Focus on Cost Reduction and Efficiency

Cost reduction and operational efficiency are critical drivers in the bagging machine market. Companies are under constant pressure to optimize their production processes while minimizing expenses. The adoption of automated bagging machines allows manufacturers to achieve higher output with lower labor costs, thereby enhancing profitability. This trend is particularly evident in industries such as agriculture and pharmaceuticals, where efficiency is paramount. The bagging machine market is projected to grow as businesses seek solutions that not only reduce costs but also improve overall productivity. This focus on efficiency indicates a shift towards more streamlined operations, which is likely to shape the future landscape of the market.

Growth of E-commerce and Retail Sectors

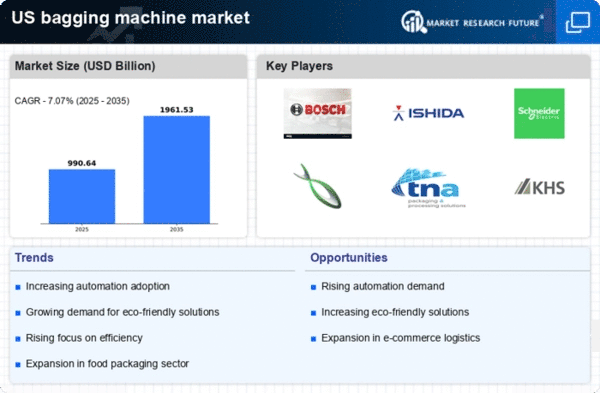

The expansion of the e-commerce and retail sectors is significantly influencing the bagging machine market. As online shopping continues to grow, the demand for efficient packaging solutions that ensure product safety during transit is paramount. Retailers are increasingly adopting automated bagging machines to streamline their operations and enhance customer satisfaction. This shift is expected to drive the market growth at a rate of approximately 5% annually. Furthermore, the need for customized packaging solutions to cater to diverse product ranges is likely to propel innovation within the bagging machine market. The interplay between e-commerce growth and packaging efficiency is creating new opportunities for manufacturers in this sector.

Technological Advancements in Packaging

The bagging machine market is experiencing a surge due to rapid technological advancements in packaging solutions. Innovations such as automated bagging systems and smart technologies are enhancing efficiency and precision in packaging processes. These advancements are likely to reduce labor costs and increase production rates, making them attractive to manufacturers. The integration of IoT and AI in bagging machines allows for real-time monitoring and predictive maintenance, which can minimize downtime. As a result, companies are increasingly investing in these advanced systems, contributing to a projected growth rate of approximately 6% annually in the bagging machine market. This trend indicates a shift towards more sophisticated packaging solutions that cater to the evolving demands of various industries.

Environmental Regulations and Compliance

Increasing environmental regulations are shaping the bagging machine market as companies strive to meet sustainability standards. The demand for eco-friendly packaging solutions is rising, prompting manufacturers to invest in bagging machines that utilize recyclable materials and reduce waste. Compliance with regulations is becoming a priority, as businesses face penalties for non-compliance. This trend is likely to drive innovation in the bagging machine market, as companies seek to develop sustainable packaging solutions that align with regulatory requirements. The emphasis on environmental responsibility is expected to influence purchasing decisions, leading to a shift towards more sustainable practices within the industry.

Rising Demand from Food and Beverage Sector

The food and beverage sector is a significant driver for the bagging machine market, as it requires efficient packaging solutions to meet consumer demands. With the increasing focus on convenience and ready-to-eat products, manufacturers are investing in advanced bagging machines to enhance their production capabilities. The sector is projected to account for over 40% of the total market share, reflecting a robust demand for efficient packaging solutions. Additionally, the need for compliance with food safety regulations further propels the adoption of automated bagging systems. This trend suggests that the bagging machine market will continue to thrive, driven by the food and beverage industry's evolving packaging requirements.

Leave a Comment