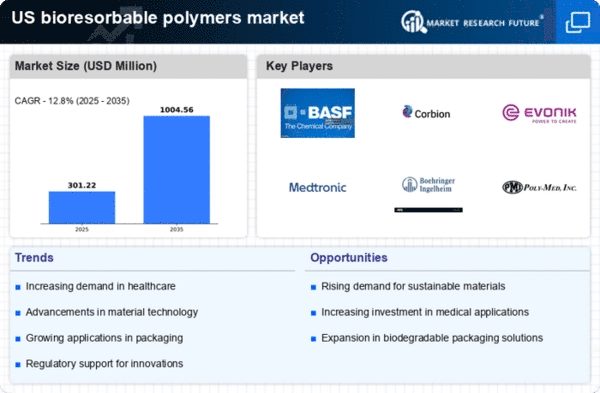

The bioresorbable polymers market is currently characterized by a dynamic competitive landscape, driven by increasing demand for sustainable medical solutions and advancements in polymer technology. Key players such as BASF SE (Germany), Medtronic PLC (Ireland), and Poly-Med Inc (US) are strategically positioned to leverage innovation and partnerships to enhance their market presence. BASF SE (Germany) focuses on developing high-performance materials that cater to the medical sector, while Medtronic PLC (Ireland) emphasizes integrating bioresorbable polymers into its medical devices, thereby enhancing patient outcomes. Poly-Med Inc (US) is dedicated to pioneering new applications for bioresorbable polymers, which collectively shapes a competitive environment that is increasingly focused on innovation and sustainability.In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance efficiency and responsiveness to market demands. The competitive structure of the bioresorbable polymers market appears moderately fragmented, with several players vying for market share. The collective influence of these key players is significant, as they drive technological advancements and set industry standards, thereby shaping the overall market dynamics.

In October Medtronic PLC (Ireland) announced a strategic partnership with a leading research institution to develop next-generation bioresorbable stents. This collaboration is expected to enhance the efficacy of their cardiovascular devices, aligning with the growing trend towards minimally invasive procedures. The strategic importance of this partnership lies in its potential to accelerate product development timelines and improve patient outcomes, thereby reinforcing Medtronic's competitive edge in the market.

In September BASF SE (Germany) launched a new line of bioresorbable polymers specifically designed for orthopedic applications. This product introduction is significant as it addresses the increasing demand for innovative solutions in orthopedic surgery, where the need for temporary implants is rising. By expanding its product portfolio, BASF SE strengthens its market position and demonstrates its commitment to meeting evolving customer needs.

In August Poly-Med Inc (US) secured a $5 million investment to enhance its R&D capabilities focused on bioresorbable sutures. This funding is crucial for advancing their technology and expanding their product offerings, which could lead to increased market penetration. The investment reflects a broader trend in the industry towards prioritizing R&D to foster innovation and maintain competitive differentiation.

As of November current competitive trends indicate a strong emphasis on digitalization, sustainability, and the integration of AI technologies within the bioresorbable polymers market. Strategic alliances are increasingly shaping the landscape, enabling companies to pool resources and expertise to drive innovation. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological advancements, supply chain reliability, and sustainable practices, underscoring the importance of innovation in maintaining market leadership.