Government Regulations and Incentives

Government regulations and incentives play a pivotal role in shaping the connected car market. In the US, regulatory bodies are increasingly focusing on promoting vehicle safety and environmental sustainability. For instance, the National Highway Traffic Safety Administration (NHTSA) has proposed regulations that encourage the adoption of connected vehicle technologies to enhance road safety. Additionally, various state governments are offering incentives for the adoption of electric and connected vehicles, which could potentially lead to a market growth of 15% by 2027. These regulatory frameworks are likely to accelerate the integration of connected technologies in vehicles, thereby driving the connected car market.

Rising Consumer Demand for Connectivity

The connected car market is experiencing a notable surge in consumer demand for enhanced connectivity features. As consumers increasingly prioritize seamless integration of their digital lives with their vehicles, automakers are responding by incorporating advanced infotainment systems and connectivity options. According to recent data, approximately 70% of consumers express a preference for vehicles equipped with internet connectivity. This trend is driving manufacturers to innovate and offer features such as real-time navigation, streaming services, and remote vehicle management. The growing expectation for connectivity is reshaping the connected car market, compelling companies to invest in research and development to meet consumer preferences.

Advancements in Telecommunications Infrastructure

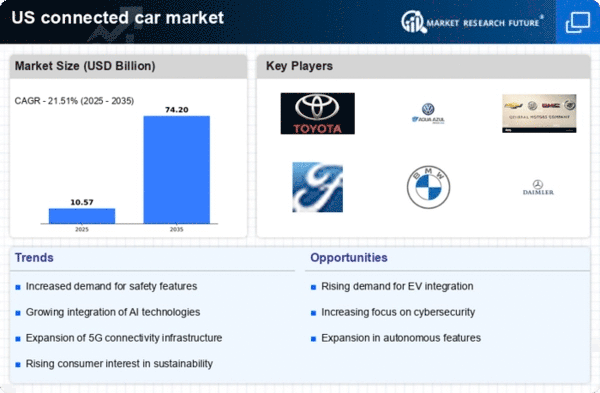

The evolution of telecommunications infrastructure is significantly influencing the connected car market. The rollout of 5G networks across the US is expected to enhance vehicle connectivity, enabling faster data transmission and improved communication between vehicles and infrastructure. This technological advancement is anticipated to support the development of applications such as real-time traffic updates and vehicle-to-vehicle communication. Market Research Future suggest that the implementation of 5G could lead to a market expansion of approximately 20% over the next five years. As connectivity improves, the connected car market is likely to witness increased adoption of smart features and services.

Growing Interest in Autonomous Driving Technologies

The connected car market is closely intertwined with the growing interest in autonomous driving technologies. As manufacturers invest heavily in research and development for self-driving capabilities, the demand for connected features that support these technologies is also rising. Data indicates that nearly 60% of consumers are willing to adopt vehicles with autonomous features if they are equipped with advanced connectivity options. This trend is prompting automakers to integrate sophisticated sensors and communication systems into their vehicles, thereby enhancing the overall driving experience. The convergence of connected and autonomous technologies is expected to propel the connected car market forward.

Increased Focus on User Experience and Personalization

User experience and personalization are becoming central themes in the connected car market. As consumers seek more tailored experiences, automakers are leveraging data analytics to offer personalized services and features. This includes customized infotainment options, adaptive driving modes, and predictive maintenance alerts. Research indicates that vehicles with advanced personalization features can enhance customer satisfaction by up to 30%. Consequently, manufacturers are prioritizing the development of user-friendly interfaces and connectivity solutions that cater to individual preferences. This focus on user experience is likely to drive growth in the connected car market, as consumers gravitate towards vehicles that offer a more personalized driving experience.