Increased Healthcare Expenditure

The rising healthcare expenditure in the US is a significant driver for the angioplasty balloons market. With healthcare spending projected to reach $6.2 trillion by 2028, there is a growing emphasis on investing in advanced medical technologies. This increase in funding allows for the procurement of innovative angioplasty balloons, which are crucial for effective cardiovascular interventions. As hospitals and healthcare facilities allocate more resources towards improving patient care, the angioplasty balloons market is likely to benefit from enhanced access to state-of-the-art devices. Furthermore, the focus on value-based care may encourage the adoption of angioplasty procedures, further propelling market growth. The financial commitment to healthcare advancements indicates a promising outlook for the angioplasty balloons market.

Growing Awareness of Preventive Healthcare

The growing awareness of preventive healthcare among the US population is driving the angioplasty balloons market. As individuals become more informed about cardiovascular health, there is an increasing demand for early intervention strategies. This shift in mindset encourages patients to seek medical advice and undergo procedures such as angioplasty at earlier stages of disease progression. Consequently, healthcare providers are more likely to recommend angioplasty balloons as a viable treatment option. The emphasis on preventive care aligns with national health initiatives aimed at reducing the burden of cardiovascular diseases. This trend suggests a potential increase in the volume of angioplasty procedures, thereby positively impacting the angioplasty balloons market.

Regulatory Support for Medical Innovations

Regulatory support for medical innovations is a crucial driver for the angioplasty balloons market. The US Food and Drug Administration (FDA) has implemented streamlined processes for the approval of new medical devices, including angioplasty balloons. This regulatory environment fosters innovation and encourages manufacturers to develop advanced products that meet the evolving needs of healthcare providers. As a result, the angioplasty balloons market is likely to experience an influx of new technologies that enhance treatment efficacy and patient safety. The proactive stance of regulatory bodies in facilitating the introduction of innovative devices may lead to increased competition and improved product offerings in the market. This supportive framework is essential for the continued growth and evolution of the angioplasty balloons market.

Rising Prevalence of Cardiovascular Diseases

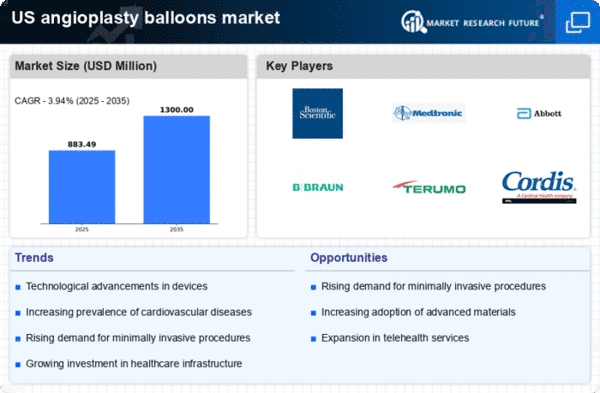

The increasing incidence of cardiovascular diseases in the US is a primary driver for the angioplasty balloons market. According to the American Heart Association, cardiovascular diseases account for approximately 697,000 deaths annually, highlighting a critical health concern. This alarming statistic suggests a growing demand for effective treatment options, including angioplasty procedures. As healthcare providers seek to address this rising burden, the utilization of angioplasty balloons becomes essential. The market is projected to witness substantial growth, with estimates indicating a CAGR of around 6.5% over the next few years. This trend underscores the necessity for innovative solutions in the angioplasty balloons market, as healthcare systems strive to improve patient outcomes and reduce mortality rates associated with cardiovascular conditions.

Technological Innovations in Medical Devices

Technological advancements in medical devices are significantly influencing the angioplasty balloons market. Innovations such as drug-eluting balloons and bioresorbable materials are enhancing the efficacy of angioplasty procedures. These advancements not only improve patient outcomes but also reduce the risk of restenosis, a common complication following angioplasty. The market for angioplasty balloons is expected to expand as healthcare providers increasingly adopt these cutting-edge technologies. In 2025, the market is anticipated to reach approximately $2.5 billion, driven by the demand for more effective and safer treatment options. As the industry continues to evolve, the integration of advanced technologies will likely play a pivotal role in shaping the future of the angioplasty balloons market.

Leave a Comment