US Construction Repaint Market Research Report: By Resin Type (Acrylic, Polyester, Epoxy) and By Application (Residential, Non-Residential) - Forecast to 2035

ID: MRFR/CnM/16844-HCR | 100 Pages | Author: Chitranshi Jaiswal| July 2025

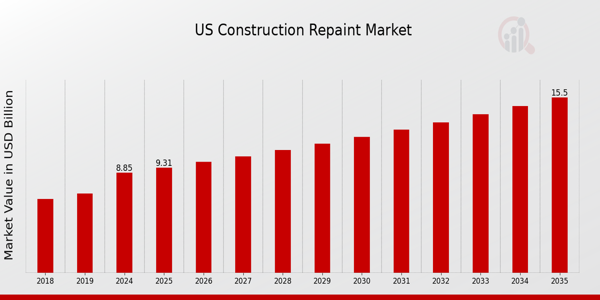

The US Construction Repaint Market Size was estimated at 8.28 (USD Billion) in 2023. The US Construction Repaint Market Industry is expected to grow from 8.85(USD Billion) in 2024 to 15.5 (USD Billion) by 2035. The US Construction Repaint Market CAGR (growth rate) is expected to be around 5.227% during the forecast period (2025 - 2035).

The US Construction Repaint Market is witnessing significant trends largely driven by a rise in housing renovations and maintenance activities. As homeowners increasingly focus on improving their properties' aesthetics and functionality, the demand for repainting services continues to grow. Factors such as the aging housing stock in the United States, where many homes are over 30 years old, necessitate regular upkeep, have created a robust market for repainting. Additionally, there is a growing preference for eco-friendly and low-VOC (volatile organic compounds) paints, reflecting an increasing environmental awareness among consumers. This shift towards sustainable practices is coupled with innovations in paint technology, resulting in products that offer greater durability and easier application.Opportunities in the market are further enhanced by the rising trend of urbanization, which is driving more homeowners to invest in interior and exterior upgrades to enhance property value. Commercial properties are also increasingly opting for repainting to maintain a professional appearance, driven by the competitive nature of the rental markets in cities across the US. Furthermore, the growing DIY culture has empowered homeowners to take on repainting projects themselves, thereby expanding the customer base for suppliers of paint products and tools. In recent times, the influence of social media platforms has also changed how consumers approach home improvement, with platforms showcasing various color palettes and trends leading to informed decisions for repainting.Homeowner engagement through these platforms encourages exploration of new styles and techniques, aligning with the changing preferences in both residential and commercial sectors. This dynamic landscape within the US Construction Repaint Market highlights how consumer behavior, technological advancements, and environmental considerations are merging to shape the future of repainting in the country.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

The United States is experiencing a significant increase in home renovation and remodeling activities, driven by a combination of rising property values and a desire for improved living environments. According to the Joint Center for Housing Studies of Harvard University, renovations in the U.S. are projected to reach a staggering 400 billion USD by 2024, representing a continuous growth in residential renovation projects. This increase is influenced by the desire of homeowners to enhance the aesthetic appeal and longevity of their properties.As more homeowners invest in renovations, the demand for repainting services in the US Construction Repaint Market is expected to surge, further contributing to the industry's growth. Organizations such as the National Association of Home Builders (NAHB) are also playing a pivotal role, providing insights and forecasting that stimulate renovation activities across various states, thus propelling the construction repaint market forward.

In the United States, growing awareness and regulatory frameworks concerning sustainability and environmental impact are promoting the use of eco-friendly paints and coatings. The Environmental Protection Agency (EPA) has introduced guidelines that encourage low-VOC (volatile organic compounds) products, making eco-friendly repaints more prevalent in the industry. As a result, companies are innovating to produce environmentally safe products that meet these regulations, leading to a rise in demand within the US Construction Repaint Market Industry.This shift towards sustainable practices is not only aligned with consumer preferences but also positions companies favorably in an increasingly environmentally-conscious market.

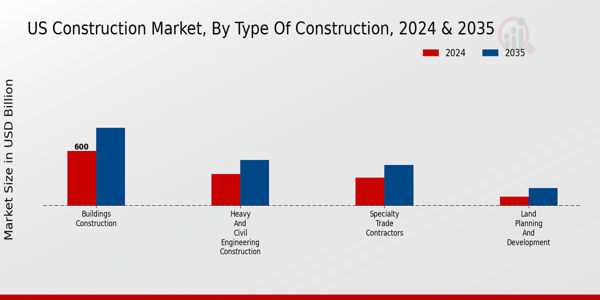

The US Construction sector has seen a rebounding expansion post-pandemic, with U.S. Census Bureau data indicating that construction spending reached approximately 1.52 trillion USD in 2022, a substantial growth driven by both residential and commercial projects. The revitalization in new constructions is directly benefitting the US Construction Repaint Market Industry, as new buildings often require multiple coats of paint during the construction phase.Organizations such as the Associated General Contractors of America (AGC) are highlighting the upward trend in construction activity, which will cumulatively enhance the repaint needs as properties age, thereby stimulating continued demand in the repaint segment.

The Resin Type segment of the US Construction Repaint Market plays a crucial role in determining the quality and performance of paint products used in various construction projects. This segment broadly encompasses different types of resins, including Acrylic, Polyester, and Epoxy, each contributing unique properties to paint formulations. Acrylic resins are known for their excellent durability, color retention, and resistance to fading, making them a preferred choice for exterior applications that require longevity amidst harsh weather conditions. They also provide good water resistance, which is essential for both residential and commercial buildings in the US, where changes in climate can impact the lifespan of paint. Polyester resins typically find their place in applications requiring a high degree of gloss, excellent mechanical properties, and resistance to chemicals. This makes them ideal for environments that encounter various industrial conditions or for decorative purposes where aesthetic appeal is paramount. They tend to provide a smooth finish that enhances the visual appeal of surfaces, which is particularly significant in the urban landscapes found across many US cities. On the other hand, Epoxy resins are recognized for their superior adhesion and chemical resistance. This quality makes them suitable for high-traffic areas where floor durability is critical, such as in warehouses, factories, and commercial spaces. The use of Epoxy-based paints and coatings is on the rise given their ability to withstand extreme conditions, which is a major factor driving growth in the repaints market. As the demand for resilient and sustainable building materials grows in the US, manufacturers are leaning towards formulations that leverage these resin types to meet consumer preferences and regulatory standards.Furthermore, the trend towards environmentally-friendly and low-VOC (volatile organic compounds) formulations is influencing the types of resins being utilized. Manufacturers are continually innovating to enhance the performance of resin-based paints while adhering to environmental guidelines, thereby presenting an opportunity for growth in this segment. Continuous advancements in resin technology are not only improving the overall performance of paints but also contributing to the market's ongoing evolution as it adapts to new consumer needs and sustainability requirements. The US Construction Repaint Market is responsive to these dynamics, with resin type playing a pivotal role in shaping market strategies and product development. The insights derived from this segment indicate a broad spectrum of opportunities and challenges, setting the stage for significant market actions as stakeholders respond to changing demands in the construction and repainting sectors.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

The Application segment of the US Construction Repaint Market reflects a significant share of the industry, driven by factors such as renovation demand, property maintenance, and aesthetic preferences. In the residential sector, homeowners increasingly prioritize interior and exterior repaints to enhance property value and curb appeal, thus contributing to robust market dynamics. Conversely, the Non-Residential segment, encompassing commercial establishments, educational institutions, and healthcare facilities, focuses heavily on durability and compliance with environmental standards, which further propels demand for high-quality repaint solutions.As the US witnesses a growing trend towards eco-friendly and sustainable products, both segments are expected to adapt by incorporating innovative materials and technologies. Moreover, regulatory frameworks and incentives aimed at improving energy efficiency in building practices will further stimulate growth in the US Construction Repaint Market, enabling a competitive landscape where both residential and non-residential applications play crucial roles in market development and evolution.

The US Construction Repaint Market has witnessed considerable competition driven by a diverse array of manufacturers offering a wide range of products for residential and commercial applications. This market is characterized by the constant introduction of innovative solutions tailored to meet the varying demands of consumers, including eco-friendly options and advanced coatings that offer durability and aesthetic appeal. The competitive landscape features robust marketing strategies and distribution channels that enhance market penetration. Companies are increasingly focusing on product differentiation and quality assurance to gain a competitive edge, responding to rising consumer expectations for sustainable and high-performance paints. Additionally, the presence of established brands alongside emerging players fuels a dynamic environment, making it necessary for businesses to remain agile and progressive to succeed.Zinsser has invigorated the US Construction Repaint Market with its notable strength in producing high-quality primers and specialty paints designed for different substrate surfaces. The brand focuses on delivering exceptional performance, often emphasizing ease of application and quick-drying features which are highly valued in the construction and renovation sectors. Zinsser's consistent reputation for reliability and innovation allows it to carve a substantial market presence. Additionally, its strategic partnerships with distributors and retailers contribute to its wide availability across various channels, making it a go-to choice for contractors and homeowners alike. The company's product range is aligned with industry-leading performance standards, providing a competitive advantage against other brands within the same market space in the US.Krylon, another key player in the US Construction Repaint Market, is renowned for its spray paint products that cater to both consumer and commercial applications. The company's product lineup includes a variety of paints, primers, and finishes designed for different surfaces, which allows Krylon to address a broad spectrum of customer needs. Its strengths lie in the ease of use and versatility, often appealing to DIY enthusiasts as well as professionals. Krylon has effectively leveraged innovative marketing campaigns and product development strategies to maintain its relevance in the market. The company has engaged in strategic mergers and acquisitions to enhance its capabilities and expand its market footprint, enabling it to deliver comprehensive solutions that meet evolving consumer preferences. With a focus on environmentally friendly options, Krylon has positioned itself as a forward-thinking brand, appealing to the growing sector of eco-conscious consumers in the US.

The US Construction Repaint Market has recently observed several pivotal developments. In September 2023, Sherwin-Williams announced plans to expand its production capabilities to meet rising demand, driven by a booming housing sector. The paint manufacturer's investment in state-of-the-art manufacturing technologies aims to enhance efficiency and sustainability in their product lines. Additionally, in August 2023, PPG Industries reported a 9% increase in revenue for their Architectural Coatings segment, reflecting a strong recovery in the construction industry as it rebounds post-pandemic. Notably, the merger between Behr Process Corporation and California Paints, which was finalized in June 2023, is expected to enhance product offerings and diversify market presence, catering to a wider range of consumer needs. The valuation growth of companies such as Valspar and Benjamin Moore continues to signal a robust market trajectory, with estimates suggesting a sustained increase in demand for high-quality, eco-friendly paints. Over the past two years, the market has been significantly impacted by fluctuations in raw material costs and supply chain disruptions, but industry players are adapting through innovative solutions and strategic investments.

| Report Attribute/Metric Source: | Details |

| MARKET SIZE 2018 | 8.28(USD Billion) |

| MARKET SIZE 2024 | 8.85(USD Billion) |

| MARKET SIZE 2035 | 15.5(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 5.227% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| MARKET FORECAST PERIOD | 2025 - 2035 |

| HISTORICAL DATA | 2019 - 2024 |

| MARKET FORECAST UNITS | USD Billion |

| KEY COMPANIES PROFILED | Zinsser, Krylon, Pittsburgh Paints, Regal Paints, DunnEdwards, California Paints, PPG Industries, Diamond Vogel, Valspar, Behr Process Corporation, Muralo Paints, Benjamin Moore, RustOleum, Olympic Paints, SherwinWilliams |

| SEGMENTS COVERED | Resin Type, Application |

| KEY MARKET OPPORTUNITIES | Sustainability-driven product demand, Innovative eco-friendly coatings, Smart technology integration, Urban renovation projects growth, Increased DIY consumer participation |

| KEY MARKET DYNAMICS | Sustainability trends driving demand, Increasing renovation activities, Technological advancements in coatings, Labor shortages impacting workforce, Rising material costs and inflation |

| COUNTRIES COVERED | US |

Frequently Asked Questions (FAQ) :

The US Construction Repaint Market is expected to be valued at 8.85 USD Billion in 2024.

By 2035, the US Construction Repaint Market is expected to reach a valuation of 15.5 USD Billion.

The expected CAGR for the US Construction Repaint Market from 2025 to 2035 is 5.227%.

In 2024, the Acrylic resin type is projected to lead the US Construction Repaint Market with a value of 3.54 USD Billion.

The Polyester segment in the US Construction Repaint Market is valued at 2.66 USD Billion in 2024.

The Epoxy segment is expected to reach a market size of 4.75 USD Billion by 2035.

Major players in the US Construction Repaint Market include PPG Industries, Sherwin-Williams, and Benjamin Moore.

Key trends in the US Construction Repaint Market include a shift towards eco-friendly products and advancements in application technologies.

Certain regions, particularly the South and West, are expected to show significant growth in the US Construction Repaint Market.

Challenges such as volatility in raw material prices and supply chain disruptions may impact the growth of the US Construction Repaint Market.

Leading companies partner with us for data-driven Insights.

Kindly complete the form below to receive a free sample of this Report

© 2025 Market Research Future ® (Part of WantStats Reasearch And Media Pvt. Ltd.)