Increased Focus on Rental Services

The crawler excavator market is witnessing a shift towards rental services, driven by cost-effectiveness and flexibility. In 2025, it is estimated that the rental segment will account for nearly 40% of the total market share. Contractors are increasingly opting for rental equipment to avoid the high capital expenditure associated with purchasing machinery. This trend is particularly pronounced among small to medium-sized enterprises that require access to high-quality equipment without the burden of ownership. Rental services provide the added advantage of allowing contractors to select the latest models equipped with advanced features, thereby enhancing operational efficiency. As the rental market expands, the crawler excavator market is likely to benefit from increased utilization rates and a broader customer base.

Government Infrastructure Initiatives

Government initiatives aimed at enhancing infrastructure play a crucial role in driving the crawler excavator market. In 2025, federal and state governments are expected to allocate substantial budgets for infrastructure projects, including roads, bridges, and public transportation systems. The Biden administration's infrastructure plan, which proposes an investment of $1.2 trillion, is likely to create a favorable environment for the crawler excavator market. These investments not only stimulate demand for construction equipment but also encourage the adoption of advanced machinery, such as crawler excavators, which are essential for executing large-scale projects efficiently. As infrastructure development progresses, the crawler excavator market stands to benefit significantly from increased procurement by contractors and construction firms.

Technological Integration in Machinery

The integration of advanced technologies into construction machinery is transforming the crawler excavator market. Innovations such as telematics, automation, and machine learning are enhancing the operational efficiency and safety of crawler excavators. In 2025, it is anticipated that approximately 30% of new excavators will be equipped with smart technology, allowing for real-time monitoring and predictive maintenance. This technological evolution not only improves productivity but also reduces operational costs for contractors. As the construction industry increasingly embraces digital solutions, the demand for technologically advanced crawler excavators is likely to rise, positioning the market for substantial growth. The ability to leverage data analytics for performance optimization further underscores the importance of technology in the crawler excavator market.

Environmental Regulations and Compliance

The crawler excavator market is influenced by stringent environmental regulations aimed at reducing emissions and promoting sustainability. In 2025, the US is expected to implement more rigorous standards for construction equipment, compelling manufacturers to innovate and produce eco-friendly crawler excavators. This regulatory landscape encourages the development of machines that utilize alternative fuels and incorporate energy-efficient technologies. As contractors seek to comply with these regulations, the demand for environmentally friendly crawler excavators is likely to rise. This shift not only aligns with The crawler excavator market. The crawler excavator market, therefore, stands to gain from the increasing emphasis on compliance and environmental responsibility.

Rising Demand for Construction Equipment

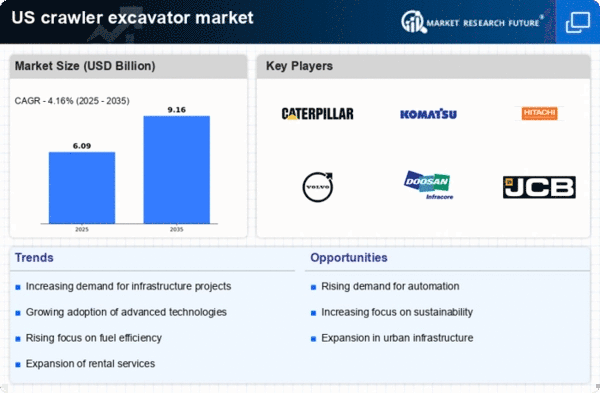

The crawler excavator market experiences a notable surge in demand driven by the expanding construction sector in the US. As urbanization accelerates, the need for efficient and versatile construction equipment becomes paramount. In 2025, the construction industry is projected to grow at a CAGR of approximately 5.5%, leading to increased investments in heavy machinery. Crawler excavators, known for their stability and adaptability on various terrains, are particularly favored for large-scale projects. This trend indicates a robust market for crawler excavators, as contractors seek reliable equipment to meet project deadlines and enhance productivity. The growing emphasis on mechanization in construction further propels the crawler excavator market, as companies aim to optimize operations and reduce labor costs.