Government Defense Budgets

The combat helmet market is significantly influenced by government defense budgets, which have seen a steady increase in recent years. The U.S. government has allocated substantial funds towards enhancing military capabilities, with defense spending reaching approximately $740 billion in 2025. This financial commitment extends to the procurement of advanced combat helmets, as military forces prioritize equipping personnel with state-of-the-art protective gear. The combat helmet market benefits from this trend, as manufacturers are encouraged to innovate and produce helmets that meet stringent military specifications. Additionally, the focus on modernization programs within the armed forces is likely to sustain demand for high-quality helmets, ensuring that soldiers are adequately protected in diverse operational environments.

Rising Demand for Enhanced Protection

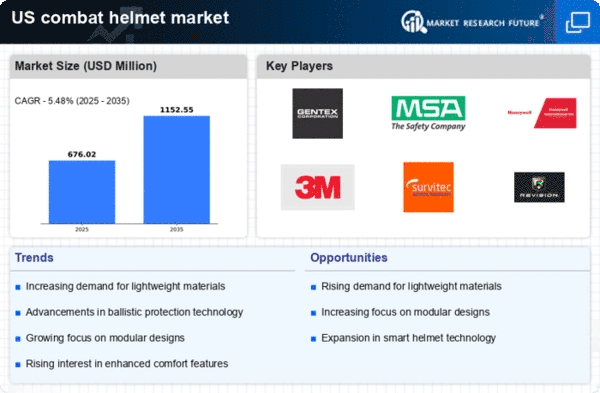

The combat helmet market is experiencing a notable increase in demand for enhanced protection solutions. As military operations evolve, the need for helmets that offer superior ballistic and impact resistance becomes paramount. Recent data indicates that the market for advanced combat helmets is projected to grow at a CAGR of approximately 5.5% through 2028. This growth is driven by the increasing awareness of soldier safety and the necessity for headgear that can withstand modern threats. The combat helmet market is responding by integrating advanced materials such as aramid fibers and composite materials, which provide lightweight yet robust protection. Furthermore, the emphasis on head injury prevention in combat scenarios is likely to propel innovations in helmet design, ensuring that soldiers are equipped with the best possible protective gear.

Focus on Soldier Comfort and Ergonomics

The combat helmet market is also being shaped by a growing emphasis on soldier comfort and ergonomics. As military personnel spend extended periods wearing helmets, the need for designs that prioritize comfort is becoming increasingly apparent. Helmets that are lightweight, well-ventilated, and adjustable are likely to enhance user experience and reduce fatigue during operations. The combat helmet market is responding to this demand by developing helmets that incorporate ergonomic features, such as adjustable padding and moisture-wicking materials. This focus on comfort not only improves soldier morale but also contributes to operational effectiveness. As a result, manufacturers are expected to invest in research and development to create helmets that balance protection with comfort, potentially leading to a more competitive market landscape.

Technological Integration in Helmet Design

The integration of cutting-edge technology into helmet design is a driving force in the combat helmet market. Innovations such as augmented reality (AR) systems, communication devices, and integrated sensors are becoming increasingly prevalent. These advancements not only enhance situational awareness but also improve overall soldier performance in the field. The combat helmet market is witnessing a shift towards multifunctional helmets that combine protection with technological capabilities. For instance, helmets equipped with communication systems can facilitate real-time information sharing among troops, thereby enhancing operational efficiency. As military operations become more complex, the demand for helmets that incorporate these technologies is expected to rise, potentially leading to a market growth rate of around 6% annually over the next few years.

Increased Focus on Research and Development

The combat helmet market is witnessing a heightened focus on research and development (R&D) as manufacturers strive to create innovative products that meet evolving military needs. Investment in R&D is crucial for developing helmets that incorporate advanced materials and technologies, ensuring that they provide optimal protection and functionality. The combat helmet market is likely to see an influx of new entrants and established players enhancing their R&D capabilities to stay competitive. This trend is supported by collaborations between defense contractors and research institutions, which aim to push the boundaries of helmet design. As a result, the market may experience a surge in innovative helmet solutions, catering to the diverse requirements of modern military operations.