Regulatory Support for Blood Safety

Regulatory bodies in the US are increasingly emphasizing blood safety, which is influencing the blood group-typing market. The Food and Drug Administration (FDA) has implemented stringent guidelines for blood collection and transfusion practices, mandating accurate blood typing to prevent transfusion reactions. As a result, healthcare providers are investing in advanced blood typing technologies to comply with these regulations. The blood group-typing market is expected to benefit from this regulatory environment, as adherence to safety standards drives demand for reliable and efficient blood typing solutions. Furthermore, ongoing updates to regulations may lead to the development of innovative products that enhance blood safety, further stimulating market growth.

Rising Prevalence of Blood Disorders

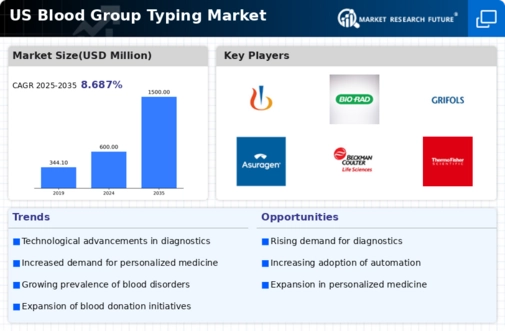

The increasing incidence of blood disorders such as anemia, hemophilia, and thalassemia is driving the blood group-typing market. According to the Centers for Disease Control and Prevention (CDC), approximately 3 million individuals in the US are affected by anemia alone. This growing patient population necessitates accurate blood typing for effective treatment and management. As healthcare providers seek to enhance patient outcomes, the demand for reliable blood group-typing solutions is expected to rise. Furthermore, advancements in diagnostic technologies are likely to improve the accuracy and speed of blood typing, further propelling market growth. The blood group-typing market is thus positioned to benefit from this trend, as healthcare systems increasingly prioritize precise diagnostics to address the needs of patients with blood-related conditions.

Expansion of Blood Donation Initiatives

The expansion of blood donation initiatives across the US is significantly impacting the blood group-typing market. Organizations such as the American Red Cross are actively promoting blood donation drives, which have seen a notable increase in participation. In 2025, it is estimated that blood donations will rise by approximately 15%, necessitating efficient blood group-typing to ensure compatibility for transfusions. This surge in donations creates a corresponding demand for blood typing services, as healthcare facilities must accurately match donors with recipients. The blood group-typing market is likely to experience growth as a result of these initiatives, as they not only enhance the availability of blood products but also emphasize the importance of accurate blood typing in transfusion medicine.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is reshaping the blood group-typing market. Innovations such as artificial intelligence (AI) and machine learning are being utilized to enhance the accuracy and efficiency of blood typing processes. For instance, AI algorithms can analyze blood samples more rapidly than traditional methods, potentially reducing turnaround times by up to 30%. This technological advancement not only improves patient care but also streamlines laboratory operations. As healthcare facilities increasingly adopt these technologies, the blood group-typing market is likely to experience significant growth. The potential for improved diagnostic capabilities and operational efficiencies positions the market favorably in the evolving healthcare landscape.

Growing Awareness of Blood Type Compatibility

There is a growing awareness among the public regarding the importance of blood type compatibility in medical procedures, which is positively influencing the blood group-typing market. Educational campaigns and health initiatives are informing individuals about the critical role of blood typing in transfusions and organ transplants. This heightened awareness is likely to lead to an increase in demand for blood typing services, as patients and healthcare providers prioritize compatibility to avoid adverse reactions. The blood group-typing market stands to gain from this trend, as the emphasis on patient safety and informed decision-making drives the need for accurate blood typing solutions.