Expansion of Cloud Infrastructure

The expansion of cloud infrastructure is a pivotal driver for the cloud analytics market. As more organizations migrate their operations to the cloud, the demand for robust analytics solutions increases. The U.S. cloud infrastructure market is expected to reach $100 billion by 2026, indicating a strong trend towards cloud adoption. This shift allows businesses to utilize advanced analytics tools without the burden of maintaining on-premises hardware. Furthermore, the scalability and flexibility offered by cloud solutions enable organizations to adapt quickly to changing market conditions, thereby enhancing their analytical capabilities. This trend is likely to continue, further propelling the growth of the cloud analytics market.

Rising Focus on Customer Experience

A rising focus on customer experience is driving organizations to adopt cloud analytics solutions. Businesses are increasingly utilizing analytics to understand customer behavior and preferences, which allows for personalized marketing strategies and improved service delivery. The cloud analytics market is expected to benefit from this trend, as companies seek to leverage data to enhance customer engagement. With an estimated 70% of organizations prioritizing customer experience initiatives, the demand for analytics tools that can provide insights into customer interactions is likely to grow. This shift underscores the importance of cloud analytics in shaping customer-centric strategies within the market.

Integration of Advanced Technologies

The integration of advanced technologies such as IoT and big data analytics is significantly influencing the cloud analytics market. As IoT devices proliferate, they generate massive amounts of data that require sophisticated analytics for effective utilization. The cloud provides the necessary infrastructure to process and analyze this data efficiently. In fact, the market for IoT analytics is projected to grow to $30 billion by 2025, highlighting the increasing reliance on cloud analytics solutions. This integration not only enhances data processing capabilities but also enables organizations to derive actionable insights, thereby driving the evolution of the cloud analytics market.

Cost Efficiency and Resource Optimization

Cost efficiency and resource optimization are critical drivers for the cloud analytics market. Organizations are increasingly seeking ways to reduce operational costs while maximizing the value derived from their data. Cloud analytics solutions offer a cost-effective alternative to traditional analytics methods, allowing businesses to pay for only the resources they use. This model not only reduces upfront investments but also enables organizations to scale their analytics capabilities as needed. As a result, many companies are transitioning to cloud-based analytics to achieve better resource allocation and financial efficiency. This trend is expected to continue, further solidifying the cloud analytics market's position as a vital component of modern business strategy.

Growing Demand for Data-Driven Decision Making

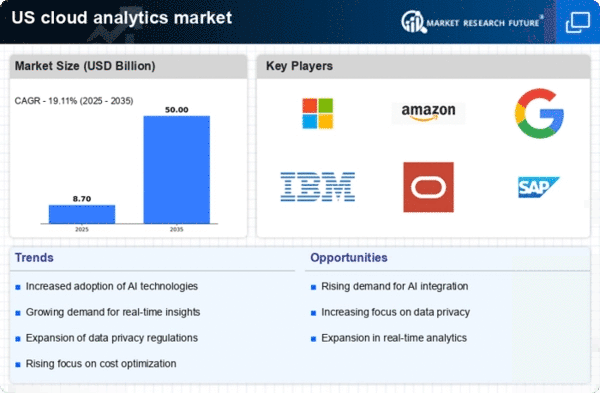

data-driven decision-making Businesses are leveraging cloud analytics to gain insights from vast amounts of data, which enhances operational efficiency and strategic planning. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is fueled by the need for real-time insights and the ability to analyze data from various sources. As companies strive to remain competitive, the adoption of cloud analytics solutions becomes essential, driving innovation and improving overall business performance in the cloud analytics market.