of 17.0% from 2022 to 2030. In particular, ultrafast lasers are expected to be widely used in the medical, manufacturing, and telecommunications industries, where their precision and efficiency in applications such as material processing, medical procedures, and telecommunications are expected to be widely adopted. The ultrafast laser market is being driven by several factors, including technological developments that have increased the performance and application capabilities of ultrafast lasers. The increasing demand for high-precision manufacturing processes and the growing trend toward miniaturization in the electronics industry are also driving the adoption of ultrafast lasers. The major players in the market, such as Coherent, Inc., Thorlabs, and Trumpf GmbH, are also strengthening their market positions through strategic initiatives such as collaborations and product innovations. These recent developments in the ultrafast laser market indicate the potential for continued growth.

Regional Deep Dive

The ultrafast laser market is expected to experience significant growth in the coming years, driven by advancements in technology and the increasing demand for ultrafast lasers in the medical, manufacturing and telecommunications industries. In North America, the market is characterized by the presence of key players and a strong research and development environment, while in Europe the ultrafast laser market is characterized by an increase in demand for ultrafast lasers in the manufacturing industry. In the Asia-Pacific region, the ultrafast laser market is characterized by a high degree of innovation and technological development, increased investment in ultrafast lasers and a growing manufacturing industry. In the Middle East and Africa, the ultrafast laser market is growing slowly, mainly in the medical and industrial fields, while Latin America is beginning to explore the potential of ultrafast lasers in a variety of applications, although at a slower pace.

North America

- The USA is home to a number of leading companies, such as Coherent and Thorlabs, which are driving the development of ultrafast lasers, particularly in medical and industrial applications.

- The recent relaxation of the regulations governing the use of ultrafast lasers in medicine has facilitated their use in the field of surgery, in particular for precise surgical operations and diagnostics.

- The National Institutes of Health has a number of research projects underway to develop ultrafast lasers for use in biomedical research. This is expected to stimulate the market.

Europe

- In Germany and the United Kingdom, research on ultrafast lasers is in the forefront. Institutes such as the Max Planck Institute in Göttingen are at the forefront of developing the technology of ultrafast lasers for industrial use.

- In Europe, the Horizon 2020 programme has made substantial grants to projects aimed at developing ultrafast lasers, which encourages collaboration between universities and industry.

- In Europe the regulations are becoming more favourable to the use of lasers in industry and in medicine. This will further stimulate the growth of the market.

Asia-Pacific

- China has now mastered the production of ultra-short pulsed lasers, and its companies have made tremendous R & D efforts.

- A great boom is in progress in the manufacture of ultrafast lasers, a demand for which is being pushed by the expansion of the semi-conductor industry.

- The emergence of advanced laser technology in the field of the Japanese and Korean governments is expected to stimulate the development of the market.

MEA

- The United Arab Emirates has been investing in the development of ultra-fast lasers, for use in medical aesthetics and precision surgery. The leading company in this field is the Dubai Laser Center.

- The authorities in the region are beginning to set up the necessary guidelines for the safe use of laser technology, which is essential for the market to develop and grow.

- Among the most interesting developments is the interest in the use of ultra-fast lasers in the field of oil and gas, particularly in the field of drilling and material processing.

Latin America

- Brazil is becoming an important player in the ultrafast laser market, with the universities and research institutes developing applications in the fields of materials science and health.

- During the last few years there has been a growing collaboration between local companies and international companies to develop ultrafast lasers in response to the needs of the region.

- The development of laser technology is influenced by economic factors, such as the value of the currency, but it is being recognized in many fields.

Did You Know?

“ULTRAFAST LASERS can produce pulses of light that last only a few femtoseconds (one femtosecond is 1015 seconds).” — National Institute of Standards and Technology (NIST)

Segmental Market Size

The ultra-short pulsed lasers are a new, high-growth market, driven by advances in precision manufacturing and medical applications. In the fields of electronics, automobiles, and health care, the ultra-short pulsed laser is a crucial technology for achieving high speed and accuracy. Miniaturization in the electronics industry requires ever-precise cutting and engraving. The use of ultra-short pulsed lasers in medical procedures such as LASIK and tattoo removal is becoming more commonplace.

The ultrafast laser is now in the stage of exploitation. Its use is widespread, and companies such as Coherent and Trumpf lead the field in its application. North America and Europe, with their strong support for advanced manufacturing, are the most notable regions. The main application areas are micro-machining, material processing, and medical applications. The ultrafast laser is used to perform precision drilling and surface structuring. The current trend is for sustainable manufacturing and the integration of artificial intelligence into the laser system. The future development of the ultrafast laser is also influenced by the development of fiber and picosecond.

Future Outlook

ULTRA-FAST LASER MARKET ESTIMATION, 2022 TO 2030, THE MARKET IS SCHEDULED TO GROW AT A HEAVY CAGR OF 17.0 PERCENT. This growth is driven by the growing adoption of ultra-fast lasers in various industries such as health care, manufacturing and telecommunications. The growing demand for precision and efficiency in these industries is expected to drive the demand for ultra-fast lasers with high peak power and short pulse duration. By 2030, the penetration of ultra-fast lasers in the industrial market is expected to reach approximately 30 percent, compared to about 10 percent in 2022, which indicates a shift towards more advanced laser solutions.

Among these developments, the development of new materials and of new ways of improving the quality of the beam are hoped to increase still further the possibilities of ultra-short pulses, and thus make them still more accessible and versatile. The favourable governmental policies, which encourage innovation in the fields of manufacturing and medical technology, will also have a positive influence on the development of the market. Also, the integration of ultra-short pulses into micro-manufacturing and medical applications such as surgery and diagnostics will play a major role in the development of the market. In industry, the growing awareness of the benefits of ultra-short pulses will lead to the market growing, driven by technological development and a greater emphasis on precision manufacturing.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 1.5 Billion |

| Growth Rate | 17.00% (2022-2030) |

Ultrafast Laser Market, Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.