Rising Demand for Convenience

The beverage cans market experiences a notable surge in demand driven by the increasing consumer preference for convenience. As lifestyles become busier, consumers gravitate towards ready-to-drink beverages packaged in cans, which offer portability and ease of use. This trend is particularly evident in the soft drink and energy drink segments, where the market has seen a growth rate of approximately 5% annually. The beverage cans market benefits from this shift, as manufacturers adapt their production lines to meet the rising demand for on-the-go packaging solutions. Additionally, the convenience factor extends to the retail environment, where cans are often favored for their lightweight and stackable nature, enhancing shelf space efficiency. As a result, the beverage cans market is likely to continue expanding, driven by the ongoing consumer pursuit of convenience in their beverage choices.

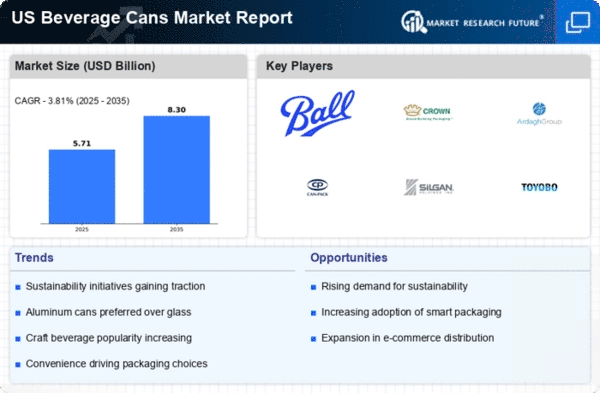

Expansion of Craft Beverage Segment

The craft beverage segment is experiencing rapid growth, significantly impacting the beverage cans market. As consumers increasingly seek unique and artisanal products, craft breweries and beverage producers are turning to cans as a preferred packaging option. This shift is attributed to the advantages of cans, including better preservation of flavor and reduced exposure to light. The beverage cans market is benefiting from this trend, as craft beverages often command higher price points, contributing to overall market revenue. Recent data indicates that the craft beer segment alone has grown by over 20% in the past year, with many craft producers opting for cans to enhance their brand visibility. This expansion not only diversifies the product offerings within the beverage cans market but also attracts a broader consumer base, further driving market growth.

Shift Towards Eco-Friendly Materials

The beverage cans market is witnessing a shift towards the use of eco-friendly materials, driven by increasing consumer awareness regarding environmental sustainability. Manufacturers are exploring alternatives to traditional materials, such as aluminum and steel, by incorporating recycled content into their can production. This trend is reflected in the growing market share of cans made from recycled materials, which has reached approximately 75% in recent years. The beverage cans market is adapting to this change, as companies strive to meet consumer demands for sustainable packaging options. Additionally, regulatory pressures are prompting manufacturers to adopt greener practices, further accelerating the transition towards eco-friendly materials. As consumers continue to prioritize sustainability in their purchasing decisions, the beverage cans market is likely to see continued growth in the adoption of environmentally responsible packaging solutions.

Increased Focus on Health and Wellness

The beverage cans market is increasingly influenced by the growing consumer focus on health and wellness. As individuals become more health-conscious, there is a rising demand for beverages that align with these values, such as low-calorie, organic, and functional drinks. This trend is evident in the beverage cans market, where manufacturers are responding by developing innovative products that cater to health-oriented consumers. Recent statistics indicate that the market for health-focused beverages has expanded by approximately 15% over the last year. Additionally, the convenience of canned beverages allows consumers to easily incorporate these healthier options into their daily routines. As the health and wellness trend continues to gain momentum, the beverage cans market is likely to see an increase in the variety of health-oriented products available in cans, further driving market growth.

Technological Advancements in Production

Technological innovations play a crucial role in shaping the beverage cans market. Recent advancements in manufacturing processes, such as the introduction of high-speed canning lines and automated quality control systems, have significantly improved production efficiency. These technologies enable manufacturers to reduce costs and enhance product quality, which is essential in a competitive market. For instance, the implementation of advanced coating technologies has led to better protection against corrosion and improved shelf life for canned beverages. The beverage cans market is likely to benefit from these developments, as they not only streamline operations but also allow for greater customization in can designs. Furthermore, the integration of smart technologies in production could lead to more sustainable practices, aligning with consumer expectations for environmentally friendly packaging solutions.