Rising Geopolitical Tensions

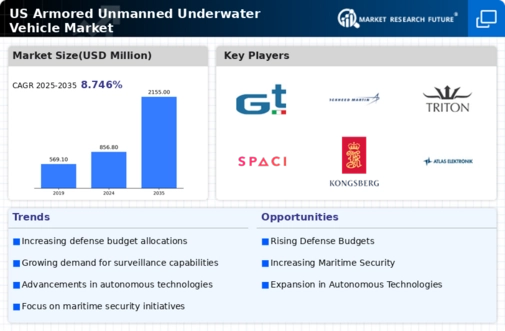

The armored unmanned-underwater-vehicle market is experiencing growth due to escalating geopolitical tensions, particularly in regions such as the South China Sea and Eastern Europe. Nations are increasingly investing in advanced military technologies to enhance their naval capabilities. This trend is reflected in the U.S. defense budget, which allocates a significant portion to underwater warfare systems. The demand for armored unmanned underwater vehicles is likely to rise as military forces seek to bolster their surveillance and reconnaissance capabilities. The U.S. Navy, for instance, has expressed interest in integrating these vehicles into its operational framework, indicating a potential market expansion. As countries prioritize national security, the armored unmanned-underwater-vehicle market is poised for substantial growth, driven by the need for advanced defense solutions.

Collaboration with Private Sector

The armored unmanned-underwater-vehicle market is witnessing increased collaboration between government entities and the private sector. Defense contractors are partnering with technology firms to develop advanced underwater systems that meet military specifications. This collaboration is fostering innovation and accelerating the development of new technologies. The U.S. government has recognized the potential of public-private partnerships to enhance defense capabilities, leading to funding opportunities for companies involved in the armored unmanned underwater vehicle market. As these partnerships grow, the market is likely to benefit from improved technologies and reduced development costs, positioning it for sustained growth in the coming years.

Technological Integration with AI

The integration of artificial intelligence (AI) into the armored unmanned-underwater-vehicle market is transforming operational capabilities. AI enhances decision-making processes, enabling these vehicles to perform complex tasks autonomously. The U.S. military is actively exploring AI applications to improve mission efficiency and reduce human error. This technological advancement is expected to increase the demand for armored unmanned underwater vehicles, as they can conduct surveillance, reconnaissance, and even combat operations with minimal human intervention. The market is projected to grow as defense contractors invest in R&D to develop AI-driven systems. The potential for AI to revolutionize underwater operations suggests a promising future for the armored unmanned-underwater-vehicle market, as military forces seek to leverage cutting-edge technology for strategic advantages.

Enhanced Maritime Security Measures

The armored unmanned-underwater-vehicle market is experiencing growth due to heightened maritime security measures. With increasing threats from piracy, smuggling, and terrorism, nations are investing in advanced surveillance technologies to secure their waters. The U.S. Coast Guard and Navy are actively seeking innovative solutions to enhance maritime security, which includes the deployment of armored unmanned underwater vehicles. These vehicles can conduct patrols, monitor suspicious activities, and provide real-time intelligence. The market is expected to grow as defense budgets allocate more resources to maritime security initiatives. The emphasis on protecting national waters suggests a robust future for the armored unmanned underwater vehicle market, as governments prioritize safety and security.

Environmental Monitoring Initiatives

The armored unmanned-underwater-vehicle market is benefiting from increased focus on environmental monitoring and marine research. Governments and organizations are recognizing the importance of protecting marine ecosystems, leading to investments in technologies that can monitor underwater environments. The U.S. government has initiated several programs aimed at studying ocean health, which often require advanced underwater vehicles. These vehicles can collect data on water quality, marine life, and underwater habitats, making them essential tools for environmental agencies. As the demand for sustainable practices grows, the armored unmanned underwater vehicle market is likely to expand, driven by the need for effective monitoring solutions that align with environmental goals.