Increased Focus on Product Safety

In the clamshell packaging market, heightened awareness regarding product safety significantly influences purchasing decisions. Consumers are increasingly concerned about the integrity and safety of the products they purchase, particularly in the food and pharmaceutical sectors. Clamshell packaging offers robust protection against contamination and damage, which is crucial for maintaining product quality. Recent statistics indicate that the food safety packaging market is expected to reach $25 billion by 2027, underscoring the importance of secure packaging solutions. Furthermore, regulatory bodies are imposing stricter guidelines on packaging materials, compelling manufacturers to adopt clamshells that comply with safety standards. This focus on product safety not only enhances consumer trust but also drives growth within the clamshell packaging market, as businesses seek to align with safety regulations.

Shift Towards Eco-Friendly Materials

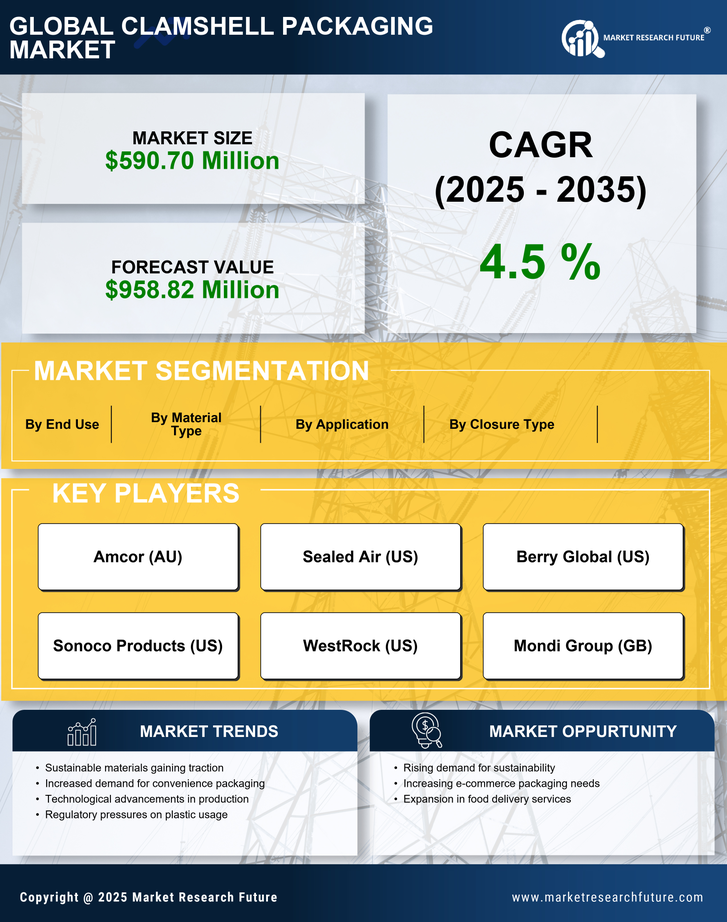

The clamshell packaging market is witnessing a transformative shift towards eco-friendly materials, driven by increasing environmental awareness among consumers. As sustainability becomes a priority, manufacturers are exploring biodegradable and recyclable options for clamshell packaging. Recent data suggests that the biodegradable packaging market is projected to grow at a CAGR of 5.7% from 2025 to 2030, indicating a strong trend towards sustainable practices. This shift is not only beneficial for the environment but also aligns with consumer preferences, as studies show that 70% of consumers are willing to pay more for sustainable packaging. Consequently, the clamshell packaging market is adapting to these demands, with companies investing in research and development to create innovative, eco-friendly solutions that meet both regulatory requirements and consumer expectations.

Rising Demand for Convenience Packaging

The clamshell packaging market experiences a notable surge in demand driven by consumer preferences for convenience. As lifestyles become increasingly fast-paced, consumers favor packaging that offers easy access and portability. This trend is particularly evident in the food sector, where ready-to-eat meals and snacks packaged in clamshells are gaining traction. According to recent data, the convenience food segment is projected to grow at a CAGR of 4.5% through 2026, further propelling the clamshell packaging market. Additionally, the ability of clamshells to provide visibility of the product enhances consumer appeal, making them a preferred choice for retailers. This growing inclination towards convenience packaging is likely to shape the future landscape of the clamshell packaging market, as manufacturers adapt to meet evolving consumer needs.

Expansion of Retail and E-commerce Channels

The clamshell packaging market is significantly impacted by the expansion of retail and e-commerce channels. As online shopping continues to grow, the demand for packaging that ensures product protection during transit becomes paramount. Clamshells are particularly advantageous in this context, as they provide excellent protection against damage while allowing for product visibility. Recent reports indicate that e-commerce sales in the US are expected to reach $1 trillion by 2025, further driving the need for effective packaging solutions. Additionally, brick-and-mortar retailers are increasingly adopting clamshell packaging to enhance product presentation and reduce shrinkage. This dual demand from both retail and e-commerce sectors is likely to bolster the clamshell packaging market, as businesses seek to optimize their packaging strategies.

Technological Innovations in Packaging Design

Technological advancements play a crucial role in shaping the clamshell packaging market. Innovations in materials and design are enabling manufacturers to create more efficient and visually appealing packaging solutions. For instance, the introduction of advanced printing techniques allows for high-quality graphics on clamshells, enhancing brand visibility. Moreover, developments in automation and production processes are streamlining manufacturing, reducing costs, and improving turnaround times. Recent data indicates that the packaging machinery market is projected to grow by 4.2% annually, reflecting the increasing investment in technology. As companies strive to differentiate their products in a competitive landscape, these technological innovations are likely to drive growth in the clamshell packaging market, offering new opportunities for customization and efficiency.