Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices is significantly impacting the 5g fixed-wireless-access market. As more households and businesses adopt IoT technologies, the demand for high-speed, low-latency internet connections is increasing. Recent reports indicate that the number of connected IoT devices in the US is expected to exceed 30 billion by 2025. This surge in connectivity requirements is likely to drive the adoption of 5g fixed-wireless-access solutions, as traditional broadband may struggle to meet the demands of numerous simultaneous connections. Consequently, the growth of IoT is poised to be a key driver for the expansion of the 5g fixed-wireless-access market.

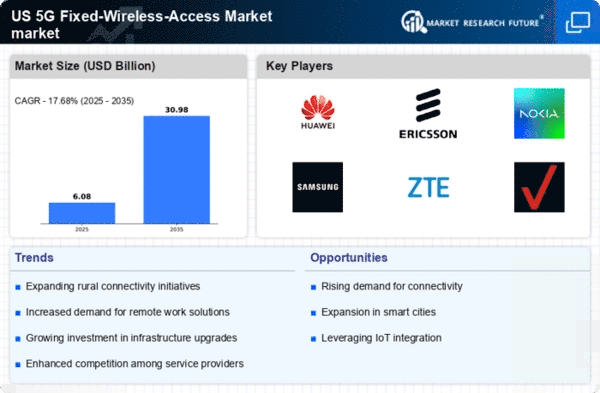

Expansion of Smart Cities

The development of smart cities across the United States is significantly influencing the 5g fixed-wireless-access market. As urban areas integrate advanced technologies for improved efficiency and sustainability, the need for robust connectivity becomes paramount. Smart city initiatives often rely on real-time data transmission, which necessitates high-speed internet access. According to recent estimates, investments in smart city projects are projected to reach $1 trillion by 2025, creating substantial opportunities for the 5g fixed-wireless-access market. This growth is likely to encourage telecommunications companies to expand their infrastructure, thereby enhancing service availability and quality in urban environments.

Rising Consumer Expectations

The 5g fixed-wireless-access market is experiencing a surge in consumer expectations for high-speed internet connectivity. As households increasingly rely on digital services for work, education, and entertainment, the demand for reliable and fast internet has intensified. Recent surveys indicate that over 70% of consumers prioritize internet speed and reliability when choosing a service provider. This trend is likely to drive investments in 5g fixed-wireless-access solutions, as providers seek to meet these heightened expectations. Furthermore, the shift towards remote work and online learning has made high-speed connectivity a necessity rather than a luxury, compelling service providers to enhance their offerings in the 5g fixed-wireless-access market.

Government Initiatives and Funding

Government initiatives aimed at expanding broadband access are playing a crucial role in shaping the 5g fixed-wireless-access market. Federal and state programs are increasingly allocating funds to improve internet connectivity in underserved areas. For instance, the Federal Communications Commission (FCC) has introduced various funding programs to support the deployment of high-speed internet infrastructure. These initiatives are expected to inject billions of dollars into the 5g fixed-wireless-access market, facilitating the expansion of services in rural and remote regions. As a result, the market is likely to witness accelerated growth driven by enhanced accessibility and affordability of high-speed internet.

Increased Competition Among Service Providers

The competitive landscape within the 5g fixed-wireless-access market is intensifying as multiple service providers vie for market share. This competition is driving innovation and service differentiation, compelling companies to enhance their offerings. Recent data suggests that the number of service providers in the fixed-wireless-access segment has increased by approximately 30% over the past two years. As providers strive to attract and retain customers, they are likely to invest in advanced technologies and infrastructure improvements. This competitive dynamic not only benefits consumers through better service options but also propels the overall growth of the 5g fixed-wireless-access market.