Increasing Healthcare Expenditure

The rising healthcare expenditure in the US is a significant driver for the cardiac surgery-instruments market. With healthcare spending projected to reach $6.2 trillion by 2028, there is a growing investment in advanced medical technologies, including surgical instruments. This increase in funding allows hospitals and surgical centers to upgrade their equipment and adopt the latest innovations in cardiac surgery. As healthcare providers prioritize patient care and outcomes, the demand for high-quality surgical instruments is expected to rise. Furthermore, the emphasis on value-based care is likely to drive investments in technologies that improve surgical efficiency and patient recovery times. Consequently, the cardiac surgery-instruments market is poised for growth as healthcare systems allocate more resources to enhance surgical capabilities.

Regulatory Support for Medical Innovations

Regulatory support for medical innovations is a crucial driver for the cardiac surgery-instruments market. The US Food and Drug Administration (FDA) has implemented streamlined processes for the approval of new surgical instruments, facilitating quicker access to advanced technologies. This regulatory environment encourages manufacturers to invest in research and development, leading to the introduction of innovative products in the market. As new instruments receive approval, healthcare providers are more likely to adopt these technologies, enhancing surgical procedures and patient outcomes. The cardiac surgery-instruments market is expected to grow as regulatory bodies continue to support the development of cutting-edge surgical tools, ensuring that patients have access to the latest advancements in cardiac care.

Rising Prevalence of Cardiovascular Diseases

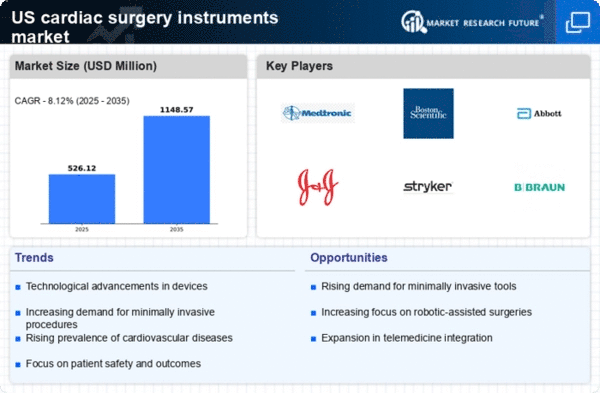

The increasing incidence of cardiovascular diseases in the US is a primary driver for the cardiac surgery-instruments market. According to the American Heart Association, cardiovascular diseases account for approximately 697,000 deaths annually, representing about 1 in every 5 deaths. This alarming statistic underscores the urgent need for effective surgical interventions, thereby propelling demand for advanced surgical instruments. As healthcare providers strive to improve patient outcomes, the adoption of innovative surgical tools becomes essential. The cardiac surgery-instruments market is likely to experience growth as hospitals and surgical centers invest in state-of-the-art equipment to address this pressing health crisis. Furthermore, the aging population, which is more susceptible to heart-related ailments, is expected to contribute to the rising demand for cardiac surgeries, further stimulating the market.

Growing Awareness and Education on Heart Health

The growing awareness and education regarding heart health among the US population is driving the cardiac surgery-instruments market. Public health campaigns and educational initiatives have increased knowledge about cardiovascular diseases, leading to earlier diagnosis and treatment. As individuals become more informed about the risks associated with heart conditions, there is a corresponding rise in demand for surgical interventions. This heightened awareness encourages patients to seek medical advice sooner, resulting in an increased number of cardiac surgeries. Consequently, healthcare providers are compelled to invest in advanced surgical instruments to meet this rising demand. The cardiac surgery-instruments market is likely to benefit from this trend as more patients opt for surgical solutions to address their heart health concerns.

Technological Innovations in Surgical Instruments

Technological advancements in surgical instruments are significantly influencing the cardiac surgery-instruments market. Innovations such as minimally invasive techniques, robotic-assisted surgeries, and advanced imaging technologies are transforming surgical practices. For instance, the integration of robotic systems in cardiac surgeries has shown to enhance precision and reduce recovery times, making procedures safer and more efficient. The market is projected to grow as hospitals increasingly adopt these cutting-edge technologies to improve surgical outcomes. In 2025, the market for robotic surgical systems is expected to reach approximately $6 billion, indicating a robust demand for advanced instruments. As healthcare providers seek to enhance their surgical capabilities, the cardiac surgery-instruments market is likely to benefit from these technological advancements.