Expansion of E-commerce Platforms

The expansion of e-commerce platforms is reshaping the distribution landscape for the cbd plant-nutrients market. As more consumers and growers turn to online shopping for convenience and accessibility, the demand for cbd plant-nutrients through digital channels is likely to increase. E-commerce sales in the gardening and agricultural sector have seen substantial growth, with projections indicating a rise of over 30% in online sales by 2025. This shift suggests that suppliers of cbd plant-nutrients must adapt their marketing strategies to leverage online platforms effectively. By enhancing their online presence and offering direct-to-consumer sales, companies can tap into a broader customer base, thereby driving growth in the cbd plant-nutrients market.

Increased Legalization of Cannabis

The ongoing legalization of cannabis across various states in the US is a significant driver for the cbd plant-nutrients market. As more states legalize both medical and recreational cannabis, the number of licensed growers is expected to increase. This expansion in cultivation operations necessitates a corresponding rise in the demand for specialized nutrients tailored for cbd plants. According to recent estimates, the legal cannabis market in the US is projected to exceed $41 billion by 2025. This growth indicates a burgeoning opportunity for suppliers of cbd plant-nutrients, as cultivators seek to optimize their yields and enhance the quality of their products in a competitive market.

Rising Demand for Organic Products

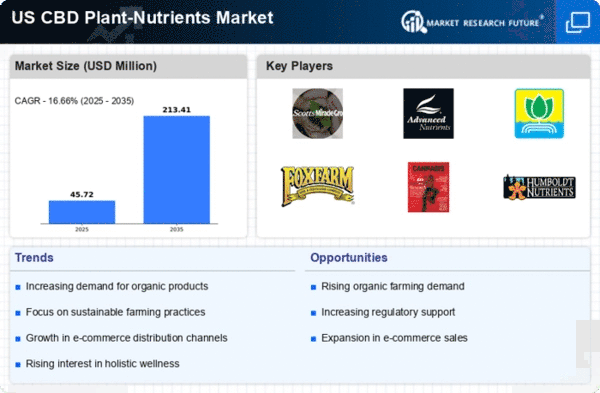

The increasing consumer preference for organic and natural products is a pivotal driver for the cbd plant-nutrients market. As health-conscious consumers become more aware of the benefits of organic cultivation, the demand for organic cbd plant-nutrients is likely to surge. In 2025, the organic food market in the US is projected to reach approximately $70 billion, indicating a robust growth trajectory. This trend suggests that consumers are willing to invest in high-quality, organic inputs for their cbd cultivation, thereby propelling the cbd plant-nutrients market forward. Furthermore, the shift towards organic farming practices aligns with broader sustainability goals, which may further enhance market growth as more growers seek to meet consumer expectations for environmentally friendly products.

Growing Awareness of Health Benefits

The rising awareness of the health benefits associated with cbd products is a crucial driver for the cbd plant-nutrients market. As consumers become more informed about the potential therapeutic effects of cbd, the demand for high-quality cbd products is expected to increase. This heightened interest in cbd is likely to encourage growers to invest in superior plant-nutrient solutions to enhance the quality and potency of their crops. Market Research Future indicates that the cbd market could reach $20 billion by 2025, reflecting a growing consumer base that prioritizes quality. Consequently, this trend may lead to an increased focus on the development and use of specialized nutrients designed to optimize cbd plant growth and efficacy.

Technological Innovations in Agriculture

Technological advancements in agricultural practices are transforming the cbd plant-nutrients market. Innovations such as precision agriculture, hydroponics, and advanced nutrient formulations are enabling growers to maximize efficiency and yield. For instance, the adoption of smart farming technologies allows for real-time monitoring of plant health and nutrient requirements, which can lead to more effective nutrient application. The market for agricultural technology is expected to grow significantly, with projections indicating a value of over $22 billion by 2025. This trend suggests that as growers increasingly adopt these technologies, the demand for specialized cbd plant-nutrients that cater to these advanced cultivation methods will likely rise, further driving market growth.