Increased Air Travel Demand

The aviation test-equipment market is significantly influenced by the rising demand for air travel in the United States. With passenger numbers expected to reach over 1 billion annually by 2027, airlines are compelled to enhance their fleet capabilities. This surge in air travel necessitates rigorous testing of aircraft systems to ensure safety and reliability. Consequently, manufacturers are investing heavily in advanced testing equipment to meet regulatory standards and consumer expectations. The market is likely to see an increase in revenue, with estimates suggesting a growth of around 6% annually as airlines expand their operations and upgrade their fleets. This trend underscores the critical role of the aviation test-equipment market in supporting the aviation industry's growth.

Focus on Safety and Reliability

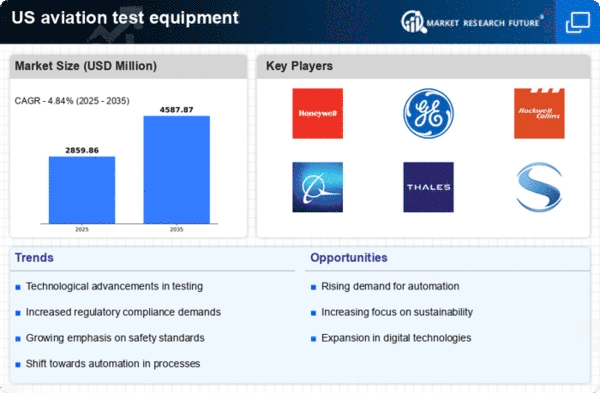

Safety remains a paramount concern in the aviation industry, driving the aviation test-equipment market. Regulatory bodies impose stringent safety standards that require comprehensive testing of aircraft systems. As incidents of technical failures can lead to catastrophic outcomes, manufacturers are increasingly investing in advanced testing solutions to ensure compliance with safety regulations. The market is expected to witness a growth rate of approximately 4.8% as companies prioritize reliability in their operations. This focus on safety not only enhances consumer confidence but also reinforces the importance of the aviation test-equipment market in maintaining high operational standards across the industry.

Investment in Military Aviation

The aviation test-equipment market is benefiting from increased investment in military aviation. The U.S. government is allocating substantial budgets to modernize its military fleet, which includes advanced aircraft and unmanned aerial vehicles. This modernization requires sophisticated testing equipment to ensure operational readiness and compliance with defense standards. The market is projected to grow at a rate of approximately 5.2% as defense contractors seek to enhance their testing capabilities. This investment not only bolsters national security but also underscores the critical role of the aviation test-equipment market in supporting military aviation advancements.

Advancements in Aerospace Technology

The aviation test-equipment market is experiencing a surge due to rapid advancements in aerospace technology. Innovations such as composite materials and advanced avionics systems necessitate sophisticated testing equipment to ensure safety and performance. The integration of automation and artificial intelligence in testing processes enhances efficiency and accuracy, which is crucial for manufacturers. As the demand for next-generation aircraft increases, the need for specialized test equipment becomes paramount. The market is projected to grow at a CAGR of approximately 5.5% over the next five years, driven by these technological advancements. This growth indicates a robust investment in research and development, further propelling the aviation test-equipment market.

Emergence of Electric and Hybrid Aircraft

The aviation test-equipment market is poised for transformation with the emergence of electric and hybrid aircraft. As manufacturers explore alternative propulsion systems to reduce carbon emissions, the need for specialized testing equipment becomes evident. These new aircraft designs require unique testing protocols to assess their performance and safety. The market is likely to expand as companies develop innovative testing solutions tailored to these technologies. Analysts predict a growth rate of around 7% in the aviation test-equipment market as the industry adapts to these changes. This shift not only reflects a commitment to sustainability but also highlights the evolving landscape of aviation technology.