Government Incentives and Funding

Government incentives and funding initiatives play a crucial role in the growth of the advanced energy-storage-systems market. In 2025, various federal and state programs have been established to promote energy storage technologies, offering tax credits, grants, and subsidies to encourage investment. For instance, the Investment Tax Credit (ITC) allows for a significant reduction in the upfront costs of energy storage systems when paired with renewable energy projects. These financial incentives are designed to stimulate market growth and facilitate the transition to cleaner energy solutions. As more stakeholders take advantage of these programs, the advanced energy-storage-systems market is expected to expand, attracting further investment and innovation.

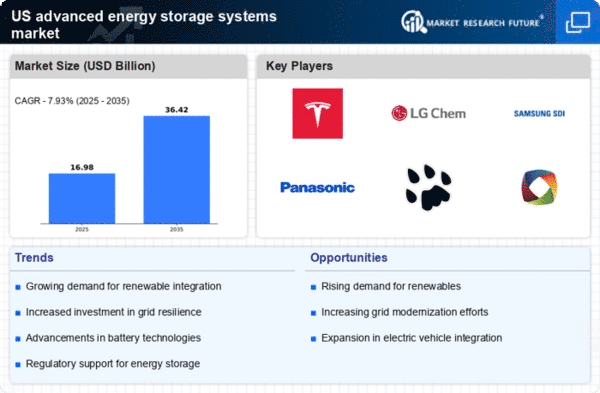

Growing Demand for Renewable Energy

The increasing demand for renewable energy sources in the US is a primary driver for the advanced energy-storage-systems market. As the nation aims to reduce its carbon footprint, the integration of solar and wind energy has surged. In 2025, renewable energy accounted for approximately 20% of the total energy consumption in the US, highlighting a shift towards sustainable practices. This transition necessitates efficient energy storage solutions to manage the intermittent nature of renewable sources. Advanced energy-storage systems are essential for balancing supply and demand, ensuring grid stability, and facilitating the widespread adoption of renewables. The advanced energy storage systems market is thus positioned to benefit from this growing trend. Utilities and businesses seek reliable storage options to complement their renewable energy investments.

Increasing Electric Vehicle Adoption

The rising adoption of electric vehicles (EVs) is a notable driver for the advanced energy-storage-systems market. As of 2025, EV sales in the US have increased by over 30% compared to previous years, leading to a growing need for efficient charging infrastructure and energy storage solutions. Advanced energy-storage systems are essential for managing the energy demands of EV charging stations, particularly during peak hours. Furthermore, vehicle-to-grid (V2G) technology allows EVs to act as mobile energy storage units, providing additional support to the grid. This synergy between EVs and energy storage systems is likely to enhance the overall efficiency of the energy ecosystem, thereby propelling the advanced energy-storage-systems market forward.

Technological Innovations in Energy Storage

Technological innovations are significantly influencing the advanced energy-storage-systems market. Recent advancements in battery technologies, such as lithium-ion and solid-state batteries, have improved energy density, efficiency, and lifespan. In 2025, the cost of lithium-ion batteries has decreased by nearly 80% since 2010, making them more accessible for various applications. These innovations not only enhance the performance of energy storage systems but also reduce the overall cost of energy storage solutions. As a result, businesses and consumers are increasingly adopting advanced energy-storage systems to optimize energy usage and reduce costs. The advanced energy-storage-systems market is likely to continue evolving as new technologies emerge, further driving adoption across multiple sectors.

Rising Energy Costs and Demand for Efficiency

The rising energy costs in the US are driving consumers and businesses to seek more efficient energy solutions, thereby impacting the advanced energy-storage-systems market. In 2025, energy prices have seen a steady increase, prompting a shift towards energy efficiency and cost-saving measures. Advanced energy-storage systems offer a viable solution by enabling users to store energy during off-peak hours when prices are lower and utilize it during peak hours when costs are higher. This capability not only reduces energy expenses but also enhances energy management strategies. As the demand for efficiency continues to grow, the advanced energy-storage-systems market is likely to experience increased adoption across residential, commercial, and industrial sectors.