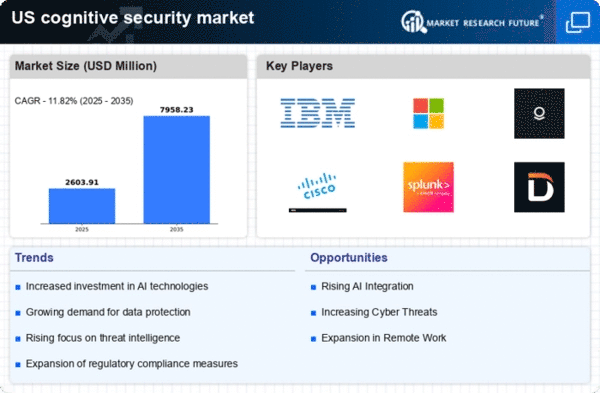

Rising Cyber Threats

The cognitive security market is experiencing growth due to the increasing frequency and sophistication of cyber threats. Organizations across various sectors are investing heavily in cognitive security solutions to protect sensitive data and maintain operational integrity. In 2025, it is estimated that cybercrime will cost businesses globally over $10 trillion annually, prompting a shift towards advanced security measures. The cognitive security market is positioned to address these challenges by leveraging AI and machine learning to detect anomalies and respond to threats in real-time. This proactive approach not only enhances security but also reduces potential financial losses, making it a critical component of modern cybersecurity strategies.

Growth of Remote Work

The shift towards remote work has significantly impacted the cognitive security market. With more employees accessing corporate networks from various locations, the potential for security breaches has increased. Organizations are now prioritizing cognitive security solutions that can monitor and protect remote access points. In 2025, it is anticipated that remote work will account for over 30% of the workforce in the US, necessitating advanced security measures. Cognitive security technologies, which utilize AI to analyze user behavior and detect anomalies, are becoming essential for safeguarding sensitive information in this evolving work environment.

Demand for Enhanced User Experience

As organizations strive to improve user experience, the cognitive security market plays a pivotal role in ensuring seamless interactions without compromising security. By integrating cognitive security solutions, businesses can analyze user behavior and adapt security protocols accordingly. This adaptability is crucial in sectors such as finance and healthcare, where user trust is paramount. In 2025, the market for cognitive security solutions is projected to reach $15 billion, driven by the need for solutions that balance security with user convenience. Enhanced user experience, coupled with robust security measures, is likely to become a key differentiator for organizations in competitive markets.

Regulatory Pressures and Compliance

Regulatory pressures are increasingly influencing the cognitive security market as organizations strive to comply with stringent data protection laws. In the US, regulations such as the CCPA and GDPR impose significant requirements on data handling and security practices. As a result, businesses are compelled to invest in cognitive security solutions that not only protect sensitive information but also ensure compliance with legal standards. The cognitive security market is expected to grow as organizations seek to mitigate risks associated with non-compliance, which can result in hefty fines and reputational damage. This trend underscores the critical role of cognitive security in navigating the complex regulatory landscape.

Investment in Digital Transformation

The ongoing digital transformation across industries is driving demand for cognitive security solutions. As organizations adopt cloud computing, IoT, and other digital technologies, the cognitive security market is positioned to provide the necessary safeguards against emerging threats. In 2025, the digital transformation market is expected to exceed $2 trillion, with a substantial portion allocated to security solutions. This investment reflects a growing recognition of the importance of integrating cognitive security into digital strategies, ensuring that organizations can innovate while maintaining robust protection against cyber threats.