Rising Interest in Electric Motorcycles

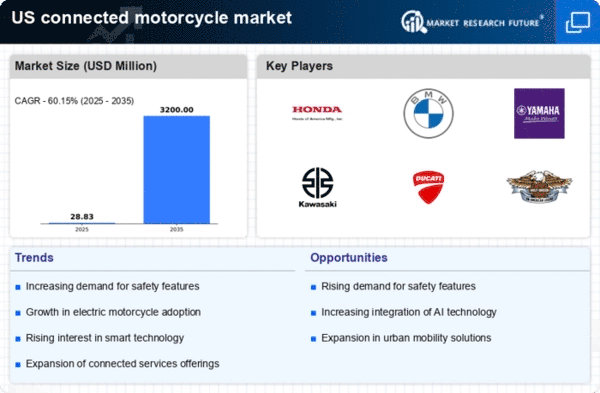

The shift towards electric vehicles is influencing the connected motorcycle market, as more consumers express interest in electric motorcycles. This trend is driven by environmental concerns and the desire for sustainable transportation options. In 2025, it is estimated that electric motorcycles will account for nearly 15% of the total motorcycle market in the US, with many models featuring advanced connectivity options. The integration of smart technology in electric motorcycles enhances their appeal, offering features such as remote diagnostics and performance tracking. As manufacturers invest in electric models, the connected motorcycle market is likely to see significant growth, catering to the evolving preferences of environmentally conscious consumers.

Regulatory Support for Safety Innovations

Regulatory bodies in the US are increasingly supporting innovations that enhance motorcycle safety, which is positively impacting the connected motorcycle market. Initiatives aimed at reducing road accidents and improving rider safety are encouraging manufacturers to integrate advanced safety technologies into their motorcycles. For instance, the National Highway Traffic Safety Administration (NHTSA) has been promoting the adoption of connected vehicle technologies, which could lead to a potential reduction in motorcycle fatalities by up to 30%. This regulatory support not only fosters innovation but also instills consumer confidence in connected motorcycles, thereby driving market growth. As safety regulations evolve, the connected motorcycle market is likely to see a rise in demand for models equipped with these advanced safety features.

Technological Advancements in Connectivity

The connected motorcycle market is experiencing a surge due to rapid technological advancements in connectivity. Innovations such as 5G networks and IoT integration are enhancing the capabilities of motorcycles, allowing for real-time data exchange and improved rider experiences. In 2025, it is estimated that the market for connected motorcycle technology will reach approximately $1.5 billion in the US, driven by consumer demand for enhanced features. These advancements not only improve navigation and communication but also facilitate vehicle diagnostics and maintenance alerts, thereby increasing the overall safety and reliability of motorcycles. As manufacturers continue to invest in R&D, the connected motorcycle market is likely to expand, offering more sophisticated features that appeal to tech-savvy consumers.

Increased Focus on Urban Mobility Solutions

The urban mobility landscape is changing, with a growing emphasis on efficient transportation solutions. The connected motorcycle market is benefiting from this trend as motorcycles are increasingly viewed as a viable alternative to traditional vehicles in congested urban areas. In 2025, it is anticipated that the market for connected motorcycles will grow by approximately 25% in urban regions, driven by the need for agile and efficient commuting options. The integration of connectivity features allows for better route planning and traffic management, making motorcycles an attractive choice for urban dwellers. As cities continue to evolve, the connected motorcycle market is likely to play a crucial role in shaping the future of urban transportation.

Growing Demand for Enhanced Rider Experience

Consumer preferences are shifting towards motorcycles that offer enhanced riding experiences, which is a key driver for the connected motorcycle market. Riders are increasingly seeking features such as smartphone integration, navigation systems, and real-time traffic updates. In 2025, it is projected that around 40% of new motorcycle sales in the US will include connected features, reflecting a significant shift in consumer expectations. This demand is further fueled by the desire for personalization and convenience, as riders look for ways to enhance their journeys. Manufacturers are responding by incorporating advanced connectivity features into their models, thereby positioning themselves competitively in the connected motorcycle market.