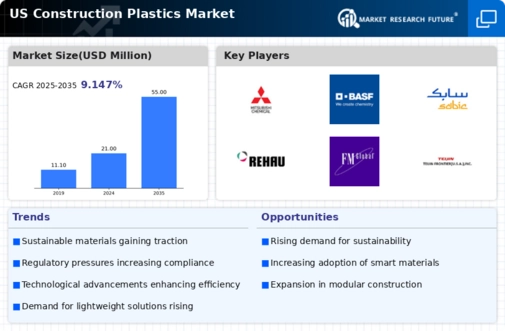

The US Construction Plastics Market is characterized by a diverse range of companies and products that cater to the evolving needs of the construction industry. This market encompasses various materials, including polyvinyl chloride (PVC), polyethylene, and other specialized plastics that serve critical roles in construction applications such as insulation, flooring, and structural components.

The competitive landscape is shaped by factors such as product innovation, technological advancements, sustainability initiatives, and strategic partnerships. Companies are keenly focused on enhancing their manufacturing processes and product offerings to meet the demands of a booming construction market, influenced by trends in green building and energy efficiency.

Robust competition exists, with several key players vying for market share through innovative solutions that address both performance and environmental impact.

Polyone Corporation

Polyone Corporation is a notable player in the US Construction Plastics Market, recognized for its strong capabilities in providing specialized polymer formulations and colorant solutions tailored for construction applications. The company has established a significant presence in the market through its commitment to innovation and customer service.

Polyone's strengths lie in its extensive product portfolio that includes materials designed for durability, aesthetics, and compliance with industry standards. The company's focus on research and development helps them stay ahead of trends, allowing them to respond promptly to customer needs while incorporating sustainable practices into their operations.

Furthermore, Polyone Corporation's strategic partnerships with key stakeholders in the construction sector bolster its position, enabling it to optimize supply chain efficiencies and enhance the performance characteristics of its product offerings.

Mitsubishi Chemical Holdings

Mitsubishi Chemical Holdings has a strong foothold in the US Construction Plastics Market, leveraging its diverse portfolio that includes high-performance plastics and innovative materials solutions. The company's key offerings cater to various segments of the construction industry, providing essential products such as acrylic sheets, polycarbonate materials, and reinforced plastics.

Mitsubishi Chemical Holdings emphasizes sustainability in its products, aiming to reduce environmental impact while meeting high-performance standards demanded by modern construction practices. The company enjoys a competitive advantage through its research and development initiatives, which lead to the creation of advanced materials that enhance energy efficiency and durability.

Additionally, Mitsubishi Chemical Holdings has made strategic mergers and acquisitions that have expanded its capabilities and market presence in the US, allowing it to tap into emerging trends and customer needs effectively. Their commitment to innovation, coupled with a strong distribution network, positions them favorably in a competitive market landscape.

Leave a Comment