Rising Healthcare Expenditures

Healthcare expenditures in the US are on the rise, which is positively impacting the air ambulance-services market. As healthcare spending increases, more resources are allocated to emergency medical services, including air transport. In 2025, healthcare spending is expected to reach approximately $4 trillion, with a significant portion directed towards improving emergency response capabilities. This trend suggests that the air ambulance-services market will likely see increased investment, leading to enhanced service offerings and expanded operational capacities. Additionally, as insurance coverage for air ambulance services becomes more prevalent, patient access to these critical services is expected to improve, further driving market growth.

Advancements in Medical Technology

Technological innovations are playing a crucial role in shaping the air ambulance-services market. The integration of advanced medical equipment, such as portable ultrasound machines and telemedicine capabilities, enhances the quality of care provided during air transport. These advancements allow medical personnel to monitor patients in real-time, ensuring that critical information is relayed to receiving facilities. The air ambulance-services market is likely to benefit from these developments, as they improve patient outcomes and operational efficiency. Moreover, the market is projected to grow by 10% over the next five years, driven by the increasing adoption of cutting-edge medical technologies that facilitate better emergency care.

Regulatory Changes Favoring Air Transport

Recent regulatory changes are favorably impacting the air ambulance-services market. The Federal Aviation Administration (FAA) has implemented new guidelines aimed at enhancing safety and operational efficiency for air ambulance providers. These regulations are designed to streamline the certification process for air ambulance operators, thereby encouraging new entrants into the market. The air ambulance-services market is likely to benefit from this increased competition, which may lead to improved service quality and reduced costs for consumers. Furthermore, as regulations evolve to support the growth of air transport services, the market could see an expansion of service offerings, catering to a broader range of medical emergencies.

Growing Awareness of Air Ambulance Services

Public awareness regarding the benefits of air ambulance services is steadily increasing, which is influencing the air ambulance-services market. Educational campaigns and outreach programs are helping to inform the public about the advantages of rapid medical transport, particularly in life-threatening situations. This heightened awareness is likely to lead to a greater acceptance of air ambulance services among patients and healthcare providers alike. As a result, the air ambulance-services market may experience a surge in utilization rates, as more individuals recognize the importance of timely medical intervention. This trend could potentially lead to a market growth rate of around 12% over the next few years.

Increasing Demand for Emergency Medical Services

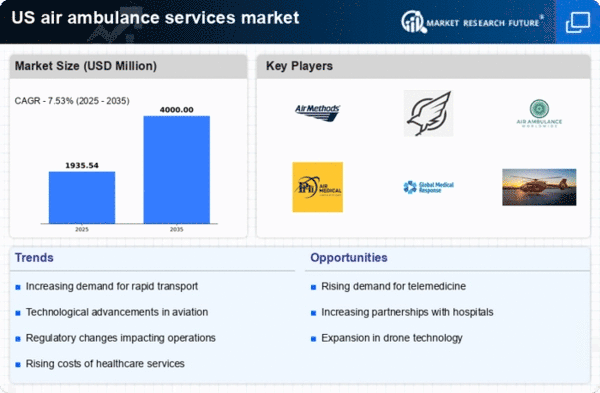

The air ambulance-services market is experiencing a notable increase in demand for emergency medical services. This trend is driven by a growing population and an increase in the prevalence of chronic diseases, which necessitate rapid medical intervention. According to recent data, the demand for air ambulance services has surged by approximately 15% annually in urban areas, where traffic congestion can delay ground transport. The air ambulance-services market is thus positioned to expand significantly, as healthcare providers seek to enhance patient outcomes through timely access to specialized medical care. Furthermore, the aging population in the US is likely to contribute to this demand, as older individuals often require immediate medical attention, thereby reinforcing the need for efficient air transport solutions.