Regulatory Changes and Safety Standards

Regulatory changes and evolving safety standards are impacting the body worn-insect-repellent market. The US government has implemented stricter regulations regarding the ingredients used in insect repellents, which has led to increased scrutiny of product formulations. Manufacturers are now required to comply with these regulations, ensuring that their products are safe for consumers. This shift has prompted companies to invest in research to develop compliant formulations that meet safety standards while maintaining efficacy. As a result, The body worn insect repellent market is likely to see a rise in products that adhere to regulations. These products will also emphasize safety and effectiveness, thereby fostering consumer trust.

Growth in Outdoor Recreational Activities

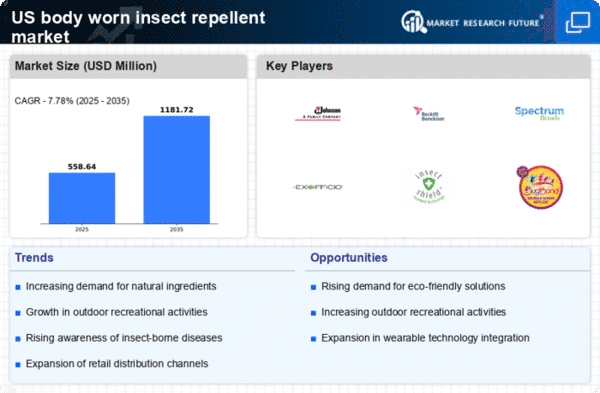

The body worn-insect-repellent market is experiencing growth due to the increasing popularity of outdoor recreational activities among the US population. As more individuals engage in hiking, camping, and other outdoor pursuits, the need for effective insect protection becomes paramount. This trend is supported by data indicating that approximately 50% of Americans participate in outdoor activities annually, leading to a heightened demand for body worn-insect-repellent products. The market is expected to benefit from this trend, as consumers seek reliable solutions to enhance their outdoor experiences while minimizing the risk of insect bites. Consequently, manufacturers are likely to focus on developing products that cater to this growing segment, further driving market expansion.

Rising Awareness of Vector-Borne Diseases

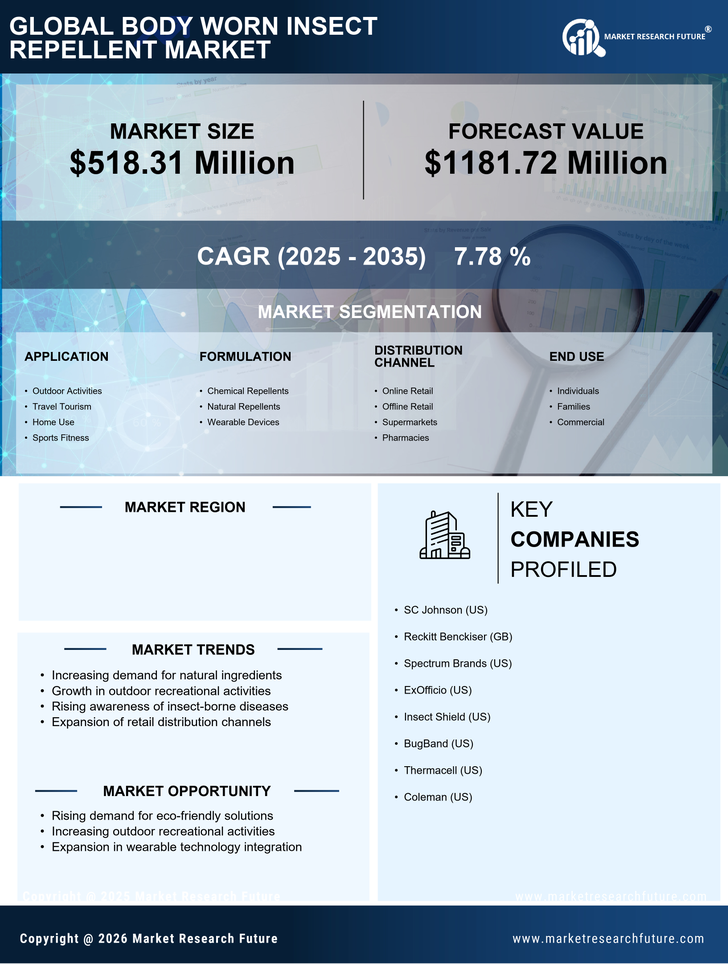

The increasing incidence of vector-borne diseases in the US has heightened public awareness regarding the importance of protection against insect bites. Diseases such as Lyme disease and West Nile virus, transmitted by ticks and mosquitoes respectively, have prompted consumers to seek effective solutions. This trend is reflected in the body worn-insect-repellent market, where sales have surged as individuals prioritize personal safety. According to recent data, the market is projected to grow at a CAGR of 5.2% over the next five years, driven by the need for preventive measures against these health threats. As awareness continues to rise, the demand for body worn-insect-repellent products is likely to expand, encouraging manufacturers to innovate and diversify their offerings.

Innovations in Product Design and Functionality

Innovations in product design and functionality are playing a crucial role in shaping the body worn-insect-repellent market. Manufacturers are increasingly focusing on creating user-friendly and effective products that cater to diverse consumer needs. For instance, the introduction of wearable devices that incorporate insect-repellent technology is gaining traction. These advancements not only enhance the effectiveness of the products but also appeal to tech-savvy consumers. The market is projected to reach $1.2 billion by 2026, with innovations driving a significant portion of this growth. As companies invest in research and development, the body worn-insect-repellent market is likely to witness a surge in new offerings that combine convenience with efficacy.

Environmental Concerns and Sustainable Practices

Environmental concerns are influencing consumer preferences in the body worn-insect-repellent market. As awareness of ecological issues grows, consumers are increasingly seeking products that align with sustainable practices. This shift is prompting manufacturers to explore eco-friendly formulations and packaging solutions. Data suggests that around 30% of consumers are willing to pay a premium for environmentally friendly products, indicating a potential market shift. The body worn-insect-repellent market is likely to adapt to these changing preferences, with companies focusing on developing biodegradable and non-toxic ingredients. This trend not only addresses consumer demand but also positions brands as responsible players in the market, potentially enhancing their competitive edge.