Growing Awareness of Bone Health

The rising awareness of bone health among the US population is driving the bone implant market. Educational campaigns and initiatives aimed at promoting bone health are encouraging individuals to seek preventive measures and treatments for bone-related issues. This heightened awareness is leading to an increase in early diagnosis and treatment of conditions such as osteoporosis and fractures. As more patients become informed about the benefits of bone implants, the demand for these solutions is expected to rise. The bone implant market is likely to see a corresponding increase in the number of surgical procedures performed, as healthcare providers respond to the growing interest in maintaining bone health. This trend suggests a positive outlook for the market, with potential growth opportunities in patient education and outreach.

Increased Healthcare Expenditure

Rising healthcare expenditure in the US is a crucial driver for the bone implant market. As the government and private sectors allocate more funds towards healthcare services, the availability of advanced medical technologies, including bone implants, is improving. In 2025, healthcare spending is projected to reach approximately $4.5 trillion, reflecting a growth rate of around 5.4% annually. This increase in funding allows for better access to surgical procedures and innovative treatment options, thereby boosting the demand for bone implants. The bone implant market stands to benefit from this trend, as hospitals and clinics invest in state-of-the-art equipment and technologies to enhance patient care. Consequently, the market is likely to see a significant uptick in the adoption of bone implants as part of comprehensive treatment plans.

Rising Incidence of Bone Disorders

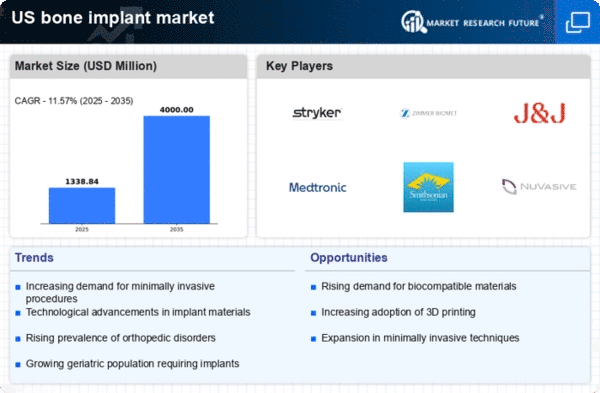

The increasing prevalence of bone disorders, such as osteoporosis and fractures, is a primary driver for the bone implant market. In the US, it is estimated that osteoporosis affects approximately 10 million individuals, with an additional 44 million at risk. This growing patient population necessitates advanced treatment options, including bone implants, to restore mobility and quality of life. The bone implant market is likely to experience substantial growth as healthcare providers seek effective solutions to address these conditions. Furthermore, the demand for surgical interventions is expected to rise, leading to an increase in the adoption of innovative bone implant technologies. As a result, the market is projected to expand significantly, with a compound annual growth rate (CAGR) of around 6% over the next several years.

Expansion of Orthopedic Surgical Procedures

The expansion of orthopedic surgical procedures is a significant driver for the bone implant market. As advancements in surgical techniques and technologies continue to evolve, more patients are opting for surgical interventions to address bone-related issues. In the US, the number of orthopedic surgeries is projected to increase, with estimates suggesting that over 1 million hip and knee replacement surgeries will be performed annually by 2025. This surge in surgical procedures directly correlates with the demand for bone implants, as they are essential components of these operations. The bone implant market is poised to benefit from this trend, as healthcare facilities invest in the latest surgical equipment and implant technologies. Consequently, the market is likely to experience robust growth, driven by the increasing volume of orthopedic surgeries and the need for effective implant solutions.

Technological Innovations in Implant Design

Technological advancements in implant design and materials are transforming the bone implant market. Innovations such as 3D printing and bioactive materials are enhancing the performance and integration of implants within the body. These developments allow for the creation of customized implants tailored to individual patient needs, which is particularly beneficial in complex cases. The bone implant market is witnessing a surge in demand for these advanced solutions, as they offer improved outcomes and reduced recovery times. Additionally, the integration of smart technologies, such as sensors and monitoring systems, is expected to further enhance the functionality of bone implants. This trend indicates a shift towards more personalized and effective treatment options, potentially increasing the market's value significantly in the coming years.