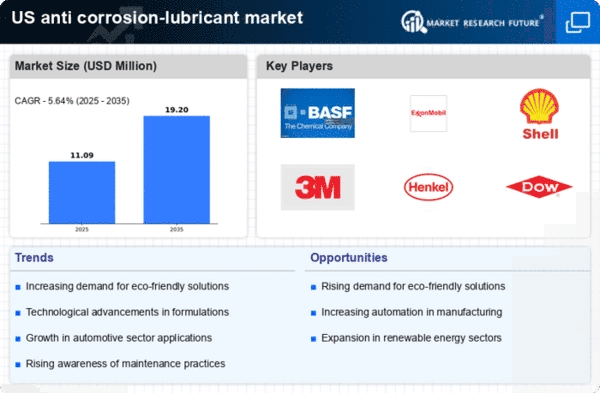

The anti corrosion-lubricant market is currently characterized by a dynamic competitive landscape, driven by increasing industrialization and the growing need for protective solutions across various sectors. Key players such as BASF SE (DE), ExxonMobil Corporation (US), and 3M Company (US) are actively shaping the market through strategic initiatives focused on innovation and sustainability. BASF SE (DE) emphasizes its commitment to developing eco-friendly products, which aligns with the rising demand for sustainable solutions. Meanwhile, ExxonMobil Corporation (US) leverages its extensive distribution network to enhance market penetration, while 3M Company (US) invests heavily in research and development to introduce advanced formulations that meet evolving customer needs. Collectively, these strategies contribute to a competitive environment that prioritizes technological advancement and environmental responsibility.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. This approach not only enhances operational efficiency but also allows for better responsiveness to regional market demands. The market structure appears moderately fragmented, with several players vying for market share. However, the influence of major companies remains substantial, as they set industry standards and drive innovation through their extensive resources and capabilities.

In October ExxonMobil Corporation (US) announced the launch of a new line of bio-based anti corrosion lubricants, aimed at reducing environmental impact while maintaining high performance. This strategic move is significant as it positions ExxonMobil at the forefront of the sustainability trend, potentially attracting environmentally conscious consumers and industries. The introduction of bio-based products may also enhance the company's competitive edge in a market increasingly focused on eco-friendly solutions.

In September 3M Company (US) unveiled a partnership with a leading automotive manufacturer to develop specialized anti corrosion coatings for electric vehicles. This collaboration is noteworthy as it reflects the growing trend towards electrification in the automotive sector, suggesting that 3M is strategically aligning itself with future market demands. By integrating its innovative technologies with the automotive industry, 3M could significantly enhance its market presence and drive growth in a rapidly evolving sector.

In August BASF SE (DE) expanded its production capacity for anti corrosion lubricants in North America, responding to increasing demand from the manufacturing sector. This expansion indicates BASF's proactive approach to scaling operations and meeting customer needs, which may strengthen its market position. By enhancing production capabilities, BASF is likely to improve its supply chain reliability and responsiveness, further solidifying its competitive advantage.

As of November current trends in the anti corrosion-lubricant market include a pronounced shift towards digitalization and the integration of artificial intelligence in product development and customer engagement. Strategic alliances are becoming increasingly important, as companies seek to leverage complementary strengths to enhance their offerings. The competitive landscape is evolving from a focus on price-based competition to one that emphasizes innovation, technology, and supply chain reliability. This shift suggests that companies that prioritize these aspects will likely emerge as leaders in the market.