Government Policies and Incentives

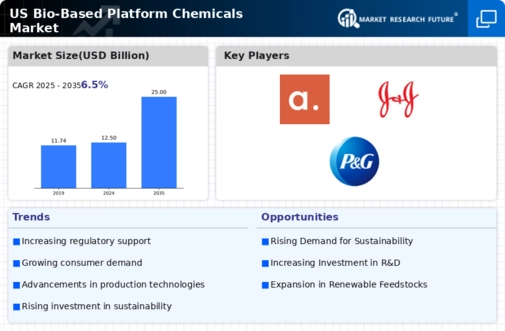

The US Bio Based Platform Chemicals Market is significantly influenced by government policies and incentives aimed at promoting sustainable practices. Federal and state governments have implemented various programs to encourage the production and use of bio-based chemicals. For instance, the Renewable Fuel Standard (RFS) mandates the blending of renewable fuels, which indirectly supports bio-based chemical production. Additionally, tax credits and grants for bio-refinery projects have been established, fostering innovation and investment in this sector. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years, driven by these supportive policies. This regulatory framework not only enhances the competitiveness of bio-based products but also aligns with broader environmental goals, making it a crucial driver for the US Bio Based Platform Chemicals Market.

Corporate Sustainability Commitments

Many corporations in the United States are increasingly committing to sustainability goals, which is a significant driver for the US Bio Based Platform Chemicals Market. Major companies are setting ambitious targets to reduce their carbon footprints and transition to renewable resources. For instance, several leading consumer goods firms have pledged to source 100% of their materials from renewable or recycled sources by 2030. This commitment is driving demand for bio-based chemicals, as companies seek to replace fossil fuel-derived inputs with sustainable alternatives. Market analysis suggests that this trend could lead to a 20% increase in the adoption of bio-based chemicals across various sectors, including personal care and food packaging. As corporations align their strategies with sustainability objectives, the US Bio Based Platform Chemicals Market is poised for substantial growth.

Rising Demand for Sustainable Products

Consumer preferences are shifting towards sustainable and eco-friendly products, which is a pivotal driver for the US Bio Based Platform Chemicals Market. As awareness of environmental issues increases, consumers are actively seeking products that minimize ecological impact. This trend is reflected in the growing demand for bio-based chemicals, which are perceived as safer alternatives to traditional petrochemical products. Market data indicates that the demand for bio-based solvents and plastics is expected to rise by 15% annually, as industries such as packaging and automotive increasingly adopt these materials. Companies are responding by reformulating their product lines to include bio-based options, thereby enhancing their market share and meeting consumer expectations. This shift not only supports sustainability goals but also drives innovation within the US Bio Based Platform Chemicals Market.

Global Market Trends and Export Opportunities

The US Bio Based Platform Chemicals Market is also influenced by global market trends and export opportunities. As countries worldwide adopt stricter environmental regulations, the demand for bio-based chemicals is expected to rise. The US, being a leader in bio-based technology, is well-positioned to capitalize on this trend. Recent data indicates that US exports of bio-based chemicals have increased by 25% over the past two years, driven by demand from Europe and Asia. This growth presents significant opportunities for US manufacturers to expand their market reach and enhance profitability. Additionally, participation in international sustainability initiatives and trade agreements can further bolster the US Bio Based Platform Chemicals Market, allowing for greater collaboration and innovation in bio-based product development.

Technological Innovations in Production Processes

Technological advancements play a crucial role in shaping the US Bio Based Platform Chemicals Market. Innovations in production processes, such as fermentation technology and enzymatic catalysis, have enhanced the efficiency and cost-effectiveness of bio-based chemical production. For example, recent developments in synthetic biology have enabled the engineering of microorganisms to produce platform chemicals from renewable feedstocks. This has the potential to reduce production costs by up to 30%, making bio-based alternatives more competitive with conventional chemicals. Furthermore, the integration of digital technologies, such as IoT and AI, in manufacturing processes is streamlining operations and improving yield. As these technologies continue to evolve, they are likely to drive further growth in the US Bio Based Platform Chemicals Market, attracting investment and fostering a more sustainable chemical landscape.