Expansion of the Nutraceutical Sector

The botanical extracts market is significantly impacted by the expansion of the nutraceutical sector, which encompasses dietary supplements and functional foods. As health and wellness trends continue to gain traction, the demand for botanical extracts in these products is on the rise. In the US, the nutraceutical market is expected to grow at a CAGR of around 7% over the next few years, with botanical extracts playing a crucial role in enhancing the nutritional profile of various offerings. This growth is indicative of a broader shift towards preventive healthcare, where consumers are increasingly seeking natural solutions to support their well-being. Consequently, the botanical extracts market is poised to benefit from this trend, as manufacturers incorporate these extracts into their formulations to meet consumer demands.

Rising Popularity of Organic Products

The botanical extracts market is witnessing a surge in demand for organic products, driven by consumers' increasing preference for clean and sustainable options. In the US, the organic food and beverage market has been growing steadily, with sales reaching approximately $62 billion in 2024. This trend is influencing the botanical extracts market, as manufacturers are compelled to source organic botanicals to meet consumer expectations. The emphasis on organic ingredients not only reflects a commitment to health and wellness but also aligns with broader sustainability goals. As a result, the botanical extracts market is likely to expand, with a growing number of products featuring certified organic extracts to cater to this discerning consumer base.

Innovations in Extraction Technologies

Innovations in extraction technologies are transforming the botanical extracts market, enabling manufacturers to obtain higher yields and better quality extracts. Advanced methods such as supercritical CO2 extraction and ultrasonic extraction are gaining traction, as they enhance the efficiency and sustainability of the extraction process. These technologies not only improve the purity and potency of botanical extracts but also align with the growing consumer demand for high-quality natural products. As the US market continues to evolve, the adoption of these innovative extraction techniques is likely to drive growth in the botanical extracts market, allowing companies to differentiate their products and meet stringent quality standards.

Regulatory Developments and Compliance

Regulatory developments play a pivotal role in shaping the botanical extracts market, as compliance with safety and quality standards is essential for market access. In the US, agencies such as the FDA and USDA are actively involved in establishing guidelines for the use of botanical extracts in food, beverages, and dietary supplements. These regulations are designed to ensure consumer safety and product efficacy, which, in turn, fosters trust in the market. As companies navigate these regulatory landscapes, the botanical extracts market is likely to see increased investment in quality assurance and compliance measures. This focus on regulatory adherence not only enhances product credibility but also supports the overall growth of the market.

Consumer Preference for Healthier Alternatives

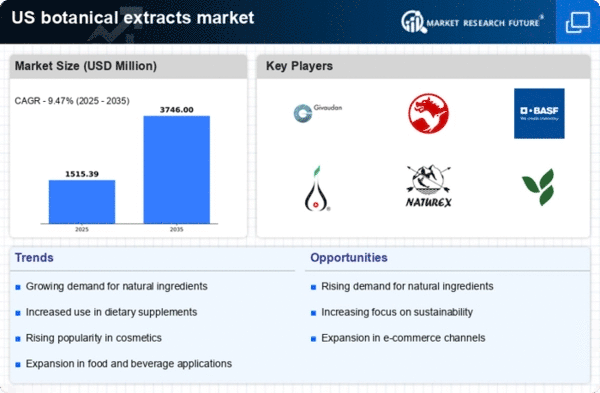

The botanical extracts market is experiencing a notable shift as consumers increasingly gravitate towards healthier alternatives in their food and personal care products. This trend is driven by a growing awareness of the benefits associated with natural ingredients, which are perceived as safer and more effective compared to synthetic counterparts. In the US, the demand for botanical extracts has surged, with the market projected to reach approximately $5 billion by 2026. This consumer preference is not only influencing product formulations but also prompting manufacturers to innovate and diversify their offerings. As a result, is likely to expand to cater to evolving consumer tastes and health-conscious choices..