Stringent Emission Regulations

The automotive heat-shield market is significantly influenced by stringent emission regulations imposed by government authorities. In the US, the Environmental Protection Agency (EPA) has established rigorous standards aimed at reducing greenhouse gas emissions from vehicles. Heat shields contribute to this effort by ensuring that engines operate at optimal temperatures, thereby enhancing combustion efficiency and reducing harmful emissions. As manufacturers strive to comply with these regulations, the demand for effective heat-shield solutions is expected to rise. The automotive heat-shield market is projected to grow as companies invest in advanced materials and technologies that not only meet regulatory requirements but also improve vehicle performance. This regulatory landscape creates a favorable environment for innovation within the automotive heat-shield market.

Rising Demand for Fuel Efficiency

The automotive heat-shield market is experiencing a notable surge in demand driven by the increasing emphasis on fuel efficiency among consumers and manufacturers. As fuel prices fluctuate, the need for vehicles that minimize energy consumption becomes paramount. Heat shields play a crucial role in enhancing fuel efficiency by protecting sensitive components from excessive heat, thereby improving overall vehicle performance. According to recent data, vehicles equipped with advanced heat-shield technologies can achieve fuel savings of up to 10%. This trend is particularly pronounced in the US, where regulatory pressures and consumer preferences are pushing manufacturers to adopt innovative solutions. Consequently, The automotive heat-shield market is expected to expand as manufacturers seek to meet these evolving demands.

Consumer Awareness and Safety Concerns

Consumer awareness regarding vehicle safety and performance is a critical driver for the automotive heat-shield market. As consumers become more informed about the importance of thermal management in vehicles, they are increasingly prioritizing safety features that include effective heat shields. These components are vital in preventing overheating and potential fires, particularly in high-performance vehicles. The automotive heat-shield market is likely to see increased demand as manufacturers respond to consumer preferences for safer vehicles. Additionally, safety ratings and performance metrics are becoming more influential in purchasing decisions, further emphasizing the need for advanced heat-shield technologies. This growing consumer awareness is expected to contribute to a robust growth trajectory for the automotive heat-shield market.

Growth of the Electric Vehicle Segment

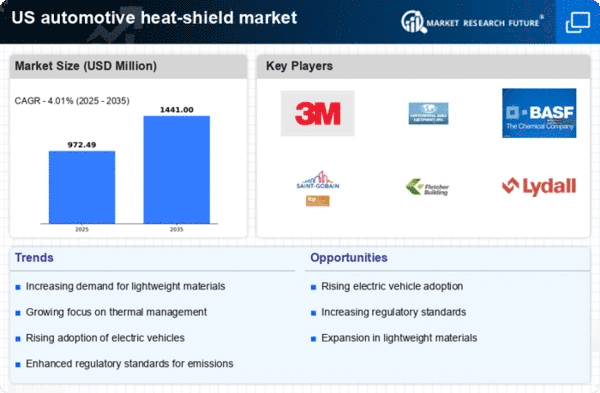

The automotive heat-shield market is poised for growth due to the rapid expansion of the electric vehicle (EV) segment. As EVs become increasingly popular in the US, the need for effective thermal management solutions is becoming more pronounced. Heat shields are essential in protecting battery systems and electric motors from excessive heat, ensuring optimal performance and longevity. The automotive heat-shield market is likely to benefit from this trend, as manufacturers develop specialized heat-shield products tailored for electric vehicles. With projections indicating that EV sales could account for over 30% of total vehicle sales by 2030, the demand for innovative heat-shield solutions is expected to rise significantly, further driving market growth.

Technological Advancements in Materials

Technological advancements in materials are reshaping the automotive heat-shield market, leading to the development of lighter and more effective solutions. Innovations such as the introduction of advanced composites and ceramics are enhancing the thermal resistance and durability of heat shields. These materials not only provide superior protection against heat but also contribute to weight reduction, which is crucial for improving vehicle efficiency. The automotive heat-shield market is witnessing a shift towards these high-performance materials, as manufacturers seek to enhance vehicle performance while adhering to weight constraints. As a result, the market is likely to see a rise in the adoption of these innovative materials, which could potentially lead to a market growth rate of around 8% annually over the next few years.

Leave a Comment